Sign up here to receive the Market Ethos by email.

May 2023.

Investor Strategy.

Executive summary

The good news is that even though there are signs that the economy is cooling, it does not look like it is falling over a cliff anytime soon. Three months, six months, or a year from now, is when things may look very different economically. And while we are enjoying this recent market rally, you never know when the market will begin to fret over the economy. When it does, it likely won’t be gradual.

We continue to remain defensive, slightly underweight in equities and slightly overweight in bonds/cash.

April showers … not this time

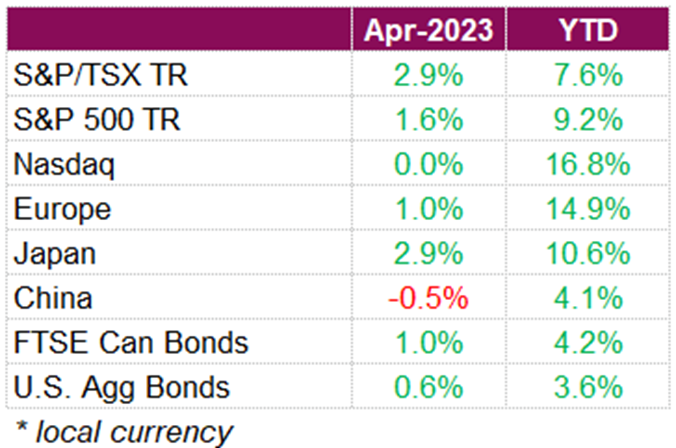

Equity and bond markets were relatively subdued in April, especially when compared to the market volatility investors became accustomed to in recent months. North American equity markets finished higher for the month with the S&P 500 logging a total return of 1.6%, its second positive month in a row, while the S&P/TSX finished April 2.9% higher, its best monthly showing since January. Of course, there are still concerns about the health of the global economy and worries that a recession may be just around the corner, and the bank crisis in March reminded us that there are still ramifications from a high interest rate and sticky inflationary environment. Markets look to be taking a more cautious approach and closely assessing every new economic data print and earnings report for clues on when things may turn.

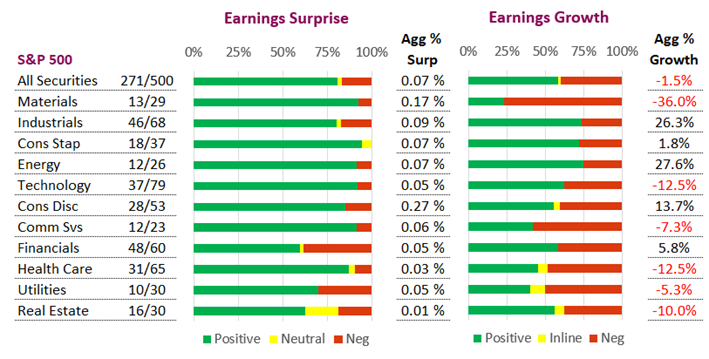

One area where investors are taking their cues is from the latest quarterly earnings reports. Earnings season in the U.S. kicked off in April, and on the surface, things are looking positive. Just over half of the companies in the S&P 500 have reported earnings so far, and of those companies, 80% have beaten expectations. Key earnings metrics are still running above their one-year averages and corporate commentary has been optimistic that a soft landing is possible. This is certainly good news, but it comes with a caveat, as expectations were set rather low for earnings this quarter. Also, digging a little deeper into the numbers, earnings growth is turning negative as margin compression is starting to take affect. Still, postive earnings surprises have lifted sentiment despite rate-hike uncertainty and a looming recession.

