Sign up here to receive the Market Ethos by email.

Market Ethos

October 10, 2023.

Now that was a blockbuster jobs report! The U.S. economy added 336k jobs in September, based on the nonfarm payroll report, much stronger than expected. Plus, the last two months were revised higher by 119k. This was a strong labour report (or labor as they like to spell it in America). Almost 100k jobs in leisure / hospitality and education / health +70k were the big contributors, as was government at +73k, bringing total government employees above pre-pandemic levels. We will touch on deficits below. Canada too, enjoyed strong labour gains at +64k. Jobs for everyone it seems is still on.

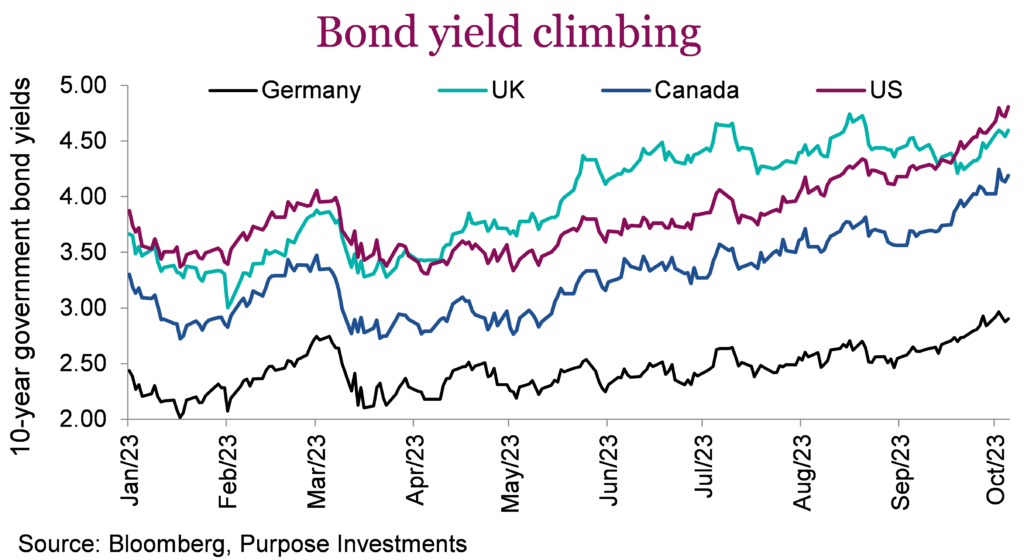

In response, bond yields have jumped higher yet again. At time of writing the U.S. 10-year Treasury is now yielding 4.8%, up a full percentage point since mid-July on what appears to be a relentless climb to who knows where. It is not just America, yields have been climbing in Canada, Europe, the list goes on. The yield gains are larger in North America, but in the past few weeks the other major markets are hopping on the trend.

So, you are telling me I can lock in a 10-year annualized return of 4.8% by owning a U.S. Treasury or 4.2% for a Canada Govie? That certainly makes for a more constructive financial plan if my portfolio target is somewhere in the 6-7% range. Of course, it wouldn’t be a straight line, but if it’s more end point focused it certainly has an appeal, as does 5% yields on money market or shorter-term vehicles. Clearly appealing yields, looking at investor behaviour this year as money has piled into money market vehicles. Based on ICI data from the U.S., money market assets have increased from $4.7 to $5.7 trillion so far this year, following a similar trend in Canada, albeit of smaller magnitude.

