Toronto, August 13, 2020 – GMP Capital Inc. (“GMP” or the “Company”) (TSX: GMP) announced today that it has entered into a definitive purchase agreement (the “Purchase Agreement”) with Richardson Financial Group Limited (“RFGL”) to consolidate 100% ownership of RGMP under GMP (the “RGMP Transaction”). Pursuant to the RGMP Transaction, GMP will acquire all of the common shares of Richardson GMP (or “RGMP”) that are not owned by the Company for a purchase price of 1.875 common shares (1.76 common shares pre-dividend) of GMP (the “Common Shares”) per common share of RGMP (“RGMP Common Share”). Today’s announcement is the culmination of the negotiation period undertaken pursuant to the terms of the RGMP Shareholders’ Agreement that commenced with the February 26, 2020 announcement of the signing of a non-binding term sheet by the Company and RFGL, and was extended on April 14, 2020 due to the global health crisis. The signing of the Purchase Agreement followed consultation with the RGMP investment advisors, the receipt of an updated formal valuation prepared by RBC Capital Markets (“RBC”) and the recommendation of the independent special committee (the “Special Committee”) of the GMP Board of Directors (the “Board”).

- GMP will acquire all of the common shares of Richardson GMP (or “RGMP”) that are not owned by the Company based on an enterprise value for RGMP of $420 million

- GMP will pay a special dividend of $11.3 million or 15 cents per common share to the pre-closing GMP shareholders, which together with the $20.7 million returned to shareholders in December 2019, represents approximately 76% of the $42.2 million proceeds received from the sale of the capital markets business

- GMP intends to resume paying quarterly dividend on its outstanding Series B and Series C preferred shares following annual and special meeting

- Richardson Financial agrees not to have its $32 million preferred share ownership in RGMP redeemed for cash on closing

Donald Wright, Chair of the Board and of the Special Committee commented, “The revised terms to the previously announced transaction in February 2020 strike what, we believe, is an appropriate balance taking into account the effects of the global pandemic, feedback raised by various stakeholders and retaining the appropriate level of capital to execute our long-term value creation strategy. This includes paying a special dividend to existing GMP shareholders of $0.15 per Common Share and securing the commitment of Richardson Financial Group to not have their preferred shares in RGMP redeemed on closing as otherwise required under the RGMP Shareholders Agreement, and instead leaving the $32.1 million in the Company to fund growth opportunities.”

“For our shareholders, clients and employees, today’s announcement signals an important step towards positioning our company for success after the brief delay caused by the global health crisis. Amongst many things, the health crisis has reminded us about the importance and demand for high-quality face-to-face advice especially during a period of volatile and uncertain markets. Richardson GMP demonstrated its resilience as assets under administration bounced back from the lows of $23.5 billion in March 2020 to just over $29 billion today. This is a credit to the 165 investment advisory teams and those that support them,” said Kish Kapoor, Interim President and CEO of GMP.”

Commenting further Mr. Kapoor said, “Now, we can move towards establishing our wealth platform at the forefront of the next generation of wealth. After a multi-year process to transform GMP, we can begin to capitalize on the considerable opportunities in the multi-trillion-dollar wealth management industry in Canada. Canadian retail wealth is expected to grow to $7.7 trillion in the next decade, and together with our partners at Richardson GMP, we remain focused on the delivery of unparalleled face-to-face advice to affluent clients opting for non-bank points of access for holistic wealth management solutions in an effort to capture a greater share of the market.”

“This transaction also recognizes the significant time, effort and commitment required to arrive at this outcome. For that, we are thankful to our shareholders, clients, advisors and our partners at RFGL for their support and patience. Powered by a strong balance sheet at the combined firms and the Richardson brand, which has a rich 90-year history of success in financial services, we are well positioned for an exciting period of growth in the Company for generations to come.”

Revised Binding Terms for RGMP Transaction

The following table provides a summary of the key revised terms compared with the terms announced on February 26, 2020.

August 13,2020 | February 26, 2020 | % Change | |

| Exchange ratio, pre special dividend | 1.76:1 | 2:1 | (12)% |

| Exchange ratio, post special dividend | 1.875:1 | 2:1 | (6)% |

| Enterprise value for RGMP (millions) | $420 | $500 | (16)% |

| Reference value of RGMP common shares | $4.25 | $5.14 | (17)% |

| RGMP’s AUA1 (billions) | $28.3 | $28.6 | (1)% |

| RGMP net working capital2 (millions) | $58.2 | $54.4 | 7% |

| GMP adjusted net working capital2 (millions) | $123.1 | $130.6 | (6)% |

| Special dividend, conditional on closing of the RGMP Transaction | $0.15/share | Nil | n/a |

| Reference value of GMP common shares, pre special dividend | $2.42 | $2.57 | (6)% |

| Reference value of GMP common shares, post special dividend | $2.27 | $2.57 | (12)% |

| GMP common share 10-day VWAP prior to announcement | $1.29 | $1.90 | (32)% |

| # of GMP common shares to be issued to RGMP shareholders (millions) | 106.9 | 111.0 | (4)% |

- June 30, 2020 assets under administration (“AUA”) was $28.3 billion compared with December 31, 2019 AUA of $28.6 billion.