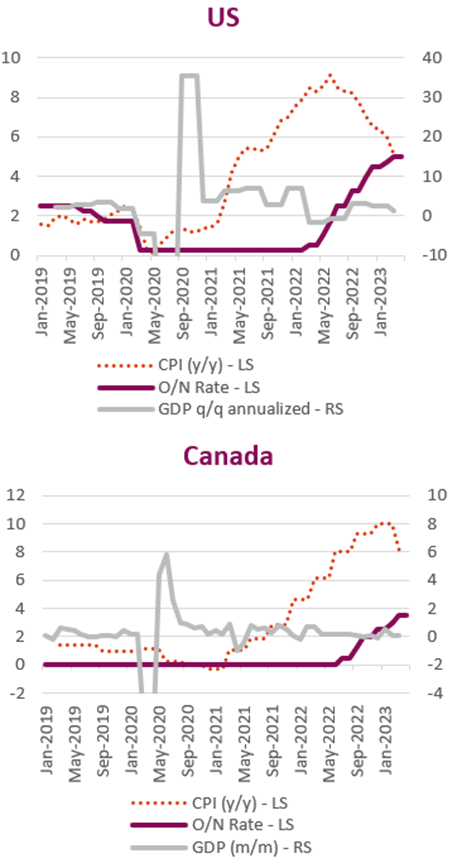

The latest earnings reports and economic data signal that consumers are still spending, despite elevated prices. Consumer spending in the U.S. remains solid, growing at an annual rate of 3.7%, while underlying demand, measured by final sales to private domestic purchasers, grew 2.9% in the first quarter after remaining flat in Q4. The PCE price index excluding food and energy, one of the Fed’s preferred inflation gauges, rose 0.3% in March and is up 4.6% YoY, while the overall PCE price index increased 0.1% from the prior month. With underlying inflation remaining elevated, the case for further interest-rate hikes from the Fed has been reinforced, despite GDP slowing considerably in Q1, rising at a 1.1% annualized pace, well below the 1.9% estimates. U.S. Treasury yields have largely steadied after a rise on expectations for the Fed to hike rates in May and the U.S. aggregate bond index finished 0.6% higher for the month.

Canada has fared much better from an economic perspective recently, with data showing the headline inflation rate in Canada posting its largest drop since the early days of the pandemic, falling to 4.3% YoY in March from 5.2% YoY in February. Canada’s economy slowed down in Q1, reinforcing the Bank of Canada’s (BoC) decision to stop raising interest rates. GDP numbers released at the end of April show that the economy expanded by 0.1% in February, slightly weaker than expectations for 0.2% growth. Preliminary data also suggest GDP contracted 0.1% in March, pointing to annualized growth in the first quarter of 2.5%. Bond markets found solace in the latest economic prints, helping the FTSE Canada Universe Bond Index rise 1.0% for the month.

Hold the line

The S&P 500 is up about +8% so far this year, the TSX +7%, Europe is up well over 10%, and Asia is doing pretty well, too. Even bonds are up. This bear market rally (assuming we are still in a bear market) is being fueled by a healthy dose of good news. The rate of inflation is coming down; in fact, durable goods prices in the U.S. have fallen 2% over the past six months. That doesn’t seem to get much attention in the headlines. Nondurables, excluding food, are down over 2%, while services are higher by a bit over 2%. Nobody is saying it’s over, but it certainly is getting better. Add to this the flare-up appears to be calming among the few U.S. banks that really proved to have poor business models for today’s environment.

Is everything hunky dory, or is the market whistling past the graveyard? According to my new best friend, ChatGPT, the phrase means “to proceed while ignoring an upcoming hazard, hoping for a good outcome”. That kind of sums up today’s market. Earnings continue to be revised lower, and while the current earnings season has its fair share of positive beats, there is something else afoot. Sales growth is still decent, helped by our old friend inflation, but earnings growth has turned negative.

