Sign up here to receive the Market Ethos by email.

December 2023.

Investor Strategy.

Executive summary

- A November to remember

- The 5% hurdle

- Are the banks a buy? Banking on a better opportunity

- The great reset final act

- Portfolio positioning

The good news is we are probably in the final act of the great reset (or third act for any Shakespeare lovers). We believe it will include a recession, higher credit spreads, more bankruptcies, margin pressure and likely lower valuation multiples in the equity market. We are closer to the end and start of a new market cycle, but this act will likely be the most exciting (although ‘exciting’ when it comes to investing is usually not enjoyable).

A November to remember

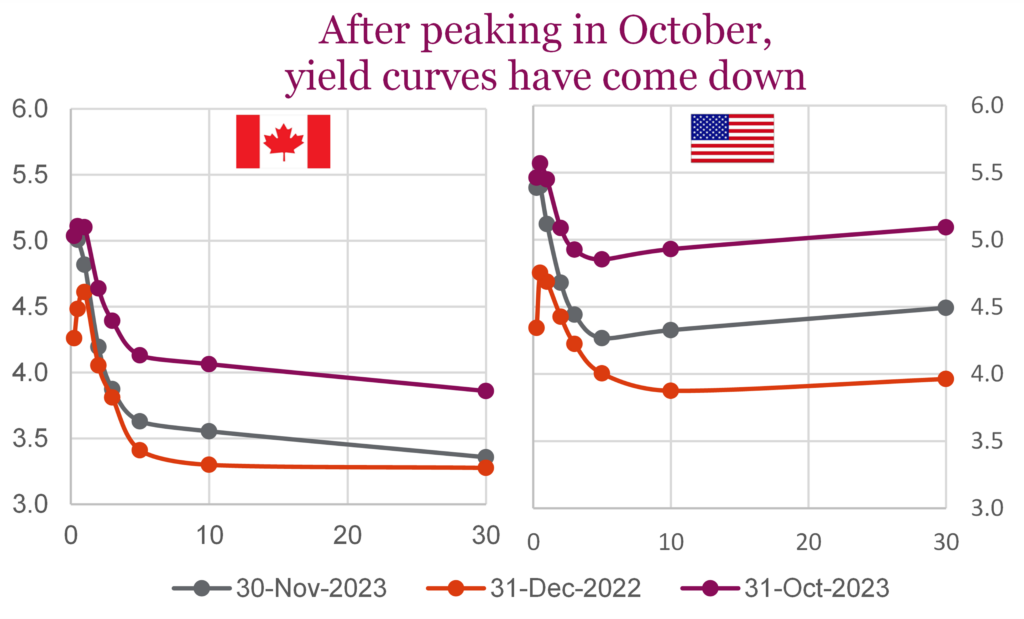

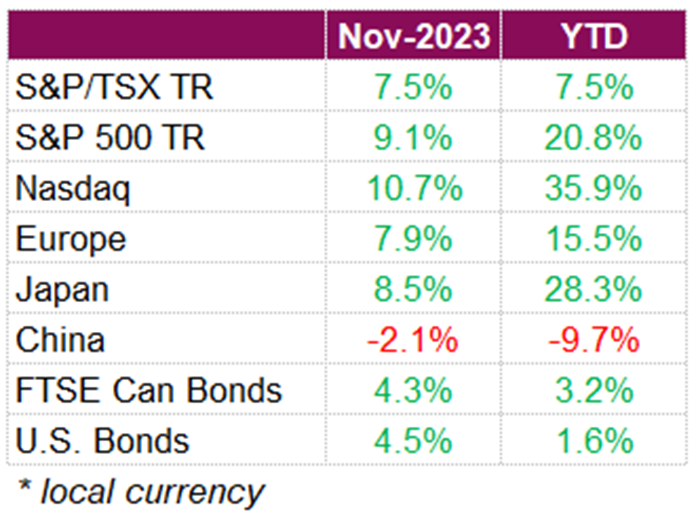

It may not be the ’year of the bond’, but it certainly was the ’month of the bond’, and equities for that matter. Economic data released over the month led to expectations that central banks have reached the end of their tightening cycles and will begin to cut rates next year. Rate markets are now pricing in both the Fed and BoC to cut their overnight rates by roughly 100 bps next year. Those expectations pushed yields across the curve down over the month, leading the U.S. Aggregate Bond index and the Bloomberg Aggregate Canadian Bond Index to rise 4.5% and 4.3%, respectively.

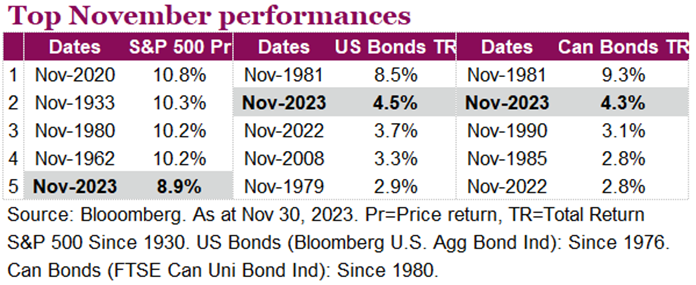

Not only did bonds move higher, but North American equities also posted strong performance after three consecutive down months. The S&P 500 posted its best month in almost a year and a half with a total return of 9.1%, and one of its best Novembers in decades. Despite facing headwinds this year, including the possibility of a recession, geopolitical turmoil and soaring borrowing costs, the S&P 500 is now up 20.8% YTD. Optimism that rates have peaked, and that the Fed will soon pivot to easing sparked an even bigger rally in riskier technology names. The risk on sentiment helped add to the Nasdaq’s stellar year, with the index advancing 10.8% in November, and now up 37% YTD on a total return basis. Closer to home, the TSX also saw an impressive gain this month, rising 7.5%, helping the index climb out of negative territory for the year and is now up 7.5% YTD on a total return basis.

