Market Ethos

October 28, 2024

The hedge conundrum

Sign up here to receive the Market Ethos by email.

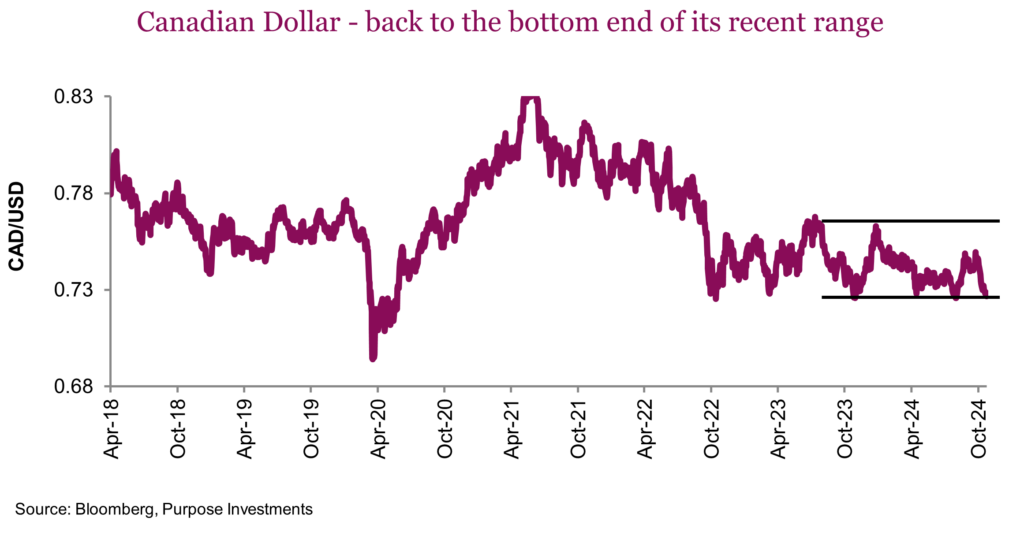

Summary: The USD has risen a lot lately against most currencies including the CAD. There are many economic/yield reasons for this move, with the biggest being USD strength ahead of the potential election uncertainties. Yet at 72 cents, the CAD may be getting too cheap.

There are so many things that are great about being Canadian. One of them is the U.S. dollar (USD), or more specifically the impact USD exposure has on Canadian portfolios. It is a natural diversifier for Canadians because it most often behaves as a safe haven currency, while our home currency and market are not. The Canadian equity market, given our resource tilt, is more sensitive to future global economic growth expectations – and so is our currency (CAD). Meanwhile the USD is viewed as a safe haven currency, in part because when trouble hits, Americans move their cash/investment closer to home, often driving the USD higher.

Given this almost natural diversification benefit of USD exposure for Canadian portfolios, we generally don’t hedge the currency for our U.S. investment holdings. The exception to this general rule is when the CAD gets too weak (or USD gets too strong), and we may do some partial hedging. So at 72.2 (1.384), is it weak enough?

