June 4, 2024

Investor Strategy

This calm won’t last

Sign up here to receive the Market Ethos by email.

Executive summary

- May flowers

- This ain’t that

- Revising cyclical yield in the Canadian dividend space

- Market cycle

- Final thoughts

Maybe the summer months will see quiet markets, or maybe this lack of volatility across many asset classes is the calm before a storm. One thing is certain, gains have been good of late, and becoming or remaining defensive feels appropriate.

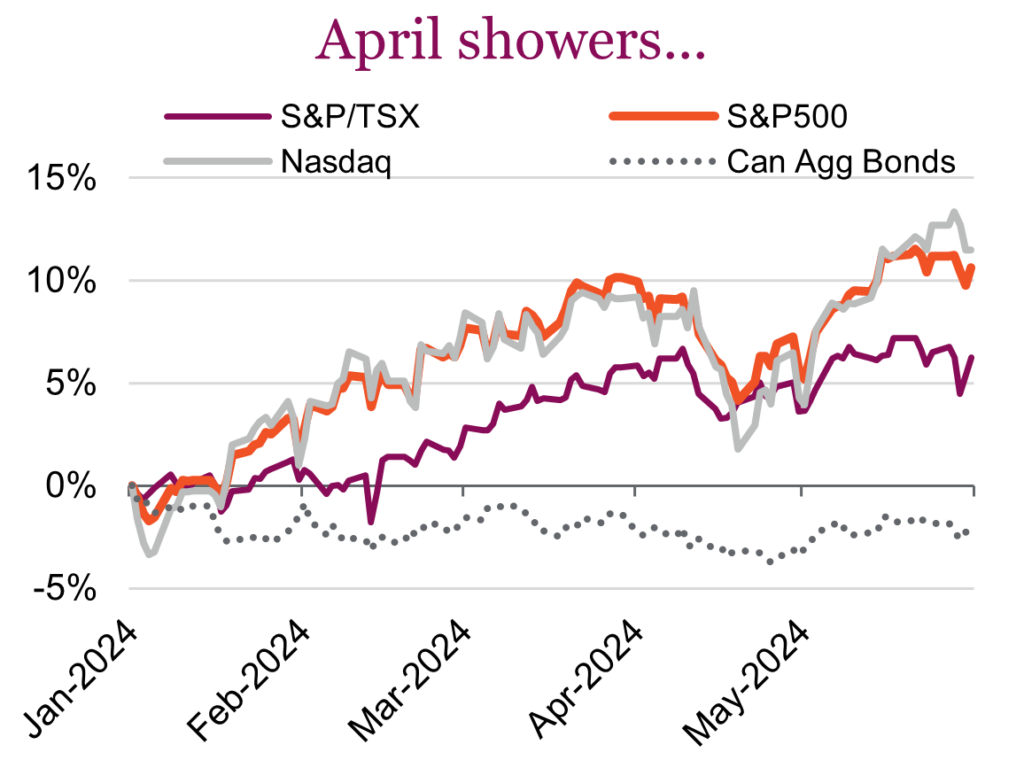

May flowers

Markets rallied in May with all major North American equity indexes rising over the month, along with both the U.S. and Canadian bond markets. Markets were able to claw back their losses from April with the S&P 500 closing May 5.0% higher on a total return basis. The Nasdaq saw its strongest month since November 2023, rising 7.0% over the month while the TSX rose 2.8% on a total return basis. Equity markets have seen an impressive start to the year, with the S&P 500 up 11.3%, TSX up 7.6% and the Nasdaq up 11.8% YTD on a total return basis for the year, although the ride has been anything but smooth. Even the rally investors enjoyed in May lost some steam at the end, with all major North American averages closing nearly 1% below their record highs by the end of the month.

