Sign up here to receive the Market Ethos by email.

Market Ethos

June 26, 2023.

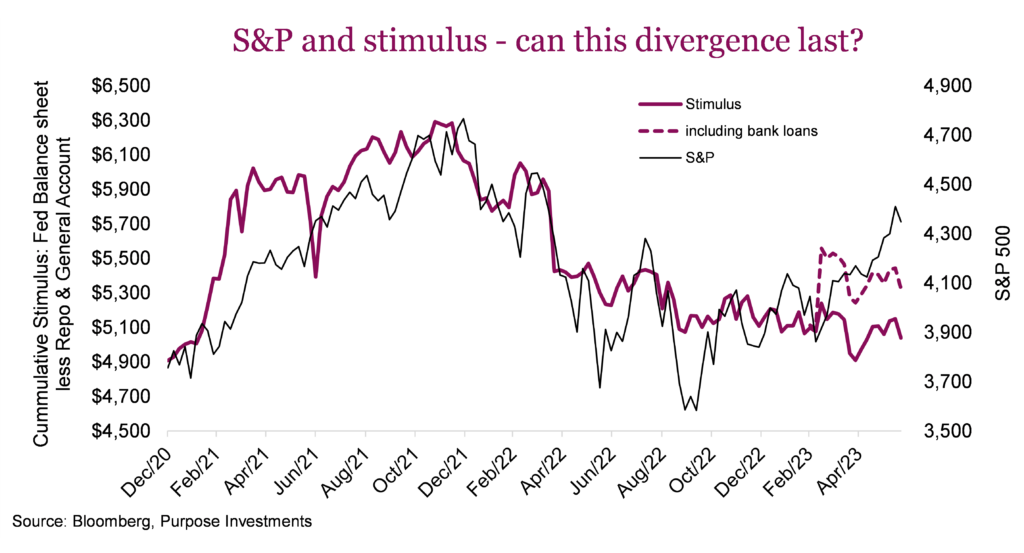

If the punch bowl is stimulus, it is safe to say that over the past number of years the market has become rather hooked on this sweet, intoxicating elixir. Quantitative easing, rate changes and twists all had pretty big impacts on stock prices, both up and down. And this relationship arguably became even stronger following the pandemic, given the sheer amount of stimulus. From the go-go highs of 2021 on the back of an overflowing punch bowl, to the pain in 2022 as the quantity of punch was slowly drawn down. But over the past month the S&P broke to the upside as the aggregate amount of stimulus stabilized … or did it?

The above chart measures stimulus based on three inputs – Fed balance sheet, Repo market and General Account (we will discuss the dashed line later). The size of the Fed’s balance sheet essentially measures quantitative easing or tightening as this results in changes in holdings for the Fed. If they buy bonds (QE), then it rises and if they sell bonds (QT), holdings decrease. Remember, if the Fed buys a bond, what does the seller do with the money? If they go out and reinvest in other bonds or anything else, that is stimulus into the financial system. However, if they park it in the Repo market (depositing back at the Fed), well, the money has just gone in a circle. That is why the size of the Repo market is subtracted from total stimulus.

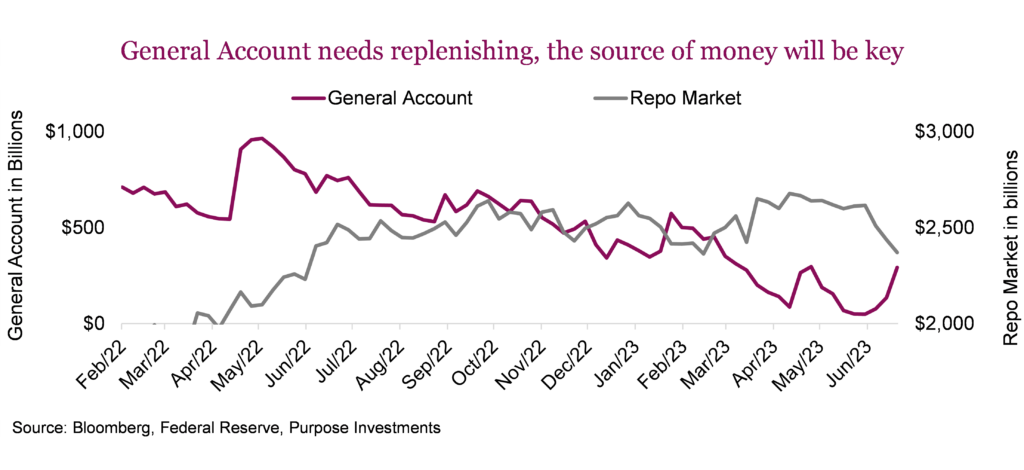

This brings us to the General Account, the U.S. government’s cheque book they use to fund government spending. If this account increases, government is holding onto money and if it is reduced, they are spending. As a result, the size of the General Account is subtracted as well. With the previous debt ceiling issue, the General Account had been almost bled dry since new issuances was not approved. Now with the debt ceiling raised, the coffers are being replenished with increased Treasury issuance. This would result in falling stimulus … depending on where the money comes from.