Positive economic data in the U.S., coupled with strong earnings reports, was the catalyst for November’s equity rally. Like previous quarters, Q3 earnings for large-cap U.S. companies came in better than expected. Roughly 80% of the companies on the S&P 500 reported positive surprises, boosting investor sentiment. Economic data which showed the U.S. economy growing at a 5.2% annualized pace in the third quarter, while also showing price pressure easing, also helped push stocks higher this month. With inflation indicators trending down and comments from Fed officials signaling that rates may have peaked, investors are now hoping November’s strong bond and equity performance will lead into December.

Data out of Canada was a little more mixed but led to the same conclusion that the central bank will soon begin to lower rates. The Canadian economy unexpectedly contracted in the third quarter, shrinking at an annualized pace of 1.1%, weaker than both survey estimates and the BoC’s forecast. Preliminary data for October suggests a slight rebound with a 0.2% growth, driven by increases in oil and gas extraction, retail trade, and construction. With price pressure easing and growth slowing, views that the BoC’s interest rates are sufficiently restrictive were reinforced, potentially paving the way for rate cuts in the first half of next year.

It was a November to remember with some top-ranked November performances from equities in the U.S. and from bonds north and south of the border. With momentum starting to dwindle as economic data trickle in, we remain concerned that risks outweigh the rewards in 2024. Before we step into the outlook for 2024, we will cover two topics that are surely on the minds of Canadian investors.

The 5% hurdle

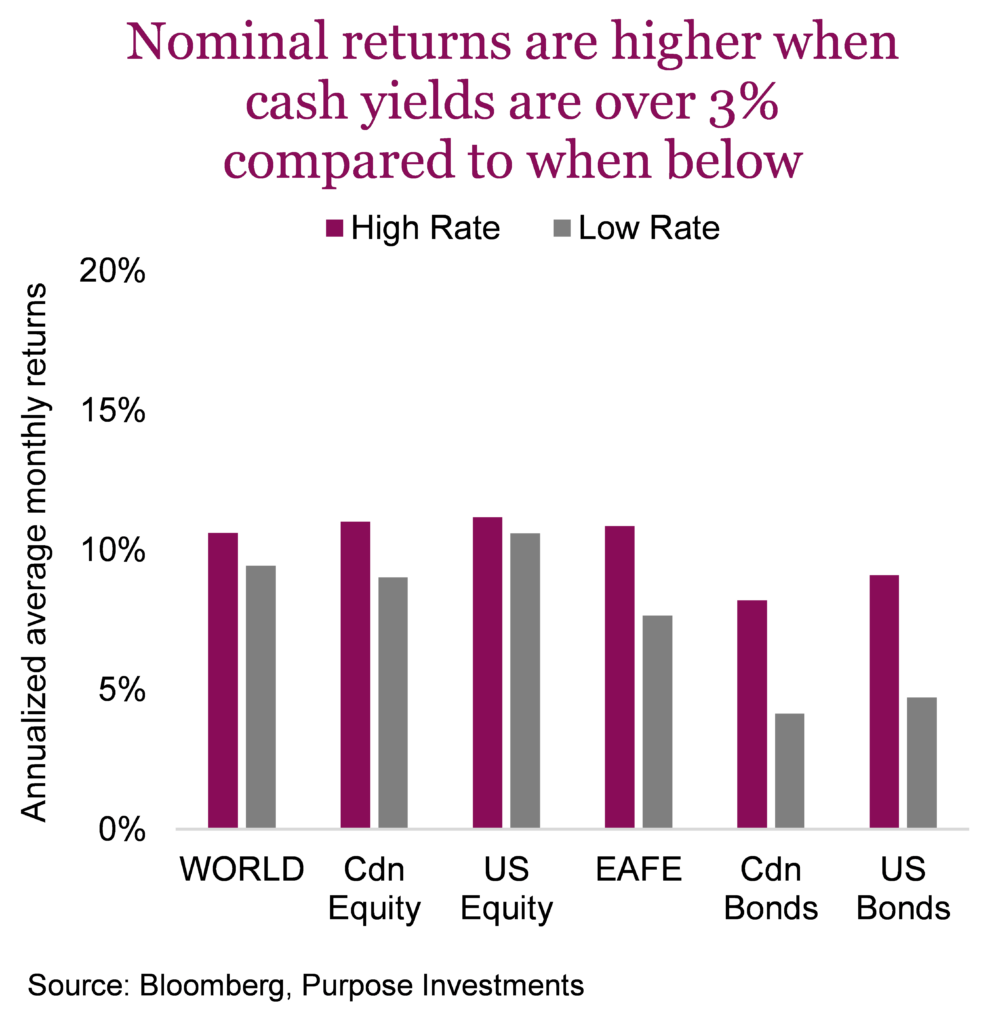

Over the past year, we have all had to wrestle with a new, often uncomfortable question – will that new investment do better than cash? Yep, the hurdle for a good idea has gotten a lot higher, given the risk-free rate, which, at about 5%, is pretty attractive. It has been a long time since we have been paid this much to sit on the sidelines, and based on fund flows into cash products, the bleachers are pretty full. The logic of this increasingly popular choice is sound. Let’s say the long-term annualized return for global equities is 9%. Is that extra 4% over cash returns worth the risk? Especially since there is a ton of variance around that 9% with lots of 20%+ years and lots of negative ones, too.

In a perfect world, equities would return what they usually return plus a few points extra given that cash, or the risk-free rate, is providing such an attractive return. Let’s call this a mythical world where the equity risk premium remains steady. (Equity risk premium is the excess return from equities over the risk-free rate). What a boring world that would be, and clearly, this world is not boring.

So, let’s dive in to see the historical impact of higher rates on historical returns. Seems like a good time to consider the impact of higher cash returns across the portfolio. Here we go:

We looked at returns from the 1950s till today, slicing the world into periods when the risk-free rate was above or below 3%. On a marginally positive note, the average monthly returns for various equity markets were a bit higher when interest rates were elevated. Global equities returned about 1% higher when cash yields were over 3% compared to below 3%. Also worth noting, the average performance improvement in a high cash rate environment is more pronounced for bonds.