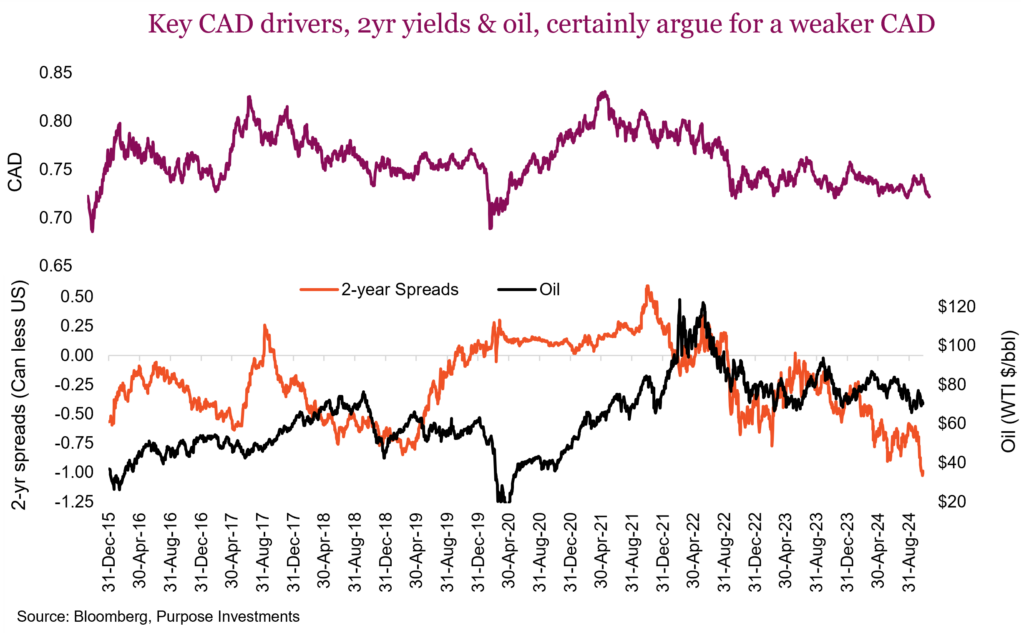

There are some really good reasons why the CAD is at 72 cents. For starters, the Bank of Canada cutting 50 bps while expectations for future Fed cuts keep moderating due to stronger economic data. Today, the Fed Funds is at 5% and the market is “pricing-in” between 5-6 25 bps cuts by the end of 2025. That compares to eight cuts priced in a mere month ago. Now Canada is already down to 3.75% with 4-5 cuts anticipated by the end of 2025. This is all just near-term economic data momentum. The Citigroup Economic Surprise index for the U.S. has been rising and now sits at +20 compared to -44 two months ago. Canada was +4 two months ago and is now -13. One economy is picking up vs expectations, the other is slowing.

Add that all up and the two-year yield differential between Canada and the U.S. is now at extreme levels. Two-year yields are often viewed as the better indicator for currency pairs, compared to overnight lending rates. That spread is more than 1% and oil prices have been trending downward, a further headwind for the CAD.

But wait there’s more. Speculators, based on futures positioning, are betting heavily against the CAD. And then there is the election, the U.S. election that is. There is a common occurrence ahead of U.S. elections for the USD to strengthen. Doesn’t always occur as there are many moving parts in currency markets, but as the election day approaches, the USD often goes up –likely money coming back to the safety of the USD just in case something goes awry. That makes this not completely a CAD/USD thing, but more general USD strength against all others. For Canadians, the USD is up 3% this month; for Japanese investors it’s up 6%.

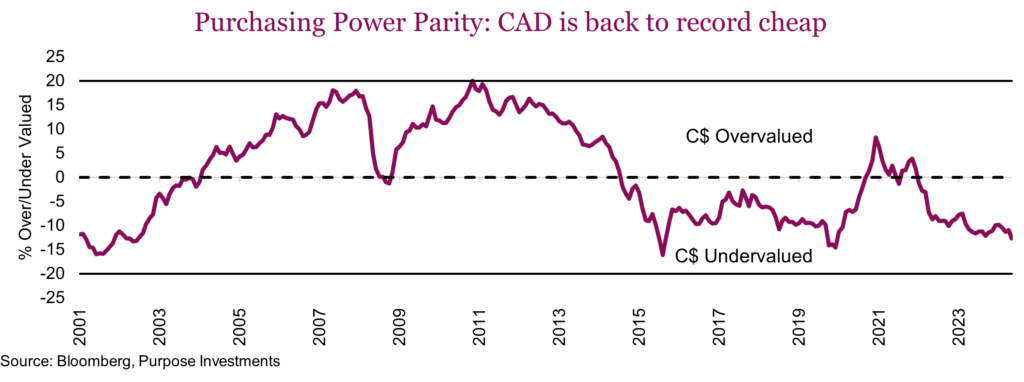

That all sounds pretty grim for the loonie doesn’t it? But that is also why it’s down at 72 cents today. Purchasing Power Parity is a model that rarely works: comparing the purchasing power in one country to the next based on the exchange rate. Yet the further it gets away from the zero line, the stronger the attraction or mean revision becomes. Today, things cost much less in Canada than the U.S. That attracts capital, that attracts tourism, that attracts acquisition interest, etc. Add all that up and your currency likely starts to appreciate.

Final thoughts

So the CAD is cheap and the USD is expensive. Add to this extremely negative futures positioning and the fact that global growth is actually pretty good. Decent or improving global economic growth is usually positive for CAD and negative for USD. If it were not for a close U.S. election in a little over a week, we would be getting really excited about hedging USD exposure. Everyone seems to be talking about contested election risk and added uncertainty. There is also the scenario where the election is resolved with less uncertainty, that could easily see the CAD snap back and rebound higher.