- Continued growth momentum in fee revenue, AUA, and recruiting pipeline

- Decline in transaction-based revenue amid heightened geo-political uncertainty and market volatility

- Improved outlook for remainder of 2022

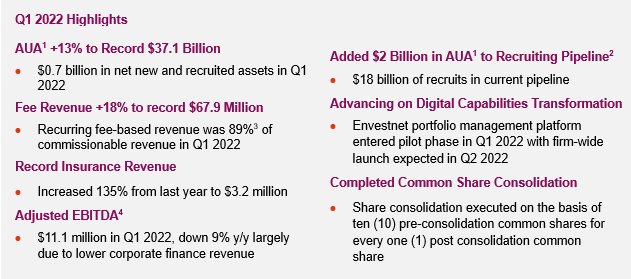

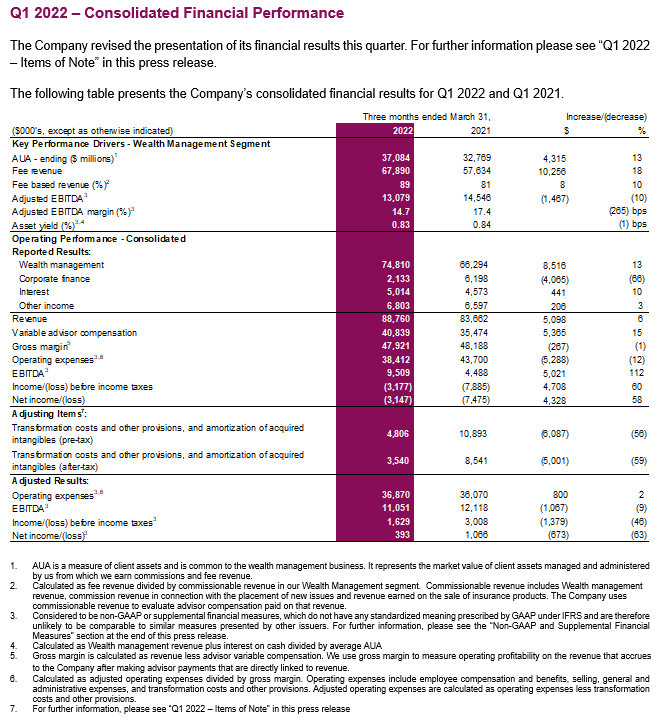

Toronto, May 4, 2022 – RF Capital Group Inc. (RF Capital or the Company) (TSX: RCG) today reported record AUA1 of $37.1 billion and record quarterly revenue of $88.8 million; up from $32.8 billion and $83.7 million, respectively, a year ago. The increase in revenue was driven largely by record fee revenue of $67.9 million, which was up $10.3 million or 18% from Q1 last year. Corporate finance and transaction-based revenue was down from elevated levels last year. Consolidated Adjusted EBITDA4 was $11.1 million this quarter compared with $12.1 million a year ago. Adjusted EBITDA4 in our Wealth Management segment was $13.1 million this quarter. The Company’s reported net loss declined largely due to a $6.1 million decrease in transformation charges.

1. Assets under administration (AUA) is a measure of client assets and is common to the wealth management business. AUA represents the market value of client assets managed and administered by Richardson Wealth from which it earns commissions and fee revenue.

2. Represents conversations with advisors that have advanced beyond a certain probability threshold, and is a measure that management uses to assess outside advisors’ interest in Richardson Wealth. The Company expects to convert only a portion of this pipeline.

3. Calculated as fee revenue divided by commissionable revenue in our Wealth Management segment. For further information, please see the “Non-GAAP and Supplemental Financial Measures” section at the end of this press release.

4. Considered to be non-GAAP or supplemental financial measures, which do not have any standardized meaning prescribed by GAAP under IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. For further information, please see the “Non-GAAP and Supplemental Financial Measures” section at the end of this press release.

Preferred Share Dividend

On May 3, 2022, the board of directors approved a quarterly cash dividend of $0.233313 per Cumulative 5-Year Rate Reset Preferred Share, Series B, payable on June 30, 2022, to preferred shareholders of record on June 15, 2022.

Virtual Annual General Meeting and Q1 2022 Conference Call

The Company will be hosting its virtual AGM (the Meeting) this morning at 10:30 a.m. At the Meeting, President & Chief Executive Officer, Kish Kapoor, will be providing an update on the Company’s strategic progress and priorities, and discussing the Company’s first quarter 2022 results.

All shareholders will have the opportunity to participate in the Meeting online. Only registered shareholders and duly appointed proxyholders will be able to ask questions and vote in real time at the Meeting. Unregistered shareholders, guests and media will be able to listen and view online via the live webcast available at the same link. Shareholders who hold their common shares with a bank, broker or financial intermediary and wish to vote at the Meeting must carefully follow the instructions provided by their intermediary.