Here lies the problem

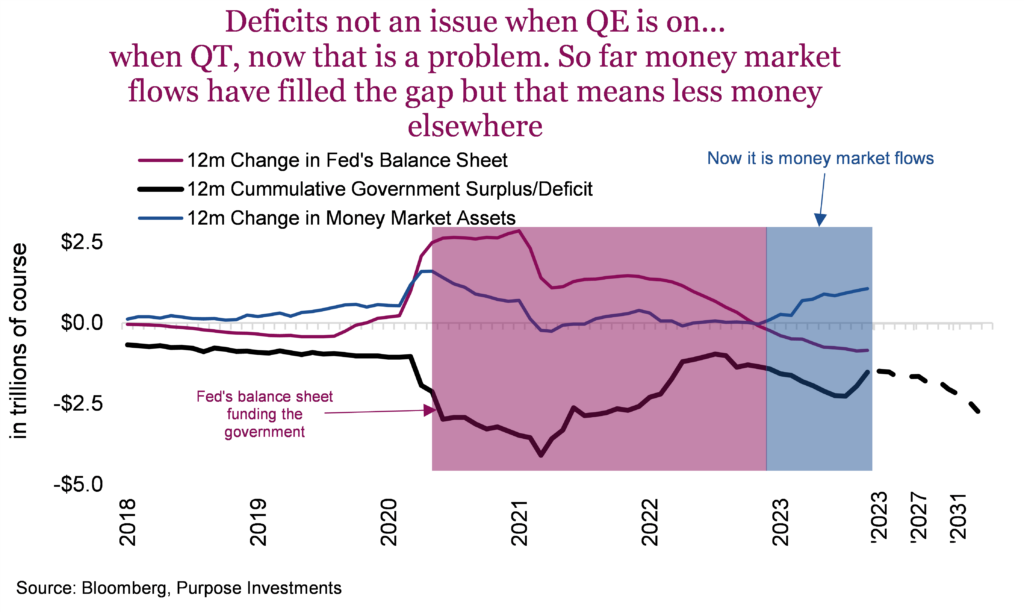

The U.S. government is expected to be running a $1.5 trillion deficit in 2023 which is forecast to rise to $2.8 trillion over the next decade. During the pandemic, when the deficit was an astonishing $3.1 trillion, it was largely funded by the central bank buying bonds and expanding its balance sheet. One hand helping the other. But that is no longer the case as QE has become QT, meaning the balance sheet is shrinking. International Treasury buying is also on the decline as other central banks such as China and Japan are simply less enthusiastic buyers compared to years past.

And then there are the banks. U.S. banks have been buyers of Treasuries in years past. But with short rates so high and unrealized losses on their existing bond holdings (expect to hear more about that in the upcoming earnings season), let’s just say they too are not enthusiastic about buying more Treasuries, especially with such a low carry. So, it’s up to the private sector which so far has been a willing buyer given money flows lured by the higher yields. But if you and I are the new buyers of government debt to fund deficits, that means our capital is not going into corporate investments as much. This is what crowding out of private investment looks like. And while it is no surprise to anyone, a dollar given to the government does not have the same economic benefit as a dollar given to a corporation.

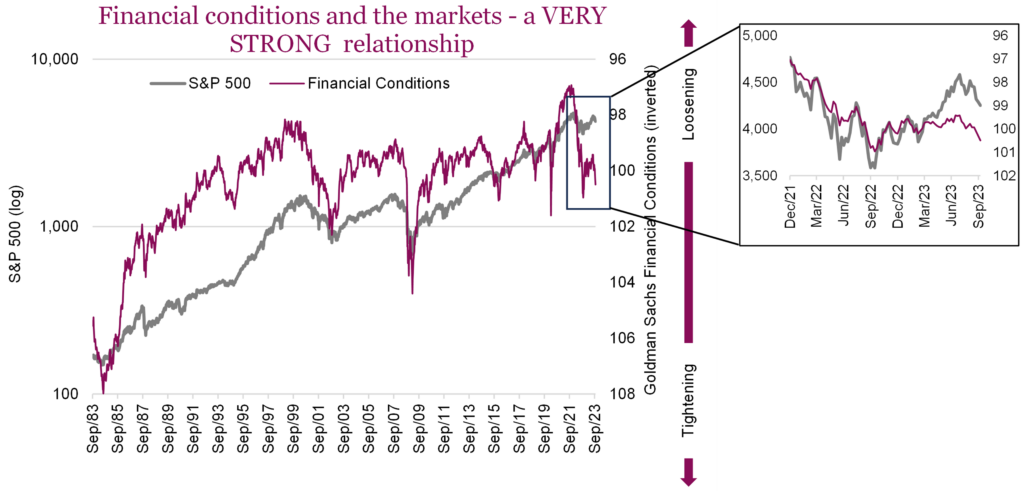

Taken all together, money supply has been shrinking, yields have moved higher and now credit spreads are rising. That means financial conditions are tightening at an increasing pace. Monetary policy is a blunt instrument that works on a delay, it is starting to bite more and more. It’s also worth pointing out that a sudden move like this in financial conditions is unsettling.

Final thoughts

The cost of capital is real again and it is a lot higher than it has been in years. It’s also not as plentiful, exacerbated by more private capital going to government spending. It isn’t all doom and gloom though; in fact it is probably healthier. Unfortunately, after so many years of a low cost of capital and tons of excess liquidity sloshing about the world, the adjustment is likely a long process. This means we will continue to see big market moves, like down in 2022 and up in the first half of 2023. We remain cautious on the second half of 2023.

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.