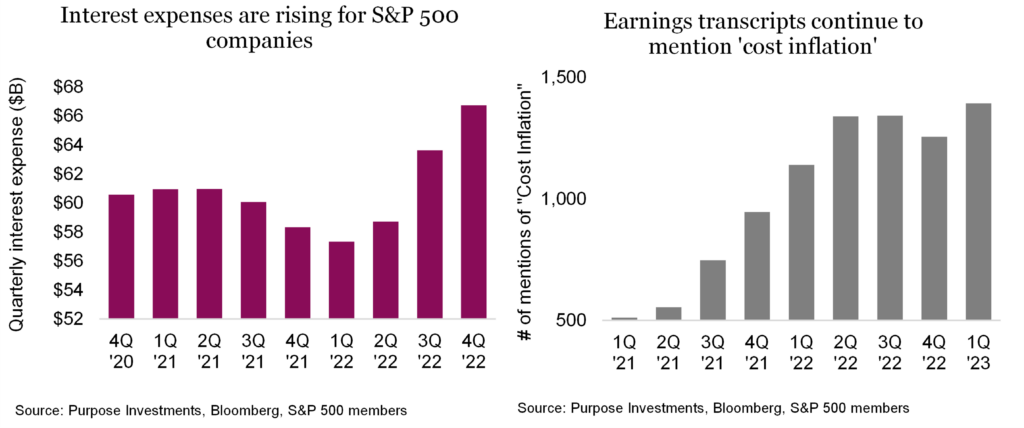

What does that mean? Well, the costs are now rising faster than revenue as companies are unable to offset cost inflation as well, plus the rising cost of credit (aka higher interest rates) may be starting to show on the bottom line. Don’t take our word for it. The chart on the right shows the total interest expense per quarter for all S&P 500 index members, which is rising; and on the right, how often companies mentioned ‘cost inflation’ during conference calls and other communications.

Margin compression has already started. The S&P enjoyed peak operating margins of a little over 16%, which have returned to more normal 13.5% levels over the past year. As cooling inflation removes the previously enjoyed sales growth lift, we believe cost inflation won’t fall as quickly. Combine this with a slowing economy, and things could accelerate. But, this is down the road a ways.

For now, the market is stuck in a range, albeit bumping up against the top end of that range of late: 3,800-4,200 for the S&P (currently 4,160) and 19-21k for the TSX (currently 20,630). Maybe there is a bit more of a lift on earnings still holding in or the Fed announcing a rate hike pause. Unfortunately, this rally is built on a very soft foundation. Falling margins and falling earnings are not ingredients for a durable market advance.

For the foundation under this recent rally to improve, you have to believe the economy is going to stabilize and then maybe improve. Q1 economic data was largely better than expected, so there is obviously a chance. However, the preponderance of indicators and data point to a more troubled scenario. Yield curve inversion, recession probability models, leading indicators … the list goes on. And let’s not forget companies are cutting costs now, with one company’s cost being another company’s revenue. There is a delayed wealth effect due to the drop in markets last year and a delayed economic impact of higher rates/yields.

The good news is that even though there are signs that the economy is cooling, it does not look like it is falling over a cliff anytime soon. Three months, six months, or a year from now, is when things may look very different economically. And while we are enjoying this recent market rally, you never know when the market will begin to fret over the economy. When it does, it likely won’t be gradual.

We continue to remain defensive, slightly underweight in equities and slightly overweight in bonds/cash.

Tech is not defensive

There are periods throughout market history where investing can seem like a simple game. That is precisely what we saw from 2019-2021. A decade of low inflation and interest rates capped off by an impulse of stimulus created one of the most unique market environments we have ever seen. The mantra “Buy the Dip” was not born in 2020, but it certainly became a common motto for a whole new investing demographic. And who is kidding whom? Over those three years, we saw the S&P 500 double, rising by +100%, making the investment process look easy to anyone. The growth in the S&P 500 was largely driven by the Technology sector, rising +191% during the same period. So, while the S&P 500 was posting a measly double, the Tech sector nearly tripled. These massive returns coincided with a global pandemic and the very temporary -33% market pullback. Impressive.

This extreme Tech sector performance has brought forward a new mindset, one that states Technology stocks are defensive, with some solid supporting arguments. Dominant market share, very healthy balance sheets, and sitting on lots of cash to deploy additional buybacks help make that argument. And don’t forget recency bias, our tendency to overweight recent history compared to more distant memories. Tech did really well in the 2020 ‘flash bear’ thanks to holding lots of cash in a frightful time. The subsequent fall in yields certainly provided multiple expansions. And our changed behaviours had us ordering new tech gadgets to help outfit the home office or keep us entertained.

Conclusion – that was a unique situation that made tech appear defensive. But it isn’t. Ad spending, consumer gadgets, and business spending dominate tech sales. And these are all very cyclical.