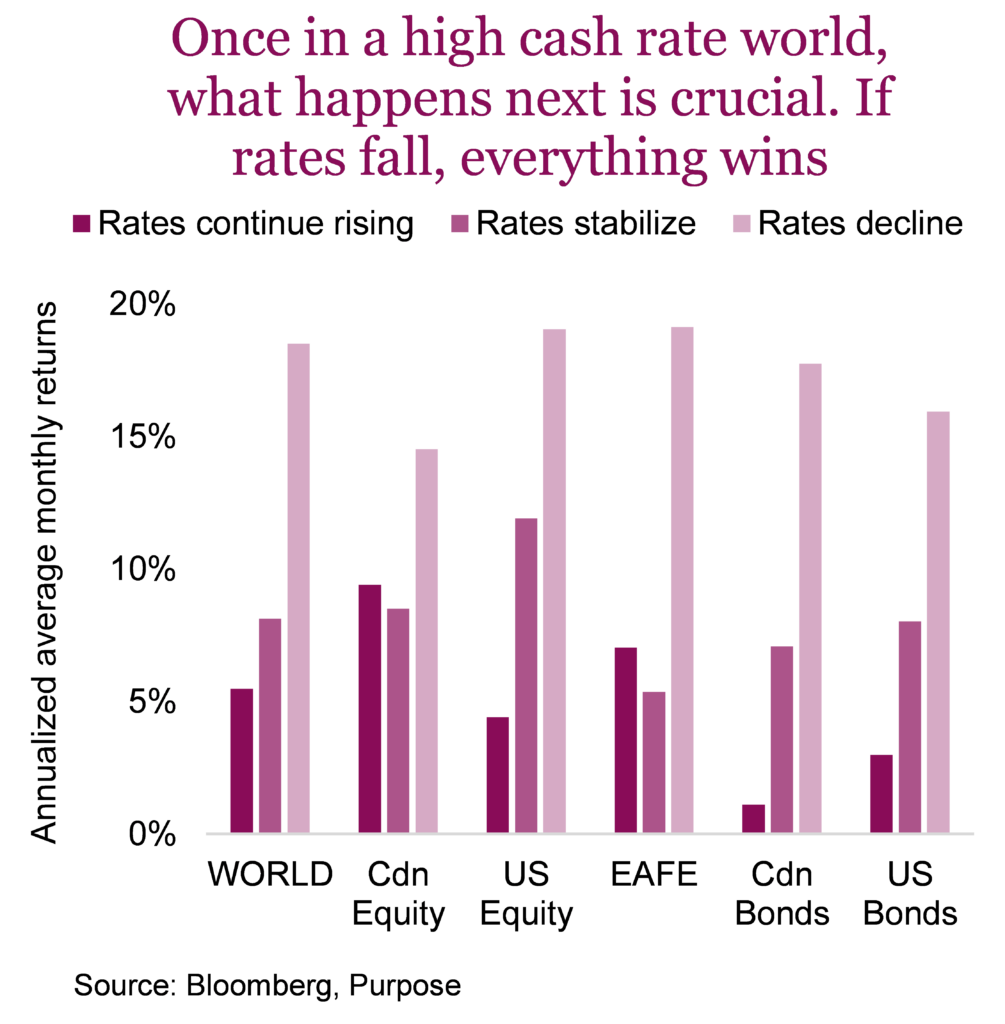

Of great importance is what happens next. If rates continue to rise, say as inflation starts to reaccelerate again, well that is not good for equities and worse for bonds. It’s interesting that Canada does okay in this scenario; we will return to that shortly. If rates stabilize up here, well, returns are decent, a bit better than bonds. But if we get rates coming down, that is the sweet spot. Historically, it is very good for bonds and equities.

We would point out that the TSX was one of the best equity markets in the 2022 bear and has trailed other markets in 2023. Given our resource and bank exposure, the TSX has a bit of a built-in hedge against inflation and movements in yields. This helps explain the underperformance of the TSX in the 2010s and may be setting the stage for outperformance going forward, if you agree inflation will be a recurring risk in the coming decade.

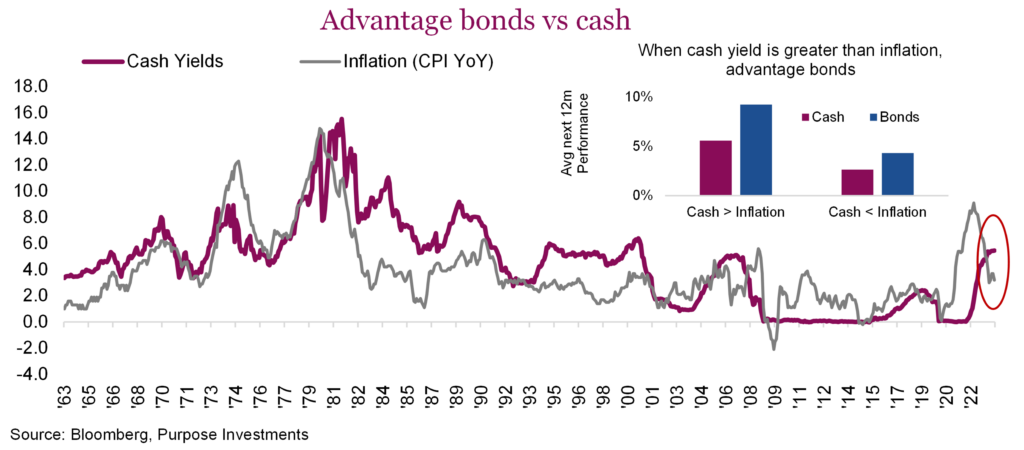

It is not just rates that matter so much for market returns, it is inflation, too. And while they both do follow each other rather loosely, whichever is higher matters for future bonds vs cash returns. You see, if rates are higher because of economic activity and inflation is below cash rates, it’s good news for bonds. Conversely, if inflation is running higher and cash rates are lower, this is bad for bonds. It is worth pointing out that the bond bear market over the past few years really started to get going at the end of 2021, when cash rates were 0.1% and inflation was 7%. They didn’t stand a chance.

