Market Ethos

July 29, 2024

Patience is a virtue

Sign up here to receive the Market Ethos by email.

Marketing in the investment management industry is often focused on pieces of a portfolio that have worked out really well. How a great idea got into a portfolio and produced the desired results. We could talk about our Japan tilt, or gold, giving ourselves the proverbial pat on the back. Not today though. Instead, we are going to discuss perhaps our worst portfolio tilt in 2024: the use of equal-weighted U.S. equity exposure instead of market capitalization weighted.

At the end of June, the S&P (S&P 500 market cap weighted) was up 15% year-to-date, while the S&P EW (S&P 500 equal weight) was up a rather disappointing 5%. Everybody knows why: the narrow leadership of a few megacaps have been leading this market of late. Nvidia, Microsoft, Amazon, etc. And they carry a much bigger weight in the S&P compared to S&P EW, which by definition is equal weight. Fortunes have somewhat reversed so far in July, with S&P down -0.5% and S&P EW up 1.7%, but clearly the spread remains in favour of S&P 500 cap weighted.

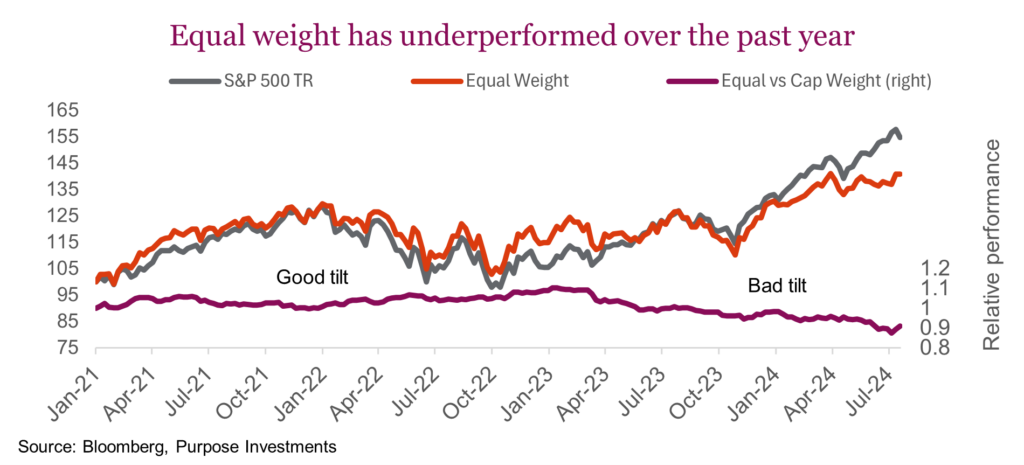

Taking a bit of a longer view on the relative performance, equal weight won in 2022 and cap weighted won in 2023. In the chart below, a rising maroon line means equal weight is winning and a falling line means cap weight is winning. If you take a super long view (the past 25 years or so), performance is roughly tied. Since 1990, equal weight has annualized 10.6% while cap weight S&P has annualized 10.9%.

The equal weight decision was predicated on a market that had become very concentrated in a few names. Sure, some of the names have changed as they used to be the FANG stocks, then Mag 7 and now maybe the horsemen of AI. The challenge is when the S&P becomes very concentrated, it often ends rather poorly for the market cap weighted index – it is increasingly risky. Of course, we didn’t expect it to go from super concentrated to super-duper concentrated, as it did. And maybe it continues, currently being driven by excitement around AI-related companies.