We are not anti-technology. We realize the world has changed and become more tech-driven, but that does not always translate to the markets. In our view, the economic fundamentals drive the market. We have already laid out the work that the next decade will not be like the last. That could potentially mean higher than 2% inflation, higher yields and more volatile economic growth. Technology investments are still very cyclical; as the economy goes, so do they (with the exception of 2020) – not to mention the ever-present risk of disruption. Should any new technologies usurp the current tech giants, markets will have to adjust meaningfully, and given the current top-heavy nature of the sector, the results will not be welcome to investors.

How we view defensive stocks

When we think of defensive stocks, we think of a few key attributes. At the top of the list is earnings stability in various stock markets or economy states. We’d place what did the best in the last bear market somewhere near the bottom. In terms of earnings variability, Consumer Staples and Health Care stand out very well. Looking back to 1990, these two sectors have by far the lowest volatility surrounding earnings. At the top of the list, it’s no surprise to see Energy, but interestingly, Technology, the previous bear market darling, is also up there.

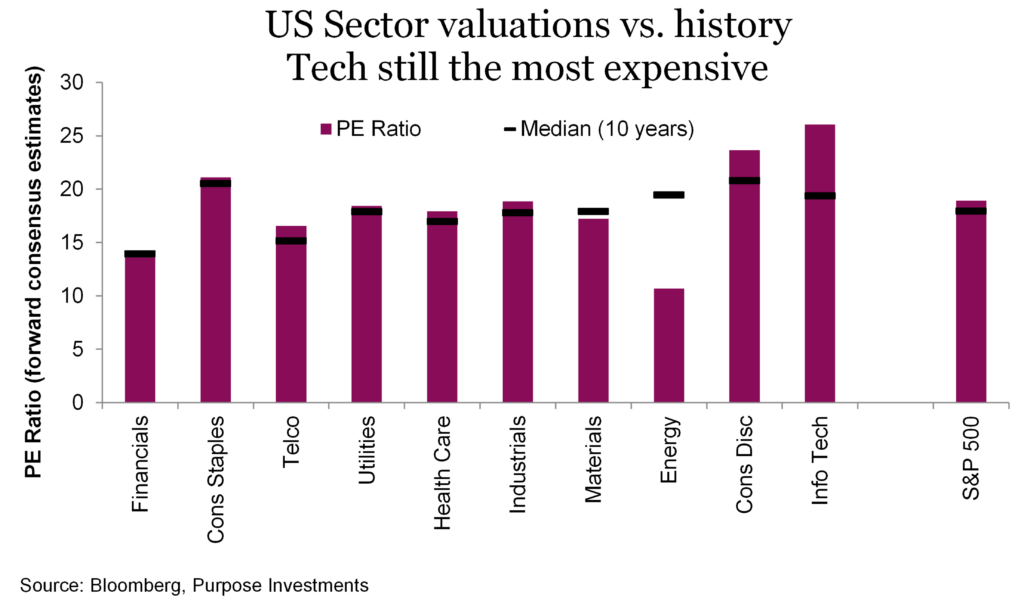

Earnings in the Tech sector are heavily affected by mega-cap names. These companies have also disproportionately driven earnings and recent gains for the entire market. This past week, we got a glimpse. With the sector up 18% year to date, they must continue to deliver strong earnings to justify current valuations. So do recent outperformance and strong gains over the Covid correction mean Tech stocks are defensive? We do not see them that way. Yes, they have some defensive characteristics, especially when it comes to balance sheet strength, but they are not immune to cyclical slowdowns.

