Market Ethos

May 21, 2024

When bad news is good news

Sign up here to receive the Market Ethos by email.

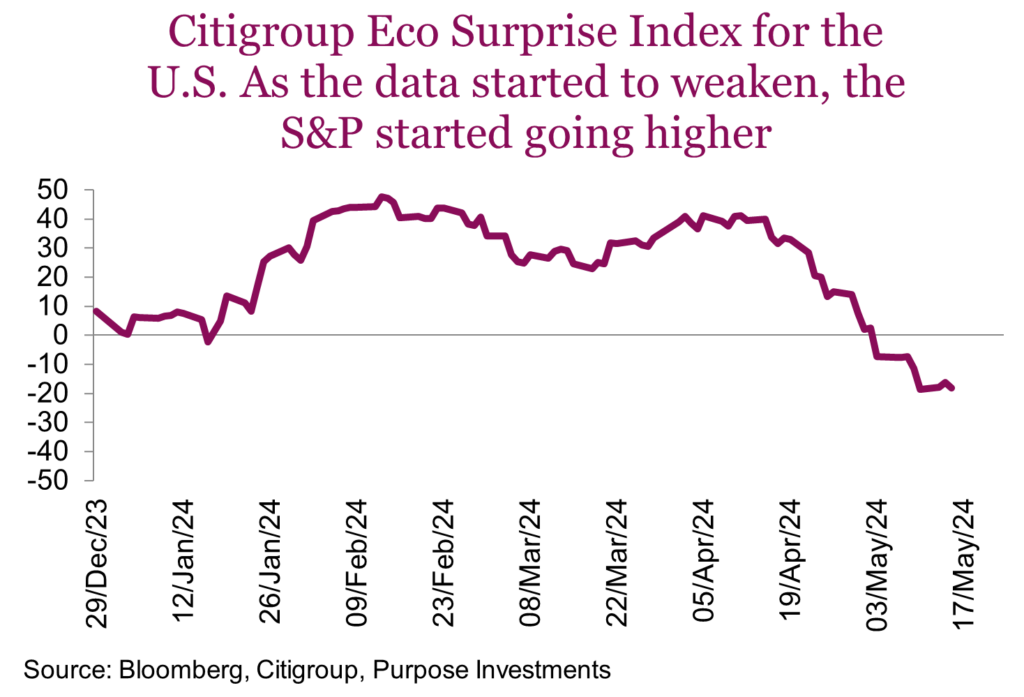

We might be in that very unique market mood when bad news is good news. The equity market weakness in April can probably be attributed to bond yields moving higher, so any economic data on the weaker growth side is welcome news at the moment. The S&P started to recover on May 3, rising 1.3% when the ever-important non-farm payroll labour report came in softer than expected, helping 10-year yields fall back down to 4.5%. Then, over the past few weeks, we have seen generally weaker economic data for the U.S. economy; bond yields have continued to come down, and equity prices have moved up.

Of course, all eyes were on the U.S. inflation print for April, which was marginally softer than expected (soft CPI is truly good news), helping bond yields fall and pushing the S&P 500 to a new all-time high. But really, 0.3% vs. expectations of 0.4% is not huge, especially given that the core reading was in line at 0.3%. This still has the annualized 3-month change running a hot 4.5%. To be fair, there was some good news beneath the surface on the CPI print. But on that day, helping, and less talked about, was a really weak Empire manufacturing survey and weak retail sales.

So, weak economic data helps bond yields come down, softens inflation fears, and opens the door a little more for central bank rate cut optimism, which allows the stock market to trade at a higher valuation multiple. Stocks up, bonds up – perfect! The problem is that this will work until bond yields have cooled enough, and then the market may start to fret about a lack of economic growth.

The U.S. economy is about 25% of the global economy, and the U.S. consumer is about 70% of the U.S. economy. So, with some rough math, the U.S. consumer is about 18% of the global economy, which is kind of important. We are well versed in never betting against the U.S. consumer, but what is not being talked about much is some clear signs of erosion. No denying past rate hikes are starting to take a toll. As is inflation, that has been making everything cost much more than before. For the past few quarters, the consumer has been complaining about the higher prices of everything from vacations to goods but is still paying the tab. This is mainly because of some positives. Good gains in labour over the past few years, wage gains too, and don’t forget all those accumulated savings that built up during the pandemic period when mobility was restricted.

Unfortunately, those positives appear to be fading while the consumer headwinds remain. Wage growth has slowed, as have job gains. But this erosion may be more apparent in behaviours. Walmart just posted stronger numbers, helped by higher-end consumer shopping at the big box. When the wealthy start showing up at Walmart, this could be evidence that higher prices are causing consumers to start downshifting their spending habits.