- Net working capital as at June 30, 2020 compared with December 31, 2019, respectively.

Other terms agreed to by the parties are consistent with those announced on February 26, 2020, including:

- Retention payments – $36 million in retention payments to RGMP’s investment advisors on closing of the RGMP Transaction, which remain subject to forfeiture provisions; and

- Three-year escrow terms on GMP common shares issued to RGMP’s shareholders – Subject to the satisfaction of certain conditions, upon closing of the RGMP Transaction, 10% of the GMP common shares to be issued to RGMP shareholders on closing (the “Consideration Shares”) will be freely tradeable by the RGMP shareholders and the remaining 90% will be placed in escrow to be released, subject to the satisfaction of certain conditions, in equal amounts on the first, second and third anniversaries of the closing.

After giving effect to the RGMP Transaction, if completed, the Company will have an estimated 182.3 million common shares issued and outstanding. RFGL, GMP’s largest shareholder with an aggregate ownership stake of approximately 24.1% of Common Shares immediately prior to the RGMP Transaction, will have an estimated aggregate ownership position of approximately 40.0% following completion of the RGMP Transaction. Existing GMP shareholders (other than RFGL) and Richardson GMP investment advisors will hold 31.4% and 28.5%, respectively, of GMP common shares following completion of the RGMP Transaction.

The following table highlights the change in percentage ownership compared with the February, 26, 2020, announcement.

| August 13,2020* | February 26,2020 | Increase/(decrease) | |

| GMP shareholders, excluding RFGL | 31.4% | 30.7% | 0.7% |

| RFGL | 40.0% | 39.7% | 0.3% |

| RGMP investment advisors and management | 28.5% | 29.6% | (1.1)% |

* Post special dividend

RFGL Agrees Not To Have Preferred Shares Redeemed for Cash

As noted above, RFGL has agreed not to have the $30.4 million in preferred share capital in RGMP that it holds, plus approximately $1.7 million in cumulative unpaid dividends, redeemed on closing for cash, as required under the RGMP Shareholders’ Agreement which will bolster GMP and RGMP’s already strong balance sheets by $32 million. The preferred share terms will be amended to add a right of RFGL to require the redemption of such preferred shares for cash at any time following the third anniversary of closing.

Transaction Rationale

The conclusions and recommendations of the Special Committee and the Board have been based on a number of factors, including the following:

- Wealth Management Strategy – The Board has carefully mapped out a clear strategy of exiting capital markets and focusing on the opportunities in the wealth management industry, which it believes offers the greatest potential for long-term value creation for shareholders. The Company intends to deploy the considerable capital at both GMP and RGMP to accelerate the growth of the wealth management business following the completion of the RGMP Transaction.

- Partnership with the Richardson Family – By completing the RGMP Transaction, the Company is partnering with and leveraging the Richardson family brand and 90-year legacy in financial services to create the destination of choice for Canada’s top advisors who share RGMP’s entrepreneurial spirit, independent culture and philosophy to deliver unparalleled face-to-face advice to Canadians opting for non-bank points of access for wealth management advice.

- Growing Market Opportunity – With approximately $4 trillion in retail financial wealth in Canada, which is expected to grow to $7.7 trillion by 2028, the opportunity in the market for an independent competitor or independent firm with national scale is significant. The Company believes that demographic trends driving a generational shift have created a growing degree of complexity and sophistication of wealth solutions, supporting the long-term value proposition. Firms and advisors that have embraced the evolution of wealth advice and have enhanced professional accreditation possess the expertise required to provide face-to-face advice across the entire household balance sheet.

- Leading Wealth Management Advisors – RGMP is one of Canada’s leading wealth management firms with 165 highly qualified professional advisory teams serving over 33,000 high net worth families and businesses across Canada. With $28.3 billion of AUA as at June 30, 2020, RGMP’s advisors have amongst the best practices in Canada with one of the highest AUA per advisory team and the firm is recognized as one of Canada’s best workplaces. For the six month period ended June 30, 2020 and the year ended December 31, 2019, RGMP had revenues of $132 million and $272 million, respectively, and adjusted EBITDA of $20 million and $50 million, respectively.