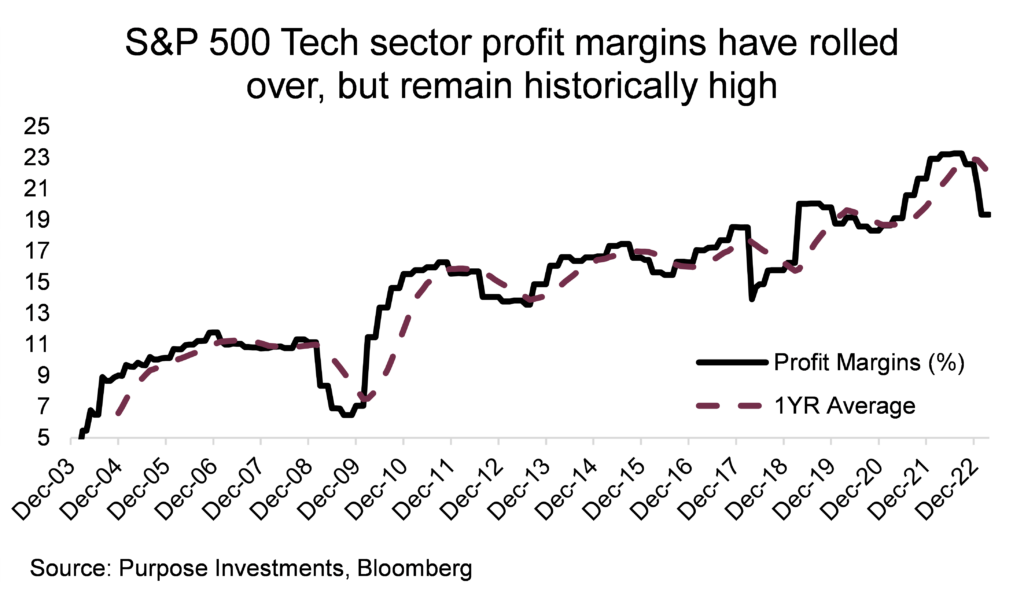

Evidence of their fallibility is the vast amount of layoffs announced over the past six months. Last year’s tech-wide reckoning in the job market continues, albeit at a slowing pace. According to LayoffsTracker, since January 2022, over 50,000 tech workers have lost their jobs. The reason behind the layoffs typically blames the macroeconomic environment and the need to find efficiencies to maintain profitability. And perhaps some overly aggressive hiring during the recovery from the pandemic. Increased layoffs have helped mitigate earnings damage so far, but margins in the sector remain high and are still at risk of at least normalizing to pre-pandemic levels. The chart above shows how much margin pressure the sector has already experienced. So far this earnings season, earnings have narrowly exceeded previously lowered expectations. However, compared to all other sectors excluding Real Estate, the Tech sector has the lowest earnings surprise and has seen growth fall by over 10%. The profitability outlook remains uncertain, and we believe there is risk in the massive premiums attributed to the sector relative to its history.