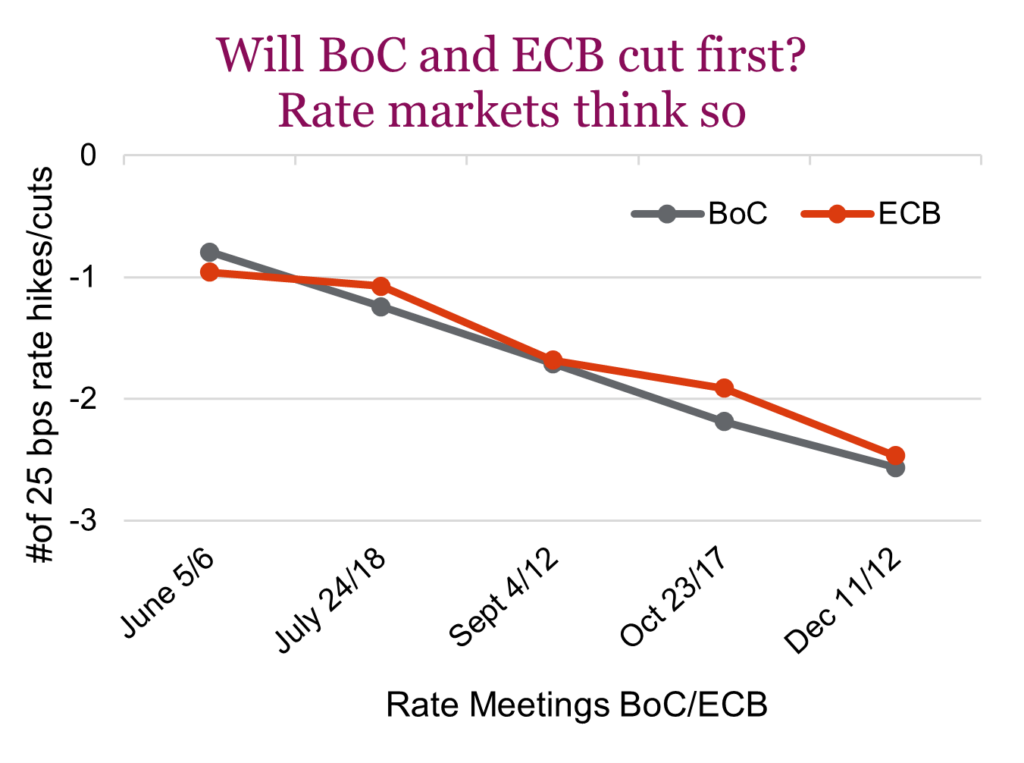

For the most part, investors chose to look on the bright side in May, taking comfort in signs that inflation is retreating in major developed economies. Dovish (or less hawkish) comments from central bankers along with cooling inflation prints have led to expectations that the BoC and EBC will lower interest rates at their next meetings. Still, the economic outlook among developed economies is varied, along with the progress towards inflation targets among central banks, most notably in relation to the Fed who is not expected to lower rates any time soon. The Fed has been cautious as there were a good number of data prints over the month that showed the resilience of the U.S. economy. Inflation figures in the U.S. have surprised more frequently on the upside this year, meaning that it will take more than one month of good inflation prints to make the Fed pivot. A positive note on the inflation front, the Fed’s preferred gauge, the core personal consumption expenditures price index increased just 0.2% from the prior month. Still, investors appear confident that inflation in most economies, including the U.S., is moving lower and will continue to do so, which helped both Canadian and U.S. bond markets see strong gains in May. When it was all said and done, the U.S. aggregate bond market was up 1.7% for the month while the FTSE Canada Universe bond index finished 1.8% higher over the month.

It wasn’t only economic data investors needed to consider over the month, the earnings season gave insight into the health of consumers and where corporations see the economy going. Equities got a boost from positive corporate earnings in May, most notably Nvidia, which blew past expectations. But positive news wasn’t isolated to just a few tech names. At the end of the month, 98% of S&P 500 companies had reported Q1 earnings results, with 78% of those companies reporting a positive EPS surprise and 61% reporting a positive revenue surprise. Investors also took comfort in disinflationary signals coming from the corporate sector. The number of S&P 500 companies who cited inflation on their earnings conference calls declined for the seventh consecutive quarter in Q1 2024 and is on track to be the lowest since Q2 2021.