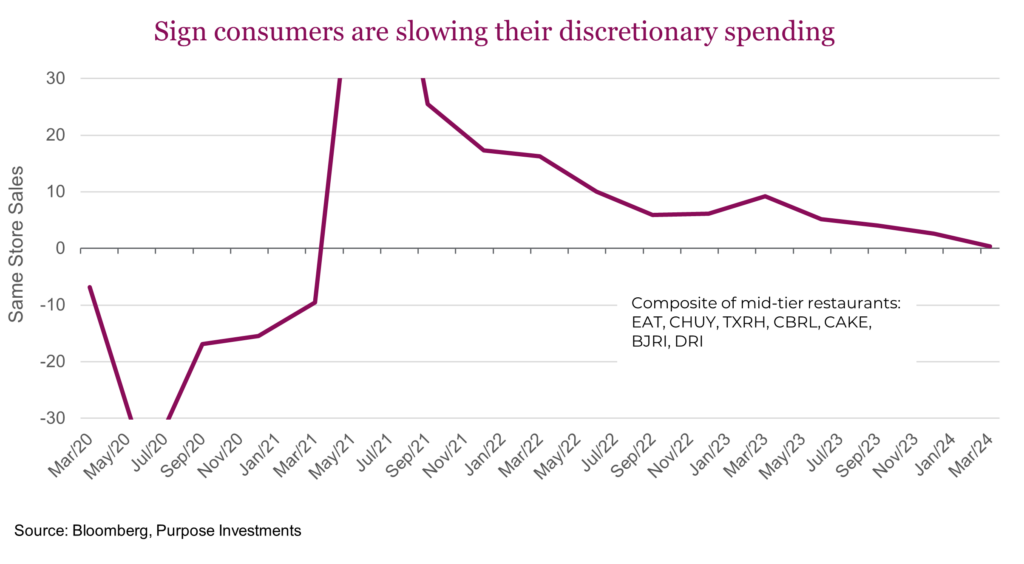

It is not just trips to Walmart; instead of higher-end retailers, look at the restaurants. Dining-out options vary greatly from those Michelin-star restaurants all the way to picking up a happy meal at McDonald’s. It is hard to get data on Michelin-star restaurants, but it continues to be challenging to get reservations, so high-end consumers still appear confident. First, popping into Walmart, then off to Le Bernardin. However, there is a quality of restaurants just above QSR (Quick Service Restaurants) that may be showing signs of softening spending choices. We created a basket of seven publicly traded sit-down restaurants that are a notch above McDonalds, Chipotle or Wild Wings. The list was created by asking one of our team members where his family eats when travelling in the U.S.

We cut off the peak and trough caused by abrupt changes brought on by the pandemic, but you can clearly see that same-store sales at these restaurants have been slowing and starting to turn negative. Even more impactful is that same-store sales are a nominal measurement, which means if volumes remained steady, then this would be higher, given that the ‘food away from home’ component of CPI is up 4.1% over the past year. Adjusted for inflation, the consumer appears to be slowing their spending habits in this very discretionary category.

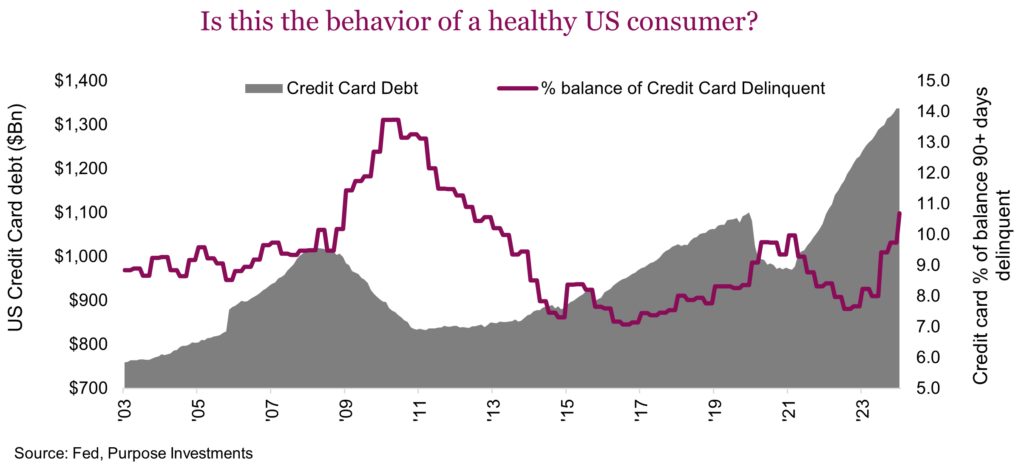

Then, there is how people are paying for things. During the pandemic, consumers were spending less and still earning well. This helped them pay down debt, including credit cards. But look at the trajectory or slope of credit card debt accumulation during the past few years, even as rates rose. Maybe we could argue that society has gone more cashless, leading us to use cards more. Fair point. So then look at the delinquency rates, ticking over 10%. Of that big pile of credit card debt, over 10% is beyond 90 days delinquent. A level not seen since early in the financial crisis of ‘08/’09.

Trends are very similar for the Canadian consumer as well. Job gains slowing, wage growth slowing, spending slowing, we are not that different.

Final thoughts

Fortunately, all this is good news today. Because this is how it is supposed to work. A central bank raises rates to slow inflation, causing slowing economic activity. Now, this mechanism, which operates on slow variable lags, has been further delayed due to aggressive fiscal spending. But it does appear to be starting to show up, at least in some of the more discretionary categories or behaviours. We are not betting against the consumer yet, but they are certainly on a fragile-looking footing.