Market Ethos.

30 January 2023.

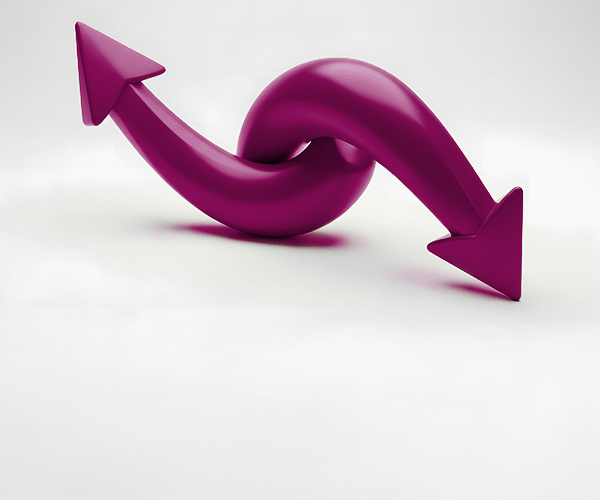

Investing is all about balancing risk and return to achieve your long-term goals. I think everyone understands returns (especially when they’re negative), but what about risk? In finance, the most popular approach incorporates the volatility or standard deviation of an investment’s returns. Standard deviation may sound a bit mathy, but if you break down the term – standard or average and deviation or dispersion – it is just a measure of the variability of returns. Of course, many more metrics have become common, including downside deviation, up/down market capture, and drawdown. Really, they are all trying to paint a picture of the risk of an investment based on its variability of returns. But is that ‘risk’?

Take risk-adjusted returns such as the popular Sharpe ratio (return divided by volatility). Both investments A & B in the chart below have the same return over the time period; however, A takes a much more volatile path to reach the same destination. Does that make B better than A? B certainly has a higher Sharpe ratio, but both result in the same wealth creation. This is where risk really depends on you, the investor