This ain’t that

The U.S. market is up a little over 10% this year, Canada +6% Europe +10%, Japan +15%, while bonds are down about -1%. Huh, that sure does look like asset allocation is working well again after the car crash of 2022. Even better, the market is moving higher thanks to good fundamental news, not simply due to central bankers jamming more money into the financial system.

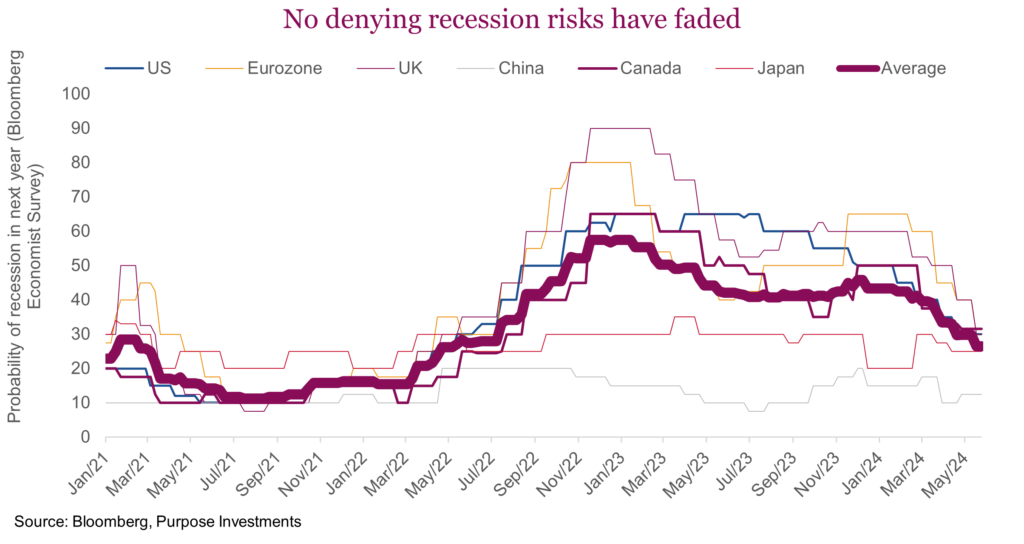

Recession risk has continued to fade, as evident in the survey of economists. For the UK, Canada, U.S., Eurozone, China & Japan, the average probability of a recession hit a high in late 2022 at about 60% and has fallen down to a mere 25% of late. The UK, which was as high as 90% and did suffer two negative quarters of GDP growth, is now down to 30%, winning the most improved ribbon. Even Canada, which is clearly struggling with higher rates has improved from over 60% to 30%. Most are clustered around the 30% zone.

The data has improved, with both markets and economists celebrating. This is good news and perhaps this better economic data will make its way into improving earnings expectations– that is what counts more. There has been some minor uptick of late, so again, encouraging. And inflation continues to cool, for the most part, which should have more central banks starting to walk rates back down in the quarters ahead.

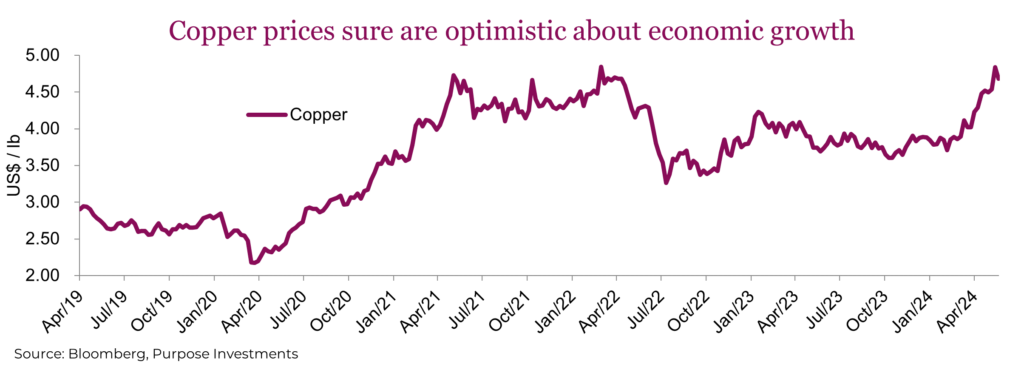

Add that all up, and can we justify most equity markets sitting around fresh all-time highs? Or even more importantly, can we expect more gains to come if this is the start of a new cycle? Fueling the optimistic view is the rising price of copper, and other commodities. Copper carries an honorary PhD in economics because of its widespread use in manufacturing, often implying a rising price coincides with rising broader economic activity. And copper has been on a tear.