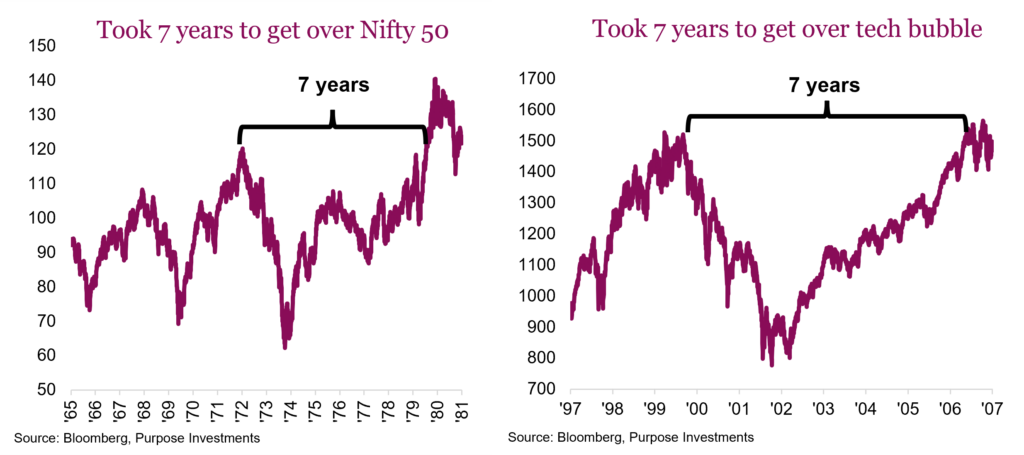

There have been a few occurrences historically when the U.S. market become so concentrated. The most often referred to is the dotcom period of the 1990s, which then lead to a seven-year period without the S&P making new highs. The equal weight S&P did not suffer this drought. It was also seven years when the nifty 50 concentration finally ended in the 1970s.

Maybe there are another two years of dominance, maybe two months, or maybe the change has started. Nobody knows but we do know it has added an incredible amount of risk to the headline index. Trees don’t grow to the sky, even if they are great trees.

Of course everyone says it’s all AI driven but there are some other factors at work. This leadership accelerated in the past few years, coincidentally the same time yields moved higher. Higher yields, or the cost of capital, has impacted companies differently depending on their business and balance sheet. Those companies that had added a lot of debt during the low interest rate 2010-2020 have suffered. If variable debt, it happened really fast. For those with more fixed debt, their pain continue to build as maturities have to be paid off or refinanced higher.

At the other end of the spectrum are these mega caps that carry little debt and often hold large amounts of cash. Which for them is starting to actually have a positive impact on the bottom line. Beyond AI, companies with higher financial leverage (more debt) have dramatically underperformed those with low or no debt. The same has played out for consumers, those more leveraged vs those that are lenders, but we will save that for another day.

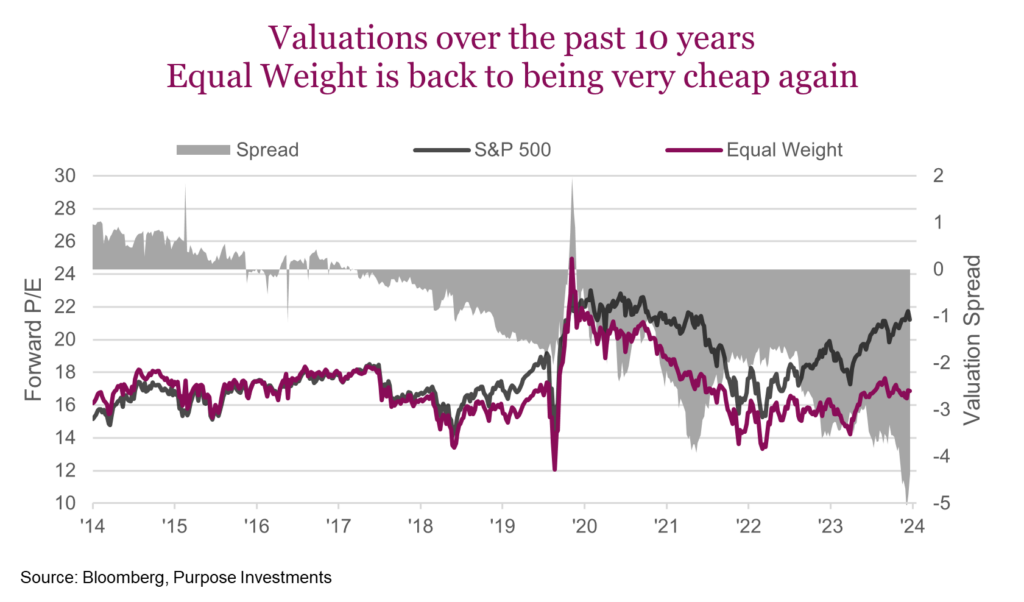

Now with bond yields coming down somewhat and the Fed soon starting to cut rates, financial conditions have been easing. For the megacaps that isn’t a big deal but for the majority of the market that has more leverage, that is good news. Add to this that the valuation spread has really gotten extreme, and the much-anticipated rotation may be starting to form.

Final thoughts

While clearly this portfolio tilt has not worked out as desired, the rationale remains and has in fact strengthened, as the narrowness of the U.S. market climbed higher. Given the valuation spread, inherent risk in the market cap iteration of the S&P 500 we remain patient (some may say stubborn) with our more positive view of equal weight. Perhaps with even higher conviction today.