If the Repo market is the source of funds to buy the new Treasuries being issued, there is no change to stimulus as this money was parked at the Fed anyway, outside the financial system. If the money comes from elsewhere, it will be a reduction of aggregate stimulus, which is not good for markets, ignoring everything else. The partial good news so far is that it appears the Repo market has been the source of most funds being absorbed by the General Account replenishment.

The chart below is scale normalized for the General Account and Repo market. As one fills up the other is emptying. We would also point out that since the start of 2023, these two accounts have largely been offsetting one another. That is good news and also helps explain why the U.S. market has remained so resilient.

Back to the first chart and the dashed line. When the regional banks started to come under pressure due to fleeing customer deposits, a couple banks failed and the Fed stepped in with a loan program. Banks could pledge bond holdings as collateral (valued at cost, not market), thus stop gapping any liquidity concerns or need to realize losses due to customer pulling their deposits. We are not going farther down this rabbit hole into the working of the U.S. financial system as we would never finish our report on time. The key is this loan program could be viewed as stimulus, but it is murky given where the money goes. If it was stimulus from the market’s perspective, it certainly helps explain this pop in equity prices beyond just AI hype.

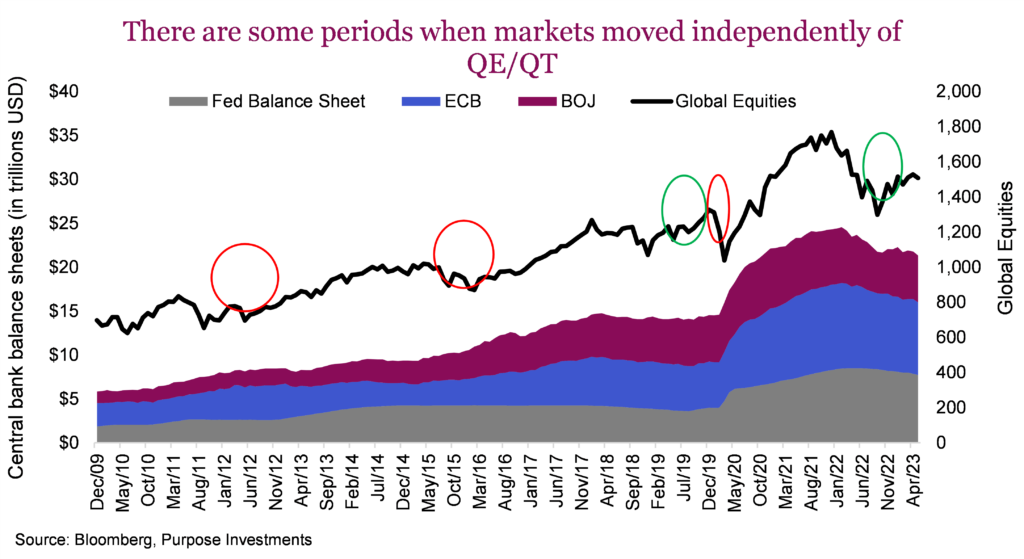

Can the market dance sober?

If the trend in the punch bowl is in the direction of less punch, can the markets still go higher? Absolutely. But looking back over the past years of this quantitative monetarily influenced market, you can draw your own conclusion. The chart below is the big 3 central bank balance sheets versus global equities. The circles are periods where it would appear the relationship has broken down. Red circles are periods when stimulus was increasing and markets still went down. Green circles are flat or less stimulus with an improving market.

The circles actually line up with strong exogeneous events impacting the market. For instance in 2011, we were going through a European debt crisis while the U.S. debt was being downgraded. In 2015 it was a sudden slowdown in economic growth coming out of China. The good news, the green circle in 2019 was the first real run where the market appeared to be lifted by improving global economic activity. The skinny 2020 red circle was the mother of all shocks – Covid. And now we have 2023, market moving higher with stimulus flat to down.

It’s hard to support the recent bounce on an improving economy. Perhaps it is just the bounce from the big fall of 2022, but risky if this bounce is not supported by economic or stimulus.

Final thoughts

Over the past month the U.S. equity market has done well, as has Japan. After that, just about everyone is down. Maybe we can attribute the narrow lift to AI or a bit of residual stimulus coming off bank lending programs. But any way you cut it, stimulus is being drawn down which is a headwind for equity prices. Especially given a global economy, that isn’t falling, but certainly is not accelerating. Sober dancing rarely lasts long.

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

*This report is authored by Craig Basinger, Chief Market Strategist at Purpose Investments Inc. Effective September 1, 2021, Craig Basinger has transitioned to Purpose Investments Inc.

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.