New cycle? This ain’t that. We would agree with the economists group view that recession risks are diminished compared to past quarters, but would temper enthusiasm or talk of a new cycle due to a number of important factors.

- Delayed and variable confusing lags or policy

Rate hikes have slowed down economic growth; that relationship remains intact. But this drag has been muted thanks to accumulated savings during the mobility reduced period following the pandemic. And from very aggressive fiscal spending just about everywhere in the world, led enthusiastically by the U.S. The concern is these buffers are starting to roll over or become depleted, which will temper growth going forward.

- Goods spending, then services spending, now what?

As we highlighted last month, during the stay-at-home period we all spent money on goods. This blew up supply chains and also supercharged economic growth in 2020-21. In 2022 we all pivoted, to a degree, back to more service spending on travel, eating out, experiences, etc. This made it appear as a recession was coming since goods spending, manufacturing and global trade slowed. But alas, it was just a tectonic shift in spending behaviour. Now, goods spending is recovering but is this robust demand or just normalizing from the depressed levels of 2022? Time will tell on this one, but our base case is this is more normalization and not the start of a new cycle.

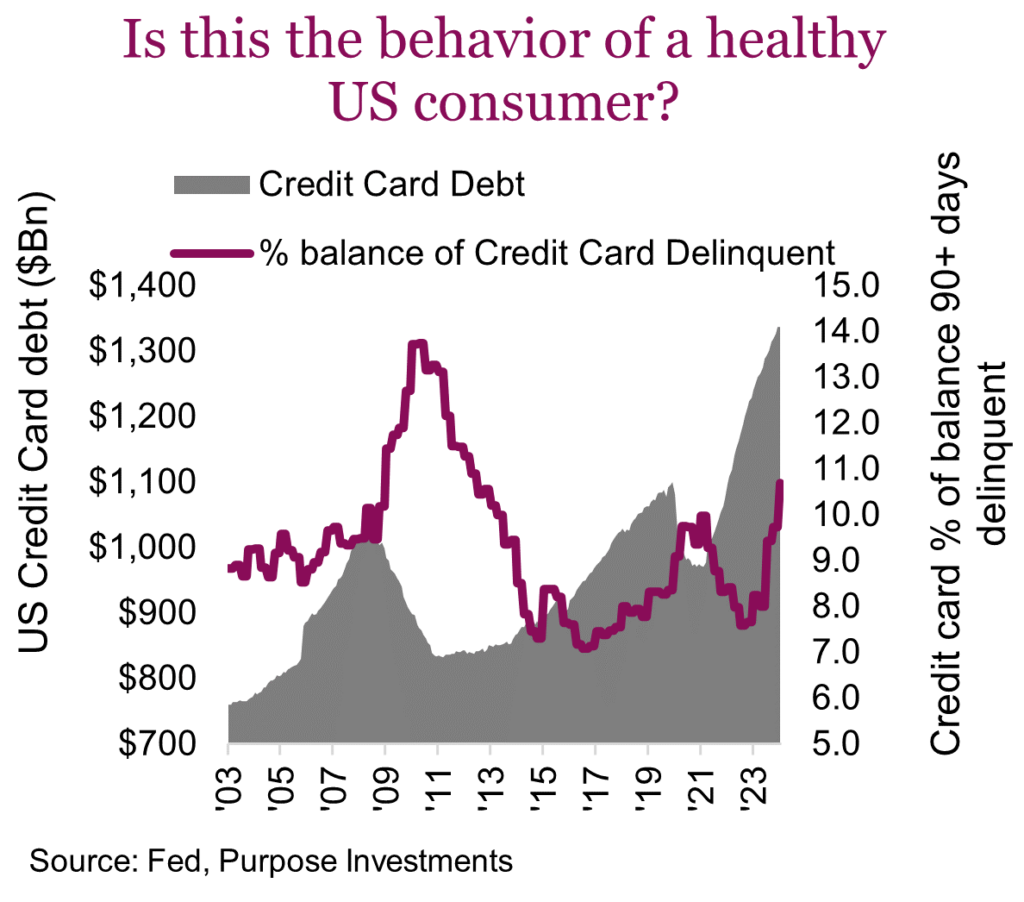

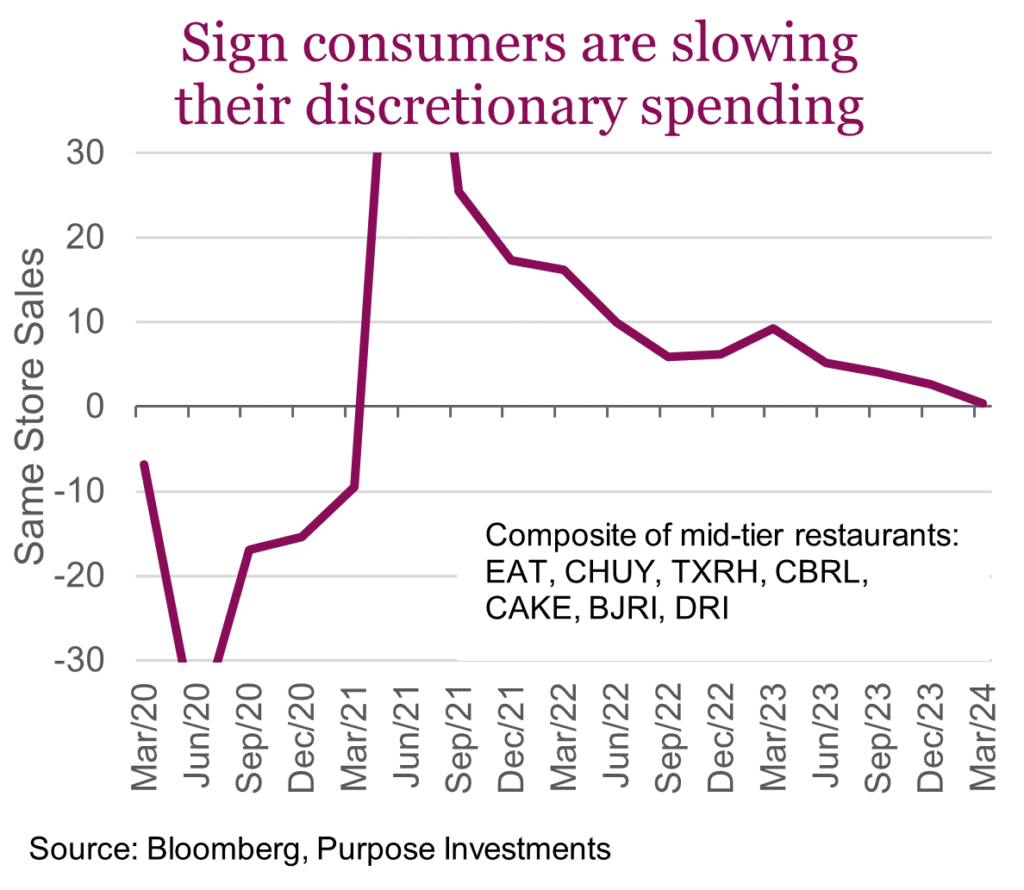

Normalization is good news, but not great news. And with accumulated savings largely depleted due to inflation and a desire to ‘live’ despite the costs, the longevity of this improved economic activity may not endure. Just look at the U.S. consumer. We are not concerned about the level of credit card debt given societies’ move towards more of a cashless world. But the delinquency rate is concerning. As is the same-store-sales at restaurants just a notch above fast food.