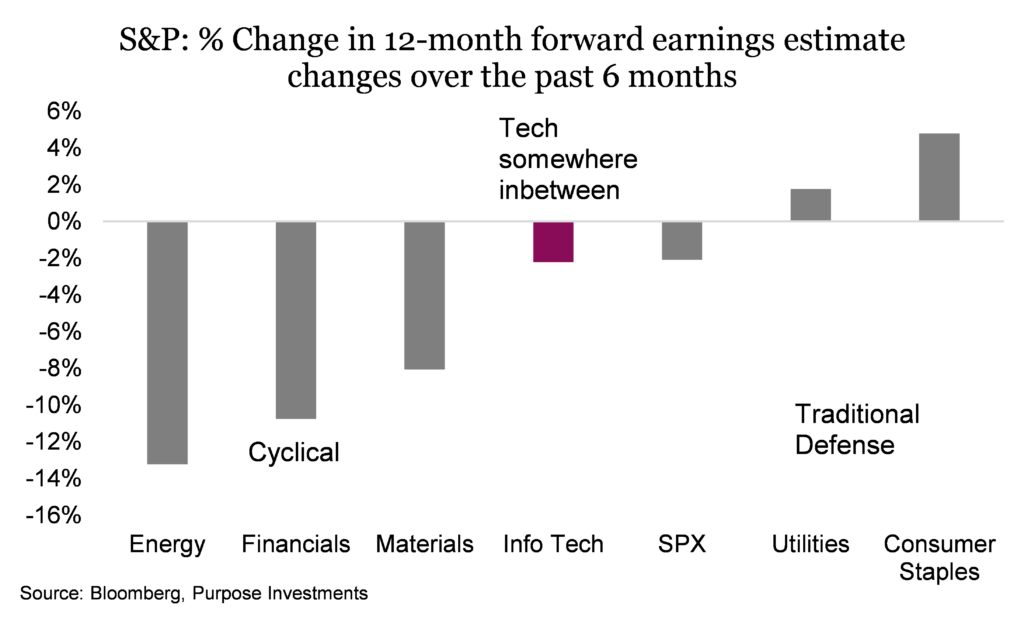

Stability is the key

Over the past six months, only Staples and Utilities have seen a rise in forward earnings estimates. All other sectors have seen a reduction. On the low end, not surprisingly, are your classically cyclical sectors like Energy and Materials, and the Tech sector sits somewhere in the middle with a definite tilt towards the cyclical. Tech earnings will likely prove to be not as defensive as many hoped or as they did in the 2020 pandemic bear. Certain segments of the tech industry are more stable, but some, like semiconductors and hardware, can be extremely cyclical.

If you were to match all the stock sectors to their corresponding items on the menu at Starbucks, Tech is definitely the Cappuccino. Popular but with lots of froth. The chart below outlines where sector valuations stand compared to their long term history. Only Tech and Consumer Discretionary (Amazon is the largest company in this sector) remain significantly overvalued. Low valuations do not mean stocks are immune to downside risk, but they certainly help reduce it.

Conclusion

Recent outperformance in the face of a looming recession does not equal a flock to safety. We remain focused on earnings stability as a crucial characteristic that defines winning stocks during recessions. A company with steady and reliable growth is preferable to one that has more erratic growth. These companies also possess some degree of pricing power which continues to be a beneficial attribute during periods of elevated inflation.

Tech stocks cannot be both the bellwether of bullish market sentiment and a defensive stalwart. Though companies within the sector provide exposure to prevailing and emerging trends such as AI, the sector is also exposed to massive sentiment swings. Traditionally, defensive sectors may not offer the same growth potential, but they do have less downside potential. Given the current macroeconomic climate, we recommend tilting portfolios to traditional defensive sectors.

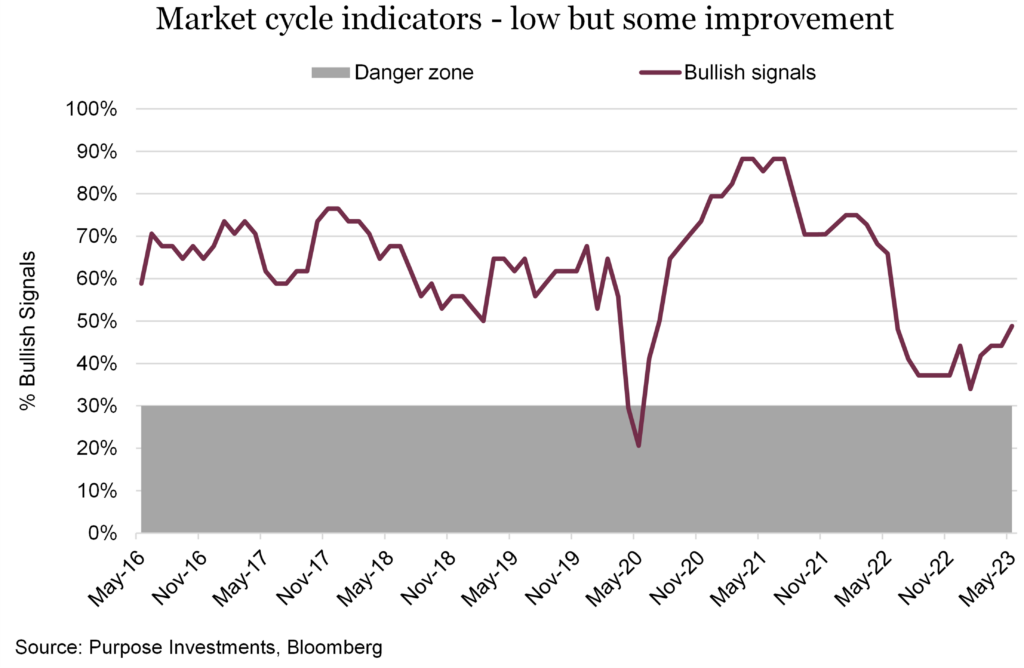

Market cycle

While we continue to lean defensive, we are not outright bearish. We believe some sort of recession is coming, and the market will likely react negatively, but the timing is very difficult to ascertain – not just the recession but also the timing of the market reaction. So, for now, we are holding the line with a mild underweight in equities and a mild overweight in cash/bonds. Enough market exposure to enjoy this current rally but with one foot in defence to hopefully pivot should things begin to deteriorate or rise high enough for us to believe the risk/return favours are becoming more defensive.

