Market Ethos

March 25, 2024

Has anyone seen my IPO?

Sign up here to receive the Market Ethos by email.

No denying the equity markets are in the throes of a strong advance. The S&P is up 21% over the past six months, Europe is up 19%, Japan 25%. And given the even stronger gains in pockets such as AI, there is no shortage of people talking bubbles; us included (read March Investor Strategy). But it isn’t a system-wide bubble, it’s more isolated mini bubbles in our opinion. That doesn’t mean it won’t hurt at some point, but it’s unlikely to be overly destabilizing. The fact is a number of key ingredients are missing to label it as a major bubble. Equity flows is one, as there isn’t really a rush of cash coming into the market as measured by fund and ETF flow data. Another crucial ingredient is the IPO market.

Last week, Reddit IPO’ed (Initial Public Offering) with an offer size of $748 million and closed on day one at $1.25 billion. That gives the company a total value of $7.5 billion; not bad given $800 million in sales during the last 12 months. IPOs doubling on the first day of trading was a weekly occurrence in the tech bubble, yet this was anything but regular. The IPO market has remained very quiet. In North America, $5 billion of IPOs began trading so far this year, on pace for the bleak annual pace for the past two years of $17B in 2023 and $22B in 2022. Even more anemic is Canada, with virtually no IPOs in 2024 so far.

Markets are strong with lots of indices making new all-time highs, so why is the IPO market so dormant? 2021 was an investment bankers dream, fueled by strong equity markets and lots of mini bubbles in things like clean tech, profitless tech, digital assets … the list goes on. It even includes the non-fundamentally driven rise of GameStop, coincidentally fueled by the Reddit crowd. To be clear, Reddit announced its IPO in 2021 and didn’t start trading till just now.

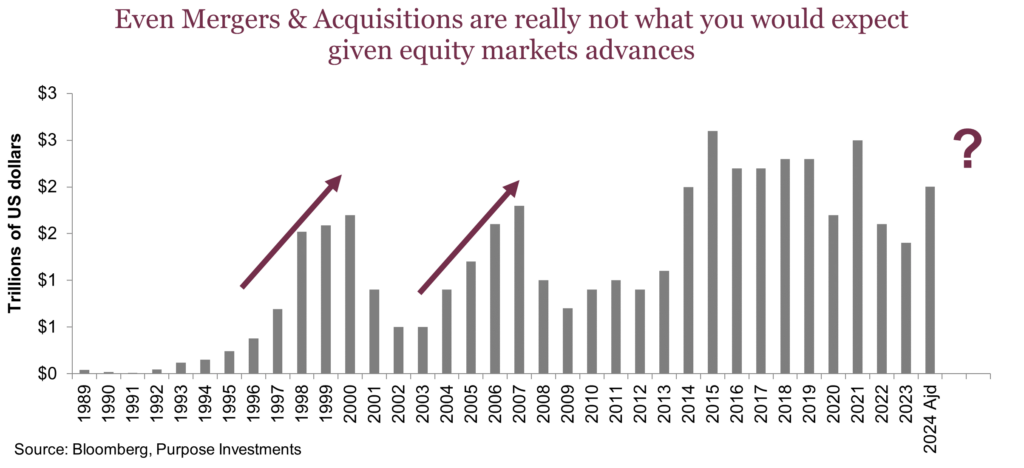

It is not just the IPO market that is eerily quiet, mergers and acquisitions (M&A) have also been rather subdued. The normal playbook is that later in a bull market, corporate leaders start getting more aggressive. And to fuel growth faster than normal organic initiatives, they turn to buying one another. Helping this process is high valuations for the buying company’s equity or easy access to credit. Perhaps we are not seeing as much M&A activity because the availability of low cost credit appears to be over, making it more expensive to lever up and buy one of your competitors. Yet, no denying the valuations among many equities are at historically high levels.

Of course, the question is why. There are likely a number of contributing factors to the dearth of IPO and M&A activity. As we pointed out, the higher cost of capital has made it more challenging; the greater the cost of doing a deal, the higher the expected rate of return must be. Strapping on more debt to buy a competitor or other business now requires a lot more expected benefit than it did when capital was cheap and plentiful.

No doubt the rise of private equity has played a part. Companies are now staying private much longer in their growth stages and using private funding sources. If the equity market environment isn’t just right, many companies may continue to opt for private funding over tapping a less receptive public market.