Not denying decent employment and wage gains are a positive, but it would appear inflation has taken a toll. And those accumulated savings are largely depleted. This is not the behaviour one would expect during the start of robust economic growth, in fact it is the behaviour often seen near the end of a cycle.

- And then there is what is priced in

We won’t harp too much on valuations as everyone knows the deal. The S&P 500 at 21x forward earnings is on the high side, but this has been the case for some time;15x for the TSX and International equities is not cheap either. The vast majority of market gains this year has come from multiple expansion.

We are not overly negative and currently are carrying just a moderate underweight in equities. However, for this market to move higher we would need to see continued improvement in global economic growth, which may be challenging. Or inflation to come down materially, alleviating the pressure higher yields elicit on the equity markets. Possible, but not our higher probability path.

Given this, we are comfortable with our moderately defensive stance.

Revising cyclical yield in the Canadian dividend space

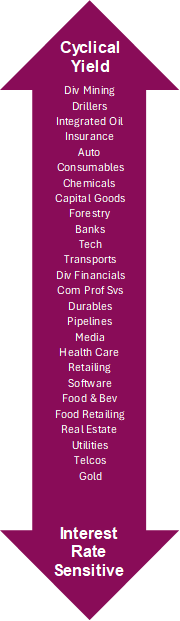

When it comes to dividend investing, the interest rates play a large role determining the relative winners and losers. Not only are dividend stocks sometimes viewed as bond proxies, but company earnings can also be quite rate sensitive. This lens of rate sensitivity reveals the full spectrum of dividend stocks. On one hand you have the highly rate-sensitive industries such as Telcos, Utilities and Pipelines and on the other are industries that are much more cyclical. We’ve long used the term cyclical yield to define these companies whose earnings depend much more on the economic cycle compared to the much more defensive rate sensitive stocks.

Our scoring, or ranking system, uses a combination of an industry’s correlation to bond yields, sensitivity to bond yields (think like Beta but instead of relative to the market it’s relative to yields) and an out-of-sample score for periods over the past decade of rising yields. The chart to the right depicts the full spectrum of sectors/industries within the TSX. The top grouping, Cyclical Yield, are those that we would expect to hold up better in a rising yield environment. The bottom grouping, Interest Rate Sensitive, are those that we would expect to perform best in a falling yield environment.

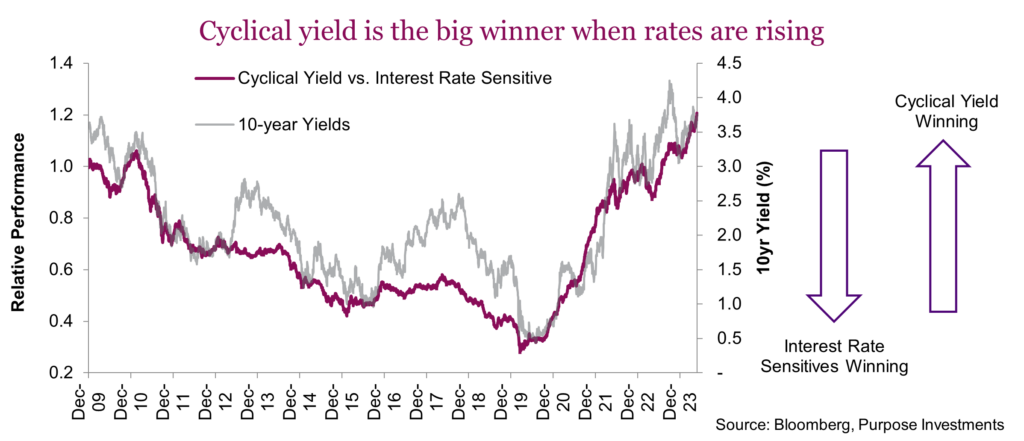

We’ve long had a tilt across our dividend mandates towards cyclical yielding dividend payers. Given the chart below, the cyclical yield has handily outperformed the rate sensitives over the past few years. The outperformance typically comes when yields have been rising. Looking back in the 2010s, there were brief periods when cyclical yield outperformed, but overall rate sensitives did quite well with the tailwind of falling yields. That all changed in late 2020 and cyclical yield has really not looked back.