But today, inflation is down to 3.2% (U.S. CPI), and cash is up at 5.5% (3-month Treasuries). You may love the 5% or so provided by cash or cash products, but we love bonds more.

Are the banks a buy? Banking on a better opportunity

Once the bastion of safety, Canadian banks were long heralded as the world’s best boring banks. The big six are, for good measure, a staple across most investment portfolios. Love them or hate them, with a 19.4% weight in the TSX, their fortunes, for better or worse, play a large role in the overall performance of the Canadian market. Thanks to a long, steady history of solid profit growth and consistent dividend growth, it’s no wonder they are held in such high esteem.

But something isn’t quite right. The group is on pace to post their second consecutive negative annual return, falling 9.3% in 2022 and currently down –1.8% on a total return basis compared to a 7.5% gain for the S&P/TSX Composite for 2023. Consecutive down years are a rare occurrence, last happening in 07-08 and 98-99. Both periods saw pretty decent bounce back for the group, which begs the question: should we be buying the banks?

Positioning and valuations

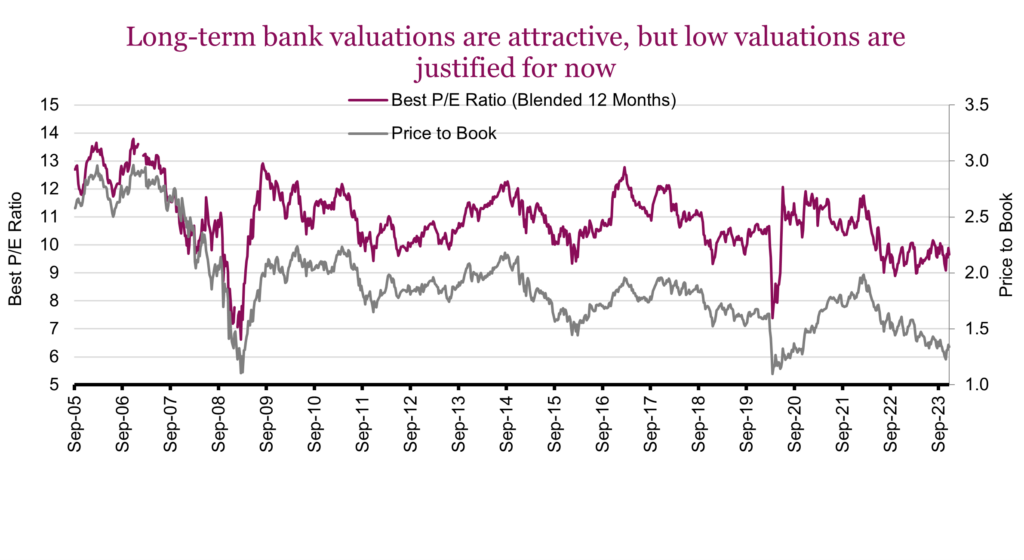

A time will come when we will be buyers. Valuations have declined by a decent amount this year. The average P/E across the big size is 9.3x forward earnings estimates. A full point and a half lower than where it stood at the beginning of the year. Looking back over the past twenty years, there have been only a few periods with such enticing entry points. Those were the financial crisis as well as the brief Covid sell-off. Both periods saw lower earnings valuations, so from a multiple standpoint, sentiment could get worse. On a price-to-book basis, with an average of 1.33, the group is nearing all-time lows but still trades above one times book value. It’s enticing, but in our opinion, not enough.

Storm clouds are forming, and with profit expectations across the Big Six shrinking, we remain firmly on the sidelines. Across the Big Six, earnings estimates for 2024 have declined an average of 12% this year. Even with the recovery amongst the banks in November, the earnings expectations have continued to deteriorate. On Bay St., banks have been diligently slashing costs, with an increasingly widespread trend of reducing headcount. Besides recession concerns, the trajectory of Canadian housing remains front and centre. Mortgage book quality, negative amortizations, and renewal risks are all large and valid concerns. Shares certainly reflect some of the prevailing pessimism but are likely not enough.

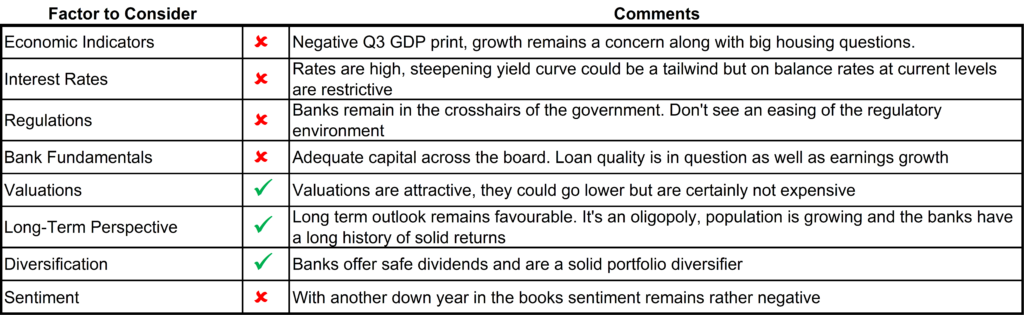

When deciding whether to add materially to the Canadian banks, there are a number of important factors to consider, which we’ve outlined in the table below. Before we get more constructive, we prefer to see more checks and fewer strikes.

In our previous report, Preparing for the Next Bull, we also delved into the banking sector. Specifically, investors are shifting focus from growth and profitability to prioritizing credit quality, capital, loan losses, and overall financial strength. Lenders face significant challenges during periods of slowing economic growth, declining yields, and an excess of available capital. When capital becomes scarce and in demand, the advantage moves back towards lenders.

While we anticipate that banks will eventually thrive, we currently recommend a cautious approach, recognizing that there is no immediate need to rush given the looming recession risk combined with concerns about the housing market. Despite attractive valuations and yields, we believe that patient investors may find a better opportunity to buy the banks in the future.