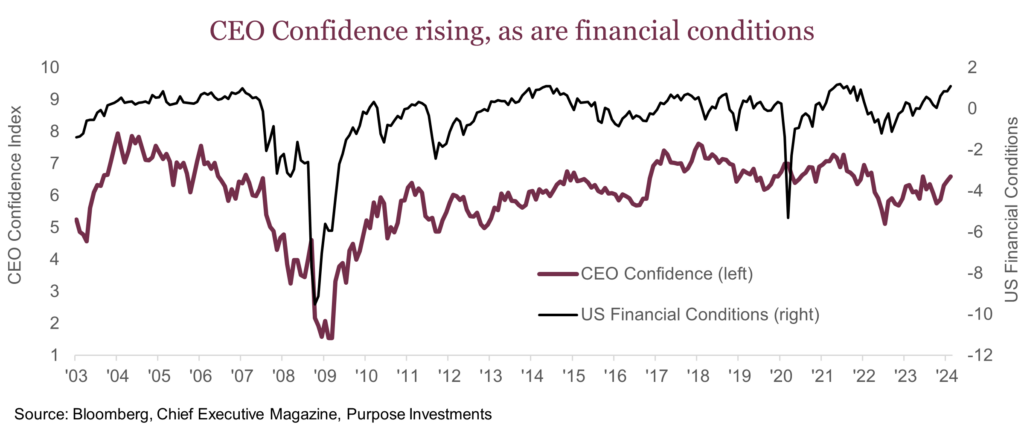

One of the other missing ingredients may be confidence. Chief Executive magazine has a monthly survey of CEOs asking how they would rate the economic outlook for the next year on a scale of 1 to 10. Confidence obviously falls during recession, and it also fell in 2022 during the battle against inflation. And while inflation has calmed, markets have recovered and even financial conditions have returned to normal levels, CEO confidence is still on the lower side. Perhaps the uncertainty of recession risks and lingering inflation are weighing on their minds. Nonetheless, lower confidence equals less M&A and fewer IPOs. On a positive note, this confidence survey has been gradually improving.

Final thoughts

If this were a broader bubble market environment, we would be seeing a lot more corporate activities from mergers, acquisitions or tapping the public market for dollars. Yet, it also demonstrates the challenges companies are facing with the higher cost of capital due to higher yields. And, given executives’ lack of confidence about the future, it likely encourages a more cautious or wait-and-see attitude.

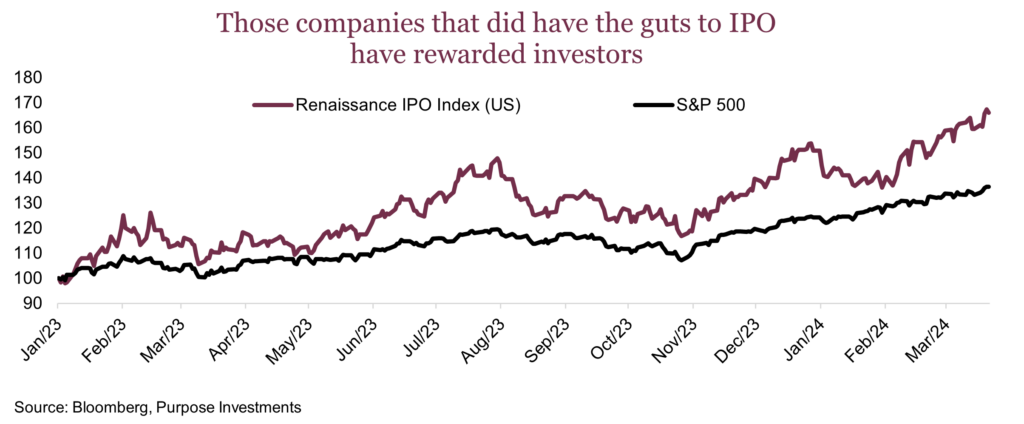

Maybe the Reddit IPO will become infectious and inject some optimism into those waiting to hit the market. Or maybe the new highs of markets will help. Or stabilizing of bond yields. There is likely a lot of pent-up demand for raising capital or doing deals or going public. Another factor that may encourage an end of this IPO drought is the performance of those that had the guts to IPO. The Renaissance IPO index tracks the performance of IPOs for two years. A bumpier road, yet IPOs have certainly been beating the broader market. Maybe the deal drought is coming to an end.