A recording of the webcast will be archived and available for subsequent at https://www.rfcapgroup.com/Investor-Relations/Shareholder-Meetings shortly following the Meeting.

Q1 2022 – Items of Note

Disclosure Enhancements

The Company revised the presentation of its financial results this quarter. This change, which only affects the presentation of revenue, aligns with how the Company assesses the performance of its business. It will also help investors better understand the Company’s revenue generation activity and key revenue drivers. Comparative periods have been realigned to conform to current period presentation.

Commencing Q1 2022, the Company is no longer providing supplemental financial information for Richardson Wealth as its consolidated and segmented financial results are now comparable with those of the prior year. Q1 2021 was the first full quarter that the Company included Richardson Wealth’s financial results on a fully consolidated basis following its acquisition by the Company in October 2020.

Pre-Tax Adjustments

The adjusted financial results presented in this press release exclude the impact of transformation program expenses and the amortization of acquired intangibles. In line with our guidance for the quarter, we have a lower volume of adjusting items in 2022, signaling the completion of the most disruptive phase of our transformation.

Q1 2022 included the following $4.8 million in adjusting items:

- $1.5 million of pre-tax charges related to our ongoing transformation ($1.1 million after-tax), reported in our Wealth Management segment. These charges relate largely to the project to outsource our carrying broker operations.

- $3.3 million of pre-tax amortization of intangible assets ($2.4 million after-tax), reported in our Corporate segment. The amortization arises from intangible assets created on the acquisition of Richardson Wealth. It will continue through 2035.

Q1 2021 included the following $10.9 million in adjusting items:

- $7.6 million in pre-tax transformation costs ($5.0 million after-tax) related to refining our organizational structure and professional fees paid related to developing and implementing our new strategy, reported in both our Wealth Management and Corporate segment.

- $3.3 million of pre-tax amortization of acquired intangible assets ($2.4 million after-tax), reported in our Corporate segment.

Non-GAAP and Supplemental Measures

The Company uses a variety of measures to assess its performance. In addition to GAAP prescribed measures, the Company uses certain non-GAAP and supplementary financial measures (SFM) that it believes provides useful information to investors regarding its performance and results of operations. Readers are cautioned that non-GAAP and supplemental measures (including non-GAAP ratios) often do not have any standardized meaning and therefore may not be comparable to similar measures presented by other issuers. Non-GAAP measures are reported in addition to and should not be considered alternatives to measures of performance according to IFRS.

Non-GAAP Measures

The primary non-GAAP financial measures (including non-GAAP ratios) used in this press release are:

EBITDA

The use of EBITDA is common in the wealth management industry. The Company believes it provides a more accurate measure of its core operating results, is a proxy for operating cash flow, and is a facilitator for enterprise valuation. EBITDA is used to evaluate core operating performance by adjusting net income/(loss) to exclude:

- Interest expense, which the Company records primarily in connection with term debt

- Income tax expense/(benefit)

- Depreciation and amortization expense, which its records primarily in connection with intangible assets, leases, equipment, and leasehold improvements; and

- Amortization in connection with investment advisor transition and loan programs. The Company views these loans as an effective recruiting and retention tool for advisors, the cost of which is assessed by management upfront when the loan is provided rather than over its term.

Operating Expenses and Operating Expense Ratio

Operating expenses include:

- Employee compensation and benefits; and

- Selling, general, and administrative expenses

These are the expense categories that factor into the EBITDA calculation discussed above.

The operating expense ratio is determined by dividing adjusted operating expenses by gross margin. The Company uses this ratio to measure the efficiency of its operations.

Commissionable Revenue

Commissionable revenue includes Wealth management revenue, commission revenue in connection with the placement of new issues and revenue earned on the sale of insurance products. The Company uses commissionable revenue to evaluate advisor compensation paid on that revenue.

Adjusted Results

In periods that the Company determines that specified items have a significant impact on a user’s assessment of ongoing business performance, it may present adjusted results in addition to reported results by removing these items from the reported results. Management considers the adjusting items to be outside of its core operating performance. The Company believes that adjusted results can to some extent enhance comparability between reporting periods or provide the reader with a better understanding of how management views core performance. Adjusted results are also intended to provide the user with results that have greater consistency and comparability to those of other issuers.

Adjusted EBITDA Margin

Adjusted EBITDA margin is a non-GAAP ratio calculated as Adjusted EBITDA as a percentage of revenue.

Adjusting items in this press release include the following, by reporting segment:

Wealth Management:

- Transformation costs and other provisions: charges in connection with the ongoing transformation of the Company’s business and other matters. These charges have encompassed a range of transformation initiatives, including refining its ongoing operating model, outsourcing its carrying broker operations, realigning parts of its real estate footprint, and rolling out its new strategy across the Company.