2024 outlook – the great reset final act

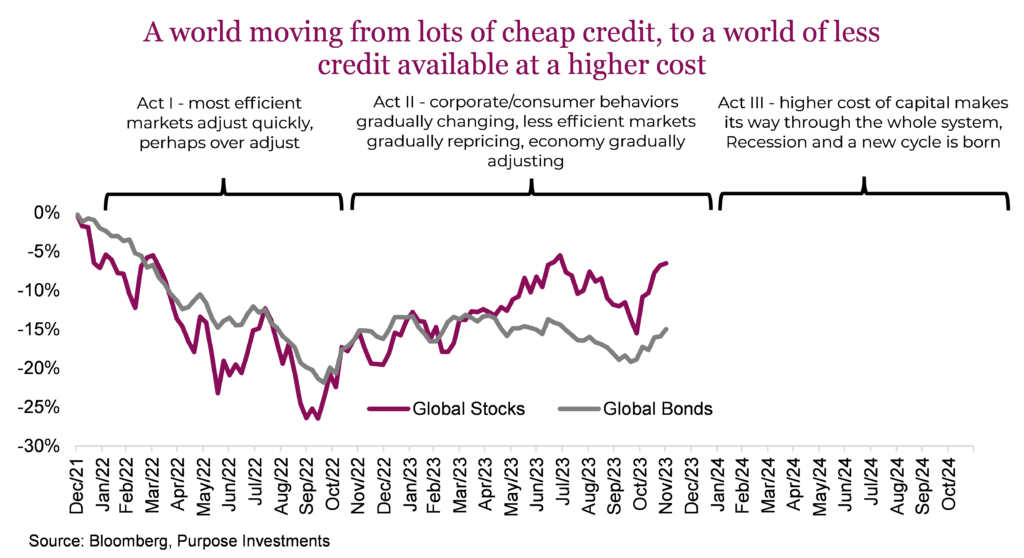

Let’s start by first taking a big step back. Over the past couple of years, we have endured a great reset following a decade-long period that was characterized by disinflation, lower economic growth, low yields and lots of monetary stimulus. Disinflation gave way to inflation, low yields gave way to higher yields and lots of stimulus has given way to monetary tightening. A period of steady asset price inflation, stocks, bonds, and real estate has given way to the repricing of everything. Credit has gone from widely abundant and very low cost to less availability and higher cost. The result: lower prices of assets.

Some prices adjusted quickly, as was evident in falling stock and bond prices in 2022. Some prices, that are stickier due to greater friction in pricing and transactions, take longer, such as with real estate. While not a fantastic year, 2023 has actually turned out pretty well. Some equity markets recovered well, including the U.S. and many international markets. Even the TSX, which lagged, has managed high single digit returns. Bonds too are up lower single digits.

As we near 2024, has the great reset run its course? We don’t think so. While parts of the market react quickly to a new world (or, more aptly, a normal world after a decade of too much credit at too low a cost), such as the global equity market and bond market, other parts will take time to recalibrate. The economy, corporate and consumer behaviour, and real estate all adjust more slowly and are likely still adjusting.

The good news is we are probably in the final act of the great reset (or third act for any Shakespeare lovers). We believe it will include a recession, higher credit spreads, more bankruptcies, margin pressure and likely lower valuation multiples in the equity market. We are closer to the end and start of a new market cycle, but this act will likely be the most exciting (although ‘exciting’ when it comes to investing is usually not enjoyable).

So, what do we expect next year:

1. Recession in 2024

Yes, we are one of the many who are calling for a recession, part of the cohort of economists crying wolf and still no wolf in sight. This has become the most talked about recession. We would also point out that the market is very confused at the moment. Some equity markets are pricing in recession risk – just look at the dividend payers or Canadian banks. Some equity markets remain euphoric, such as the S&P. Credit spreads remain close to historical norms, clearly not signalling trouble. Bond yields, still kind of high due to inflation, don’t seem to be worried about economic growth.

Add to this an inverted yield curve that has now been inverted for 13 months, coincidentally around the historical average lead time and continued slowing global trade. Not to mention countries such as Germany, the UK, and now Canada flirting with recession, China slowing, and the list goes on. But then there is America, bucking the trend.

How to stave off a recession 101 – Let’s start by looking at the track record of policy. Governments around the world went to town implementing Modern Monetary Theory (MMT) to save the economy due to the impact of the pandemic. MMT, for those who hopefully have forgotten about this as it’s a terrible idea, involves the government spending money and the central bank buying government bonds to finance spending. It worked, protecting the economy, but it also created an inflation problem and likely many imbalances.

So now the monetary money printing has gone into reverse, BUT fiscal spending has continued at levels rarely seen outside full-on recessions. Think about it: we have central banks trying to get inflation under control, and at the same time, the government attitude remains spend, spend, spend. So far in 2023, the average deficit (as % of GDP) across the US, UK, Eurozone, China and Canada is 5.6%, compared to 2.2% in the couple of years before the pandemic. This is anything but a coordinated response between monetary and fiscal policy. The fun part about economics is that you really don’t know the impact or knock-on effects of policy for years.

How does this impact 2024? We believe the credit contraction, high rates, and past inflation will inevitably overtake fiscal spending and lead to recession.