- Strong Management Team – Led by Kish Kapoor, Interim President and Chief Executive Officer of GMP, who has decades of experience at prominent wealth management firms, along with Andrew Marsh, President and Chief Executive Officer of RGMP, who has over 30 years of wealth management experience, including as a founding executive of RGMP, and other seasoned executives, following completion of the RGMP Transaction, the Company will have in place a strong management team to execute on its growth strategy.

Unanimous Board Approval

Having received the unanimous recommendation of the Special Committee, the Board (excluding conflicted directors, who did not participate in deliberations) unanimously approved the RGMP Transaction and determined that entering into the Purchase Agreement is in the best interests of GMP. The Board intends to recommend that GMP’s shareholders vote in favour of the RGMP Transaction at an annual and special meeting of shareholders to be held on October 6, 2020 (the “Meeting”) to consider and approve, among other business of the Meeting, the RGMP Transaction.

Independent Valuation and Fairness Opinion

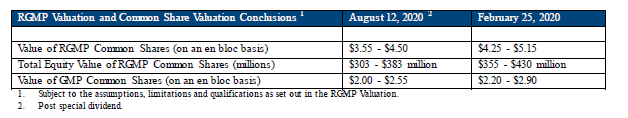

The Special Committee retained RBC Capital Markets (“RBC”) to prepare a formal valuation of the RGMP Common Shares (the “RGMP Valuation”) and of the Common Shares (the “Common Share Valuation”) to be issued by the Company pursuant to the RGMP Transaction (the “GMP Consideration”) as required under Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI 61-101”), which formal valuation was delivered orally to the Special Committee on February 25, 2020. RBC updated its formal valuation as at August 12, 2020 based on updated assumptions provided by the Company which reflect the effects of the current business environment amid the global pandemic outbreak (COVID-19), among other factors. As part of the RGMP Valuation of the RGMP Common Shares, RBC included the after tax, net present value impact of $36 million in retention-related bonuses to RGMP investment advisors. A significant portion of the Common Share Valuation was directly derived from the RGMP Valuation given the Company’s ownership interest in RGMP.

The following table provides a summary of the key elements of RBC’s formal valuation as of August 12, 2020, which are subject to the assumptions, limitations and qualifications contained therein.

RBC has also provided its opinion (the “Fairness Opinion”) to the Special Committee and the Board that, as of August 12, 2020, and subject to the assumptions, limitations and qualifications contained therein, the GMP Consideration to be paid by the Company pursuant to the RGMP Transaction is fair, from a financial point of view, to the Company.

Cormark Securities Inc. served as financial advisor to RFGL.

Investment Advisor Support

“Marc Dalpe and Neil Bosch, the two elected investment advisors representatives on the board of Richardson GMP, with the strong support of our fellow shareholders in Richardson GMP, joined me in fully endorsing the RGMP Transaction,” said Andrew Marsh, President and Chief Executive Officer of Richardson GMP. “This transaction allows us to usher in a new era of expansion at Richardson GMP. The success of our long-term partnership with some of Canada’s top advisors is validated by this transaction as we remain focused on building a firm that is focused exclusively on serving the complete wealth management needs of Canadian families. As importantly, we are pleased to have delivered on our promise to our advisor partners who chose to join Richardson GMP and the growing number of highly experienced advisors looking to join us.”

Minority Shareholder Protections

The RGMP Transaction incorporates the following protections for the GMP minority shareholders:

- Escrow Consideration – Upon closing of the RGMP Transaction, 10% of the Consideration Shares will be paid to RGMP’s shareholders and the remaining 90% will be placed in escrow to be released in equal amounts on the first, second and third anniversaries of the closing subject to the satisfaction of certain conditions.

- Special Committee Process – The RGMP Transaction is the result of an extensive process conducted by the Special Committee, consisting entirely of independent directors, to review and analyze the RGMP Transaction and available alternatives, and extensive negotiations with RFGL and other shareholders of Richardson GMP on the pricing and other terms of the RGMP Transaction.

- Fairness Opinion – The Special Committee and the Board received an opinion from RBC that, as of August 12, 2020, and subject to the assumptions, limitations and qualifications contained therein, the GMP Consideration to be paid by the Company pursuant to the RGMP Transaction is fair, from a financial point of view, to the Company.