Corporate:

- Transformation costs: incremental professional and advisory fees in connection with the acquisition of Richardson Wealth and the development of its go-forward strategy

- Amortization of acquired intangible assets: amortization of intangible assets created on the acquisition of Richardson Wealth

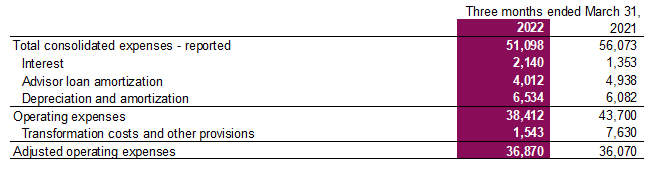

All adjusting items affect reported expenses. The following table itemizes these adjustments and reconciles reported operating expenses to adjusted operating expenses:

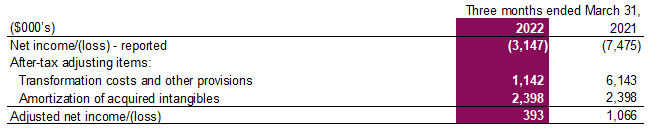

The following table provides a reconsolidation of the Company’s reported net income/(loss) to adjusted net income/ (loss):

Supplemental Financial Measures

The Company’s key SFMs disclosed periodically in this press release include AUA, recruiting pipeline, net new and recruited assets, AUA per advisory team, and household AUA. The composition of a SFM is included in this press release where the measure is first disclosed.

Forward-Looking Information

This press release contains forward-looking information as defined under applicable Canadian securities laws. This information includes, but is not limited to, statements concerning objectives and strategies to achieve those objectives, as well as statements made with respect to management’s beliefs, plans, estimates, projections and intentions and similar statements concerning anticipated future events, results, circumstances, performance, or expectations that are not historical facts. Forward-looking information generally can be identified by the use of forward-looking terminology such as “outlook”, “objective”, “may”, “will”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “should”, “plans” or “continue”, or similar expressions suggesting future outcomes or events. Such forward-looking information reflects management’s current beliefs and is based on information currently available to management. The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement.

The forward-looking statements included in this press release, including statements regarding the NCIB and Consolidation, the nature of our growth strategy going forward and execution of any of our potential plans, are not guarantees of future results and involve numerous risks and uncertainties that may cause actual results to differ materially from the potential results discussed or anticipated in the forward-looking statements, including those described in this press release, our 2021 Annual MD&A, and our latest Annual Information Form (AIF). Such risks and uncertainties include, but are not limited to, market, credit, liquidity, operational and legal and regulatory risks, and other risk factors, including variations in the market value of securities, dependence on key personnel and sustainability of fees. In addition, other factors, such as general economic conditions, including interest rate and exchange rate fluctuations, and natural disasters, or other unanticipated events (including the novel coronavirus and variants thereof (COVID-19) pandemic) may also influence our results of operations. For a description of additional risks that could cause actual results to differ materially from current expectations, see the “Risk Management” and “Risk Factors” sections in our 2021 Annual MD&A.

Although we attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other risk factors not presently known to us or that we presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information.

Certain statements included in this press release may be considered a “financial outlook” for purposes of applicable Canadian securities laws. The financial outlook may not be appropriate for purposes other than this press release.

Forward-looking information contained in this press release is:

- based on management’s reliance on certain assumptions it considers reasonable; however, there can be no assurance that such expectations will prove correct. As such, readers should not place undue reliance on the forward-looking statements and information contained in this press release. When relying on forward-looking statements to make decisions, readers should carefully consider the foregoing factors, the list of which is not exhaustive;

- made as of the date of this press release and should not be relied upon as representing our view as of any date subsequent to the date of this press release. Except as required by applicable law, our management and Board undertake no obligation to update or revise any forward-looking information publicly, whether as a result of new information, future events or otherwise; and

- expressly qualified in its entirety by the foregoing cautionary statements

About RF Capital Group Inc.

RF Capital Group Inc. (RF Capital) is a TSX-listed (TSX: RCG) wealth management-focused company. Operating under the Richardson Wealth brand, the Company is one of Canada’s largest independent wealth management firms with $35.9 billion in assets under administration (as of April 30, 2022) and 20 offices across the country. The firm’s Advisor teams are focused exclusively on providing strategic wealth advice and innovative investment solutions customized for high-net worth or ultra-high-net worth families and entrepreneurs. The Company is committed to maintaining exceptional fiduciary standards and has earned certification – determined annually – from the Center for Fiduciary Excellence for its Separately Managed and Portfolio Management Account platforms. Richardson Wealth has also been recognized as a Great Place to Work™ for the past three years, a Best Workplace for Women, a Best Workplace in Canada and Ontario, Best Workplaces for Mental Wellness, in Financial Services and Insurance, and for Hybrid Work. For further information, please visit our corporate website at www.rfcapgroup.com and www.RichardsonWealth.com.

Media and Investor Contact:

RF Capital Group Inc.

Rocco Colella, Managing Director, Investor Relations

Tel: (416) 941-0894; [email protected]