For now, the economy has improved a bit and so have our Market Cycle indicators. Little improvement in the U.S. data, namely consumer sentiment, plus a bit of improvement in housing helped; as did Emerging market performance as a bellwether of the global economy. This is good news, reducing the risk of a sudden imminent recession.

Portfolio positioning

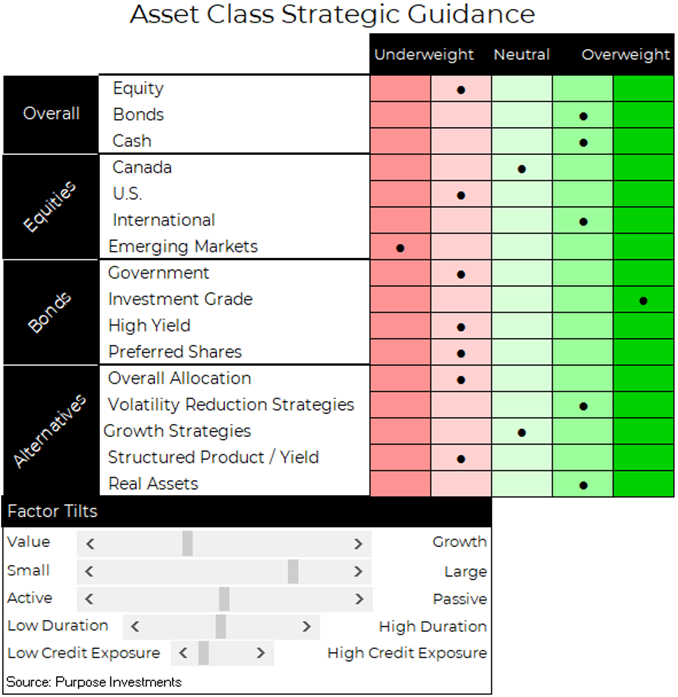

No change to our portfolio positioning during the past month: still mild underweight equities, mild overweight bonds/cash. The equity breakdown has us neutral in Canada, given better valuations and value tilt of our home market. We might have a mild underweight in the U.S. as we believe the growth factor and a decade of relative outperformance are both negatives going forward. We prefer international developed markets, both Europe and Asia.

For bond allocations, we are leaning on quality and have a neutral duration view after many years of carrying a lower exposure. Duration is bad when inflation is the biggest issue; it is a positive when a recession is the risk.

For alternatives we have a slight underweight simply because we can now find defense and yield in more traditional asset classes – less need to be fancy. Within alternatives, we continue to lean on defensive or volatility management strategies and real assets.

The final word

After going overweight during the summer rally in ’22, we went back to market weight equity at the end of last summer. This was then ratcheted down to a mild underweight in early March. Clearly, so far in 2023, everyone should have piled back into the NASDAQ but we are not convinced. Yes, inflation is better, the Fed may pause, and the economic data has not imploded, but earnings are starting to feel the pinch. This pinch may become more pronounced at the same time the economy weakens, which is not a healthy combination.

We continue to remain defensive, slightly underweight in equities, and slightly overweight in bonds/cash. If the market rallies much more, we may consider trimming market exposure even more. This is the strategy for a rangebound market that has a greater probability of breaking to the downside than the upside.

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

*Authors:

Purpose Investments: Craig Basinger, Chief Market Strategist; Derek Benedet, Portfolio Manager

Richardson Wealth: Andrew Innis, Analyst; Phil Kwon, Head of Portfolio Analytics; Mark Letchumanan, Research; An Nguyen, VP Investment Services

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.