- Procedural Protections – The RGMP Transaction is subject to a number of procedural protections under MI 61-101, including the requirement for approval by the holders of a majority of the Common Shares (excluding RFGL and any other shareholders required to be excluded under MI 61-101). In evaluating the RGMP Transaction, the Company’s shareholders will have the benefit of enhanced disclosure requirements under MI 61-101 and the independent formal valuation conducted by RBC, which will be included in the Company’s management information circular to be distributed to shareholders in advance of the Meeting.

Special Dividend

Conditional upon the receipt of shareholder approval to reduce the stated capital of the Company, the Board intends to pay a special dividend in the amount of $0.15 per GMP common share to GMP shareholders of record prior to closing of the RGMP Transaction. Based on the current number of outstanding common shares of 75,434,492, this special dividend will result in an aggregate payment of $11.3 million to common shareholders of GMP. With the $20.7 million returned to shareholders in December 2019, the Company will have returned approximately 76% of the $42.2 million proceeds received from the sale of the capital markets business.

As noted above, subject to the receipt of shareholder approval to reduce the stated capital of the Company, the Company will resume paying quarterly dividends on its Series B and Series C preferred shares, based on its regular quarterly payout schedule. The September 30, 2020, dividend of approximately $1.1 million will be paid October 31, 2020 to shareholders of record on October 16, 2020, with the fourth quarter dividend of approximately $1.1 million expected to be paid on December 31, 2020.

Additions to Board of Directors

Conditional on closing of the RGMP Transaction, Sandy Riley, current CEO of RFGL and former Board member, and Marc Dalpe, current investment advisor representative on the Richardson GMP board of directors, will join the Board.

Name Changes – at GMP and Richardson GMP

At the Meeting, shareholders will also be asked to approve changing the name of GMP Capital Inc. to something we believe will be more aligned with the go-forward wealth management-focused strategy of the Company. Contemporaneously, Richardson GMP intends to change its name for the Anglophone and Francophone markets, respectively to:

Annual and Special Meeting

GMP intends to convene the Meeting on October 6, 2020 to approve, among other annual and special business, the RGMP Transaction and the name change.

The RGMP Transaction is expected to close in the fourth quarter of 2020, subject to shareholder and regulatory approvals and other customary closing conditions. The terms and conditions of the RGMP Transaction and all annual and special matters to be voted on at the Meeting will be disclosed in greater detail in a management information circular for the Meeting that is expected to be mailed to GMP’s shareholders in September 2020. Copies of the Purchase Agreement and of the management information circular for the Meeting will be filed with Canadian securities regulators and will be available on the SEDAR profile of GMP at www.sedar.com. Shareholders are urged to read those and other relevant materials when they become available.

NON-GAAP MEASURES

We use certain measures to assess our financial performance that are not generally accepted accounting principles (“GAAP”) measures under International Financial Reporting Standards (“IFRS”). These measures do not have any standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other issuers. Non-GAAP measures should not be considered as alternatives to net income or comparable metrics determined in accordance with IFRS as indicators of GMP’s performance, liquidity, cash flows, and profitability.

Assets Under Administration

Assets under administration (“AUA”) is a non-GAAP financial measure of client assets that is common to the wealth management business. AUA represents the market value of client assets managed and administered by the Company from which the Company earns commissions and fees. This measure includes funds held in client accounts as well as the aggregate market value of long and short security positions. The Company’s method of calculating may differ from the methods used by other companies and therefore may not be comparable to other companies. Management uses these measures to assess Richardson GMP’s operational performance.

Adjusted Measures

Financial statement items that exclude significant items are non-GAAP measures under IFRS. Management believes adjusting certain results and measures by excluding the impact of specified items may be more reflective of ongoing operating results and provides readers with an enhanced understanding of how management views GMP’s and RGMP’s core performance. Management assesses performance on both a reported and an adjusted basis and considers both bases to be useful in assessing underlying, ongoing business performance. Presenting results on both bases also permits readers to assess the impact of the specified items on the results for the periods presented.

Richardson GMP presents earnings before interest, income tax, depreciation and amortization (EBITDA) which excludes:

- Interest expense recorded primarily in connection with subordinated loan financing arrangements.

- Income tax expense (benefit) recorded.

- Depreciation and amortization expense recorded primarily in connection with equipment and leasehold improvements.

- Transition assistance loan amortization in connection with investment advisor loan programs. RGMP views these loans as an effective recruiting and retention tool, the cost of which is assessed by management upfront when the loan is provided rather than over its term.

RGMP also presents an adjusted EBITDA which excludes the following (“adjusted EBITDA”):

- Share-based compensation costs recorded in connection with awards granted to employees and investment advisors of RGMP

EBITDA and adjusted EBITDA do not have any standardized meaning prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by other issuers. These non-GAAP measures should not be considered as alternatives to net income or comparable metrics determined in accordance with IFRS as indicators of RGMP’s performance, liquidity, cash flows, and profitability. RGMP’s management believes adjusting results by excluding the impact of the specified items is more reflective of ongoing financial performance and cash generating capabilities and provides readers with an enhanced understanding of how management views Richardson GMP’s core performance.