Deciding when to switch or actively tilt between rate sensitive vs more cyclical stocks boils down to a few key considerations.

- Economic indicators – Cyclicals have thrived during periods of accelerating GDP growth. The resiliency of the U.S. economy has surprised many, and the soft landing has benefited cyclicals. Rates remain stubbornly high, along with inflation. While the path to 2% inflation and how long it will take to get there remains one of the most important macro questions out there, interest rates remain near cycle peaks. Higher for longer should hurt cyclicals the longer rates remain restrictive.

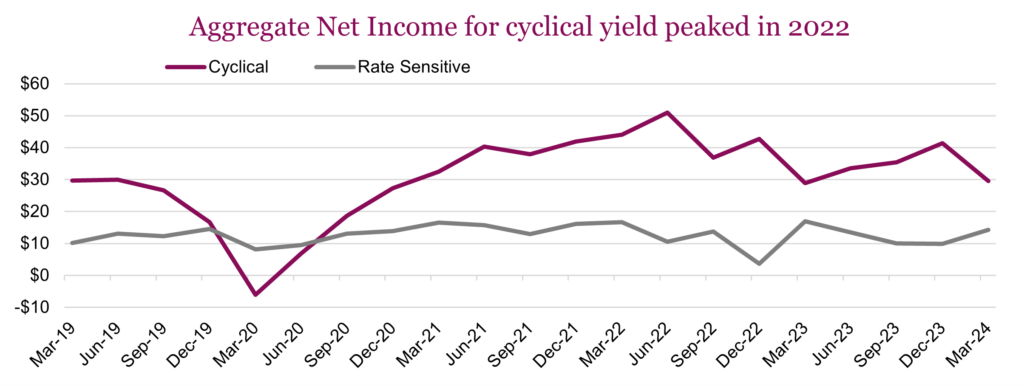

- Business cycle phases – The business cycle remains healthy and in expansion territory. Margins have remained historically healthy and based on the latest earnings quarter, both sales growth and earnings growth remain strong. While the business cycle remains healthy from a 10,000 ft perspective, digging into the specific sectors we do see an interesting trend developing. The chart below aggregates total net income from continuing operations across both cyclical yield and the rate sensitives. Cyclical earnings peaked back in 2022, and have been trending lower. Conversely, rate-sensitive net income bottomed in late 2022, and has begun to recover. Relative earnings growth favours the rate sensitives, which has been aiding the lower beta tilt seen in the market of late.

- Market sentiment – Risk appetite in the market remains strong, and investor sentiment remains decidedly bullish. The AI story continues to drive strong relative performance as investors continue to be guided by the urge to not miss out. While the relative performance this year has certainly benefited cyclicals over the past few months, rate sensitive stocks have actually begun to do quite well. In May, the utilities sector was the second-best performing sector in both Canada; U.S. Staples too have been solid relative winners. This could in fact be an early sign that investors are increasingly looking to diversify into lower beta names.

- Fundamentals – Valuations can sometime take the back seat to investment decisions, especially in a new era investment environment. Investors would be wise to remember that excesses are never permanent, and past trends don’t have anything to do with future performance. From a traditional valuation standpoint, certain cyclical sectors (Energy) still appear somewhat cheap, as the average P/E across our cyclical industries is still just 15.3x, compared to 19x for the Canadian rate sensitives. For cyclical companies, a low P/E doesn’t necessarily mean a stock is cheap because the P/E ratio can be misleading. During boom times, earnings tend to be high, which can make the P/E ratio appear low. During downturns, earnings drop significantly, and the P/E goes parabolic or even nonexistent. Low P/Es across the cyclical space can reflect the peak of the business cycle. Rate sensitives might have a higher P/E but they are also, on average, trading at a sizeable discount to their average valuations. Telecom and Utility sectors in particular are trading at nearly a 20% discount. Undervalued assets offer a margin of safety, reducing potential downside risk.