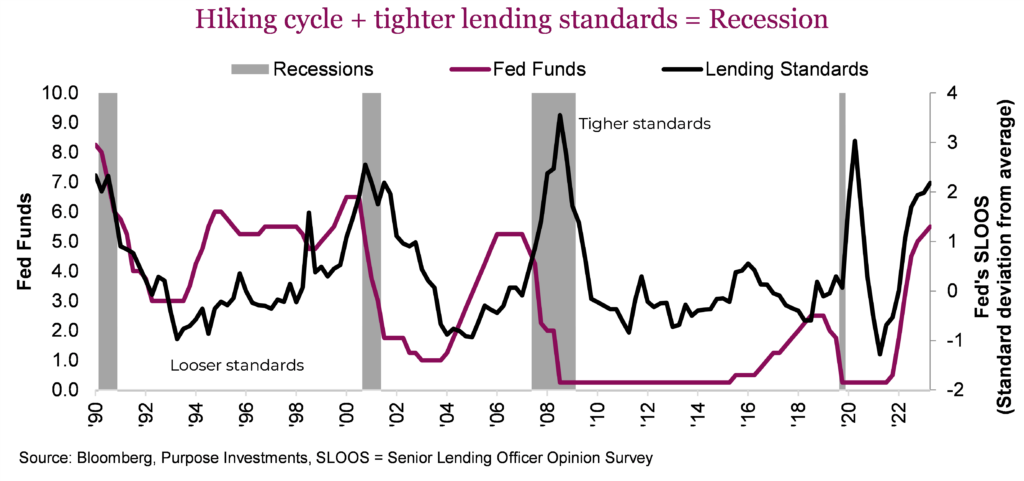

We are not going to bore you with a pile of charts that we have published over the past couple of quarters highlighting the recession’s early warnings. These include the inverted yield curve, Fed recession probability models, slowing global trade, the U.S. unemployment rate rising 0.5%, negative leading indicators, and so on. Instead, let’s talk overnight rates. Most are aware of the historical pattern of the U.S. Fed raising rates, going too far, and presto, you get a recession. But it is not just rates, it’s rates and lending standards. Fed hiking cycles that are not accompanied by a significant tightening of lending standards most often result in a soft landing. If lending standards are tightening, that leads to recession. Today, they are tightening.

Yes, continued fiscal spending may stave off recession, but our experience tells us relying on government policy rarely works out. In fact, this fiscal spending during past quarters of decent economic growth may help keep inflation higher than it could have been, which could keep overnight rates higher for longer as well.

The recession probabilities for the U.S. have been coming down over the past couple of months (currently 51% over the next year), but at the same time, have been rising in the UK (60%), Eurozone (65%), China (18%) and Canada (42%). We remain in the camp that preparing or positioning for a potential recession is the best path. And focusing market exposure in pockets that provide an added safety buffer from lower valuations.

2. Peak yields are behind us

It is not a huge leap of logic to connect our view that we have seen peak yields with our concern of a recession in 2024. We continue to believe, as we did a year ago, that inflation fears will soften, and this will lead to a rise in markets, both stocks and bonds. Yet this sweet spot for markets would pivot at some point as inflation fear would be gradually replaced by economic growth concerns. Today, we are still in the sweet spot. In 2024, we expect the pivot.

The naysayers of a recession continue to focus on the strength of the U.S. economy, helping offset global weakness. And the U.S. economy has proven very resilient, keeping U.S. yields higher. This strength is likely attributed to leftover stimulus or savings from the pandemic years, a decent labour market (which is weakening), and of course, added stimulus following the regional bank funding mechanism. However, those savings are dwindling, labour is softening, and stimulus has turned in the other direction.

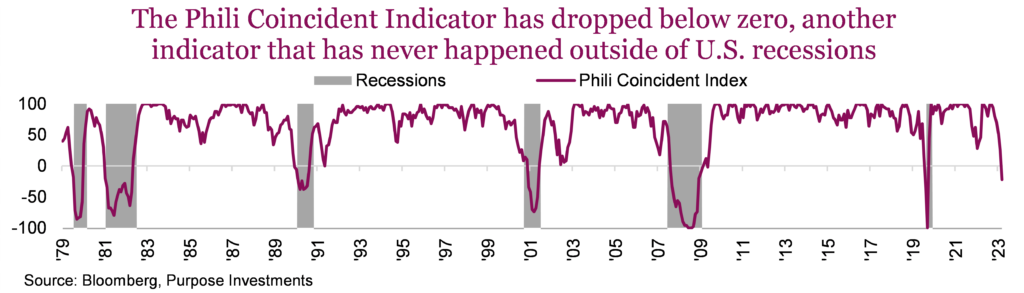

But you don’t need to look at the forward-looking recession warning signs any longer, as the real-time indicators are starting to pile up. U.S. unemployment has risen 0.5%, which has always been a threshold associated with the near onset of recessions. And then there are the Philly Coincident indicators. This index tracks multiple data points that have historically turned at the same time as the overall economy. It has never gone below zero without a recession in tow.

If this trend continues, yields will go lower.

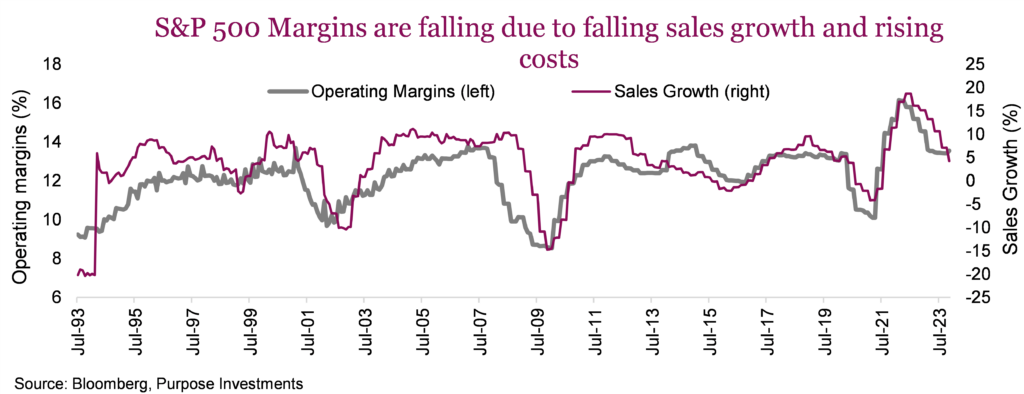

3. Margins to come under pressure

Full disclosure, we have been expecting margins to come under pressure for a bit now (we are most often a bit early). Rising wages, rising interest costs, and rising input costs certainly have risen over the past couple of years for corporations. But we underestimated how easily companies would pass on those rising costs, perhaps because for much of the past two decades, companies did not have much ability to raise prices. With inflation rampant, companies did not hesitate to raise prices; everyone just sucked it up and paid higher prices. $900 to fly to Montreal, really? And no, it wasn’t business class. But we all managed to save margins, keeping them high and healthy; go team!