FORWARD-LOOKING INFORMATION

This press release contains “forward-looking information” as defined under applicable Canadian securities laws. This information includes, but is not limited to, statements concerning our objectives, our strategies to achieve those objectives, as well as statements made with respect to management’s beliefs, plans, estimates, projections and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations that are not historical facts. Forward-looking information generally can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plans” or “continue”, or similar expressions suggesting future outcomes or events. Such forward-looking information reflects management’s current beliefs and is based on information currently available to management. The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement.

The forward-looking statements included in this press release, including statements regarding the RGMP Transaction, the nature of GMP’s growth strategy going forward and execution of any of its potential plans, are not guarantees of future results and involve numerous risks and uncertainties that may cause actual results to differ materially from the potential results discussed in the forward-looking statements. In respect of the forward-looking statements and information concerning the consolidation of 100% of ownership in Richardson GMP, and the Company’s strategy going forward, management has provided same based on reliance on certain assumptions it considers reasonable at this time including the timing of the completion of any transaction involving Richardson GMP and that any conditions precedent can be satisfied. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release.

Risks and uncertainties related to the RGMP Transaction include, but are not limited to: failure of GMP and RFGL to obtain the required shareholders and regulatory approvals for, or satisfy other conditions to effect, the RGMP Transaction; the risk that the RGMP Transaction may involve unexpected costs, liabilities or delays; the risk that, prior to or as a result of the completion of the RGMP Transaction, the business of GMP and/or Richardson GMP may experience significant disruptions, including loss of clients or employees due to transaction related uncertainty, industry conditions or other factors; risks relating to employee retention; the risk that legal proceedings may be instituted against GMP or Richardson GMP; and risks related to the diversion of management’s attention from GMP’s ongoing business operations. For a description of additional risks that could cause our actual results to materially differ from our current expectations, see the “Risk Management” and “Risk Factors” sections of GMP’s most recent Annual and Interim MD&A and the “Risk Factors” section in the Company’s AIF. For additional information on the risk factors related to the RGMP Transaction, see “The Sale Transaction – Reasons for the Sale Transaction” and “The Sale Transaction – Risk Factors” in GMP’s Notice of Special Meeting and Management Information Circular dated July 8, 2019 (the “July 2019 Circular”). Material assumptions and factors underlying the forward-looking information in this press release include, but are not limited to, those set out in “Business Environment – Outlook” in GMP’s most recent Annual and Interim MD&A. GMP’s most recent Annual and Interim MD&A and July 2019 Circular are filed under the Corporation’s profile on SEDAR at www.sedar.com.

Although forward-looking information contained in this press release is provided based on management’s reliance on certain assumptions it considers reasonable, there can be no assurance that such expectations will prove to be correct. Certain statements included in this press release may be considered a “financial outlook” for purposes of applicable Canadian securities laws, and as such, the financial outlook may not be appropriate for purposes other than this press release. Readers should not place undue reliance on the forward-looking statements and information contained in this press release. When relying on forward-looking statements to make decisions, readers should carefully consider the foregoing factors, the list of which is not exhaustive.

The forward-looking information contained in this press release is made as of the date of this press release, and should not be relied upon as representing GMP’s views as of any date subsequent to the date of this press release. Except as required by applicable law, Management and the Board undertake no obligation to publicly update or revise any forward-looking information, whether as a result of new information, future events or otherwise.

ABOUT GMP CAPITAL INC.

GMP currently operates through two business segments: Operations Clearing and Wealth Management; and a corporate segment. Operations Clearing provides carrying broker services to Richardson GMP and other third parties, including trade execution, clearing, settlement, custody, and certain other middle- and back-office services, and other expenses associated with providing such services. Wealth Management consists of GMP’s non-controlling ownership interest in Richardson GMP. Richardson GMP, one of Canada’s largest independent wealth management firms, is focused on providing exclusive and comprehensive wealth management and investment services delivered by an experienced team of investment professionals. GMP is listed on the Toronto Stock Exchange under the symbol “GMP”. For further information, please visit our corporate website at gmpcapital.com.

For further information please contact:

GMP Capital Inc.

Rocco Colella, Director, Investor Relations

145 King Street West, Suite 200, Toronto, Ontario M5H 1J8

Tel: (416) 941-0894; Fax: (416) 943-6175

[email protected] or [email protected]