Bond yields have had an extended trend higher, and dividend strategies, especially those tilted more so towards interest rate sensitive sectors, have had a difficulty go. Being active managers, we’ve had a definite tilt towards cyclical yield, which has helped. Looking ahead to the future rate path, the trajectory certainly isn’t as clear as it was back in 2020/2021. The growing consensus believes rates have peaked, and with growth rates slowing, cyclical yield may not be the best place to be. The relative cheapness and recent earnings growth trends in favour of rates sensitives also makes this space more attractive. The recent rise in global interest rates approaching cycle highs, alongside a US market trading at a high valuations (21.4x forward earnings), presents a potential challenge for the stock market. However, this environment can also be viewed as an opportunity. By strategically adding investments with higher interest rate sensitivity and inherent defensiveness, investors can position their portfolios to benefit from falling rates in the same way as increasing duration in a fixed income portfolio.

Market cycle

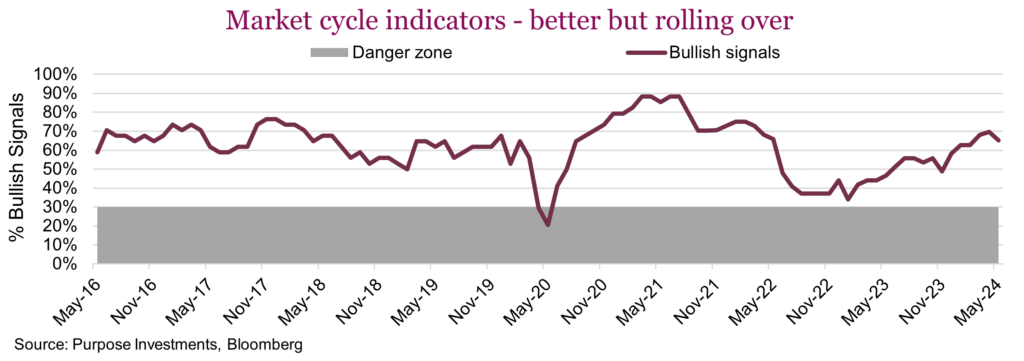

After many months of steady improvement, we have seen the Market Cycle signals take a small step lower over the month of May. Market Cycle indicators are comprised of over 40 indicators that have in the past proven to be a good forward-looking signal for the broader economy.

Among the 19 U.S. economic signals, two slipped from bullish to bearish. The Citigroup Economic Surprise index turned negative, as generally the data has been coming in softer of late. And NAHB housing activity soured. Two signals also flipped to bearish among the global economic signals. Baltic Freight rates declined, but you could put a positive spin on it and say this is just cooling concerns about Red Sea travel. DRAM prices fell as well, while Rates and Fundamental signals remained stable.

On a sobering note, you can see a score for ‘Better / Worse’ in each category, with either ‘+’ or ‘-’ next to each signal. This measures the direction the data is traveling over the past month. Is it getting better or worse? Compared to last month, Rates got worse from 3/0 to 0/2. US economy was stable from 7/12 to 6/13, worsening rather than improving but roughly the same as last month. Global economy stayed at 3/5. Fundamentals, following earnings season, have dropped from 10/2 to 4/8– not good as this is a material swing in momentum.

Overall, this just highlights some deterioration in direction, but that does change often.

The only change we have made from a strategic allocation perspective is increasing exposure to emerging markets. After being underweight emerging markets for many years, we are now back to neutral. This was predicated on an elevated valuation spread between emerging markets and developed markets, as well as improving global trade and relative earnings growth.

Outside this change we remain moderately underweight equities, holding a bit more bonds and cash. Among equities we are a bit underweight U.S. equities and overweight internationals. Bonds have us carrying a bit higher duration.

Final thoughts

Maybe the summer months will see quiet markets, or maybe this lack of volatility across many asset classes is the calm before a storm. One thing is certain, gains have been good of late and becoming or remaining defensive feels appropriate. The back half of this year certainly has more challenges than the first half. We are going to see a big U.S. election. We will also likely see if this uptick in global growth is a bounce or the start of something sustainable. And maybe there will be a broader central bank pivot.

The only certainty? This calm won’t last.