Here comes the hard part, if inflation fueled higher input costs and higher sales revenue, now that inflation is cooling, how does it all work out? Or, more specifically, will cost inflation for corporations slow down faster, the same or slower compared to output price inflation? This does become very company or industry-specific, but a couple of factors have us believing costs won’t slow down as quickly, leading to margin pressure.

Interest costs are on the rise due to higher rates and yields. A handful of companies that have net cash may benefit from this, but the VAST majority are seeing rising interest expenses. Variable debt costs have moved quickly, but now fixed term debt is gradually rising as bonds mature and are refinanced. In Q3 of 2022, S&P 500 companies paid a total of about $51 billion in interest expenses; this latest quarter, $64 billion. And this will continue to rise even if rates/yields start to come back down given its lagged temporal dynamics.

Then there are wages. Not sure if anyone noticed, but when inflation jumped to 7%, not many employers opted to increase wages in line. That was the sweet spot for margins, keeping wages in check and raising prices. Well, labour now has more bargaining power, and wages have been rising, playing catch up. Given the lagged dynamic in wages, it too could continue rising even as corporate pricing power wanes.

Finally, the mother of all determinants of margins, sales growth. Sell more units, raise prices, it doesn’t matter which. Sales growth and margins move hand-in-hand simply because corporations are leveraged entities, both operationally and financially. So the question then is where are sales heading? Once again, if we are in the recession camp, sales growth is going to keep coming down, and this will drag down margins too.

4. Bonds outperform both cash and likely equities, too

The U.S. aggregate bond universe has a yield to worst of 5.3%; the Canadian equivalent is about a point less at 4.3%, while cash is hovering at about 5%. Let’s go through some scenarios. Cash wins if inflation re-accelerates, leading to rising yields. Or perhaps strong issuance of bonds (supply) outpaces demand, leading to higher yields. While not impossible, we believe this is improbable. The economy is slowing, which should put continued downward pressure on inflation and yields. If yields fall even just a little further from current levels, which have already declined, bonds will perform better than the current yield to worst.

Cash rates are not likely to change in 2024. While the Fed Fund futures are pricing in 4-5 rate cuts in 2024 (1-1.25%), we remain unconvinced. Inflation should continue to moderate, but inflation is pretty sticky and likely not to fall enough to warrant such cuts. Of course, if the economy does weaken substantially, we could see more rate cuts, but this would also coincide with significantly lower yields, which would benefit bonds even more.

Put all this together, cash likely delivers about 5% in 2024, or a bit less if we get a few rate cuts. Bonds, using the U.S. aggregate, provide about 3.5% in coupon yield, plus 2% in price appreciation as most bonds are below par simply from moving one year closer to maturity, plus X% from a move in yields. A 0.5% move lower in yields across the curve would roughly add another 3% to returns given a duration of about 6. 3.5+2+3. Sign me up. Even double-digit bond returns in 2024 are not out of the question.

Equity returns, of course, will likely prove the most volatile and challenging, as they usually do. Global equities are currently trading at 17x estimated earnings for the next 12 months. It is a bit more expensive in the U.S. and less expensive in most other markets, including Europe and Canada. Meanwhile, earnings growth is estimated at about 10-12%.

Equity returns can be decomposed into three sources: dividends, earnings growth and a changing market multiple. Dividends will likely deliver about 2% of gains, and if earnings estimates prove accurate, markets would gain 12-14%, assuming a constant valuation multiple. These are big IFs. Since we believe a recession has a good chance of becoming a reality, the earnings growth could prove aspirational. And, if a recession starts to take shape, uncertainty about the future may have investors not willing to pay as high a multiple for estimated earnings. Also, let’s not forget that the longer-term average multiple is closer to 16. Many factors move the market valuation multiple, with rising uncertainty not being conducive to a historically elevated multiple. In short, this could easily lead to lower equity markets.

However, a full-year outlook for equities is challenging. The timing of this potential recession is very uncertain, and just as uncertain is when the market begins to price in the risk. Timing-wise, we could see a drop in equity markets and a subsequent recovery by the end of 2024. Of course, the depth and duration (or existence, for that matter) of a recession will be a huge determinant.

In short, expect a challenging year for equities and a bumpy ride. Add to this, the risks continue to rise as the current year-end rally, while enjoyable, further tempers our enthusiasm for 2024. There are some positives, though. If bond yields continue to come down, this is supportive of the market valuation multiple. And many pockets of the market are already pricing in some sort of recession – just look at international markets, the TSX at 12.5x earnings or those beloved dividend names that currently enjoy a solid valuation safety buffer.

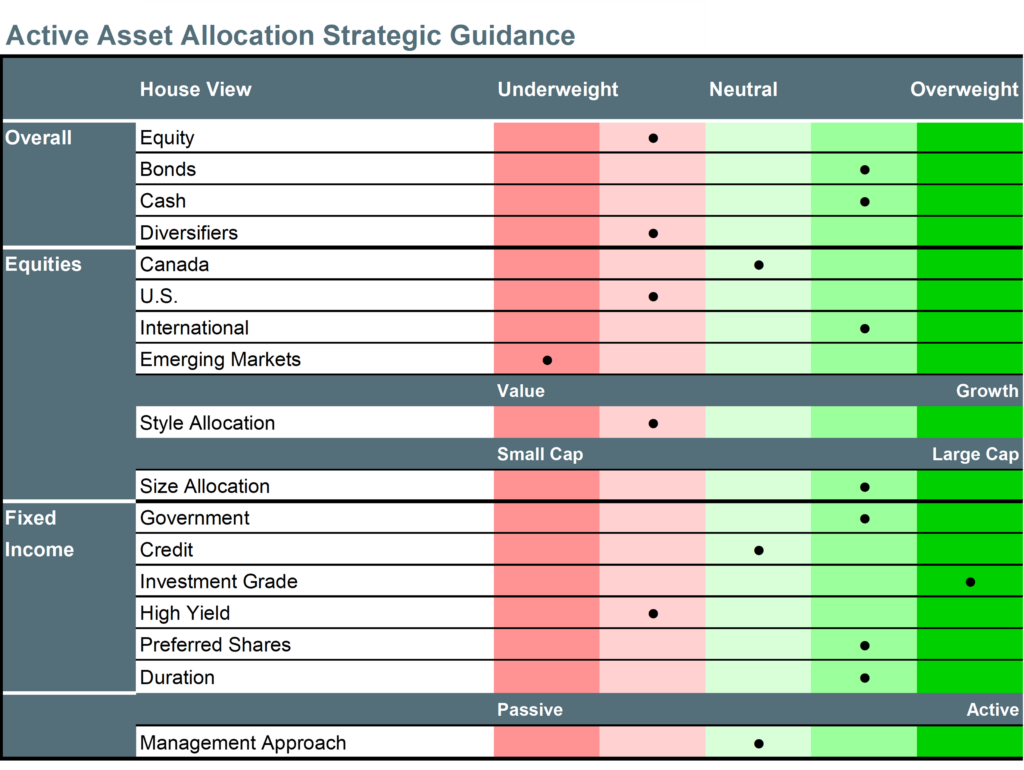

We love bonds, we like cash, and we worry about equities. Hence our moderate underweight in equities and overweight bonds + cash. If it all works out, we will pivot to more equities on weakness. Timing will be everything, as Jack Burton often said – it’s all in the reflexes.

Finally,

5. 2024 will be an exciting year

Portfolio positioning

We would characterize our portfolio positioning as moderately defensive. Holding above-average bonds and cash and less equities. However, there is still enough market exposure to enjoy the party in case this Santa Claus rally makes it all the way to the holidays, or dare we say, into January, which is typically a good month. But defensive enough that should things begin to deteriorate, we are decently positioned and becoming full-on defensive is just a few short trades away.

Among equities, we still favour international equities given the valuation safety buffer and since earnings estimates have already been revised lower. The allocation does have a developed market Asian tilt, with a positive view of Japan (more on this below). Underweight U.S. given valuations and earnings that we believe remain too optimistic. And finally, Canada market weight. The dividend factor is so beaten up, valuations so appealing that we can handle the economic risk inherent in the TSX. However, we would point out our underweight on banks … for now. More on this topic above in a previous section.

This has our bond allocation looking boring as well, as we are focusing on government, investment grade, and are now more comfortable with duration.

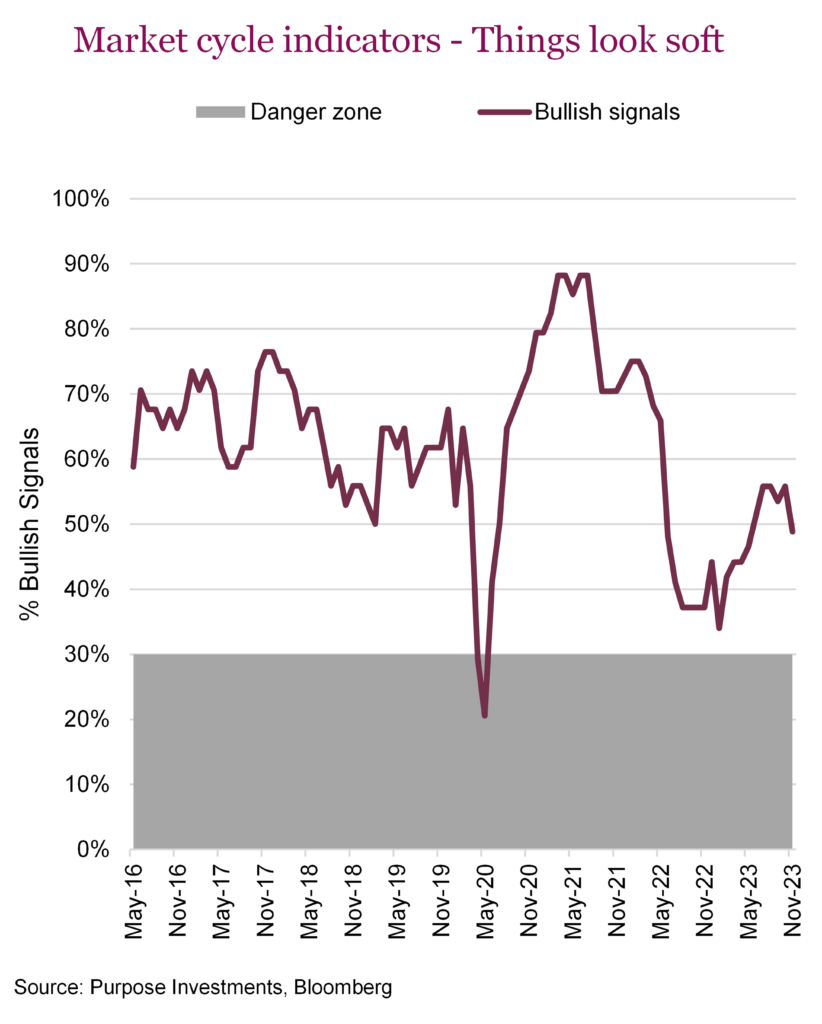

Recession risk is rather high as we head into 2024, and defense is the more prudent positioning. We, of course, will be closely monitoring our market cycle indicators. They did capture the improving data trends earlier in 2023 but have started to roll over again of late. The recent weakness has largely been for the U.S. economy, while signals elsewhere have remained stable or even shown some little bits of improvement. If the signals deteriorate much further, we will likely be moving to be more defensive.

Sticking with the party terminology, we are at the party, standing near the door, sipping a light beer.

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

*Authors:

Purpose Investments: Craig Basinger, Chief Market Strategist; Derek Benedet, Portfolio Manager

Richardson Wealth: Andrew Innis, Analyst; Phil Kwon, Head of Portfolio Analytics; An Nguyen, VP Investment Services

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.