Sign up here to receive the Market Ethos by email.

Market Ethos

October 30, 2023.

We are about halfway through the U.S. earnings season, with 245 of the S&P 500 companies having already reported. Earnings are backward-looking, kind of like GDP reports, since the quarter started in July and ended in September. Nonetheless, companies offer a direct look at what is happening on the ground and deliver their expectations for the coming quarters via guidance. We would include Canadian earnings as well, but only 14% of the TSX has reported. Things move a little slower up here. So, let’s dive into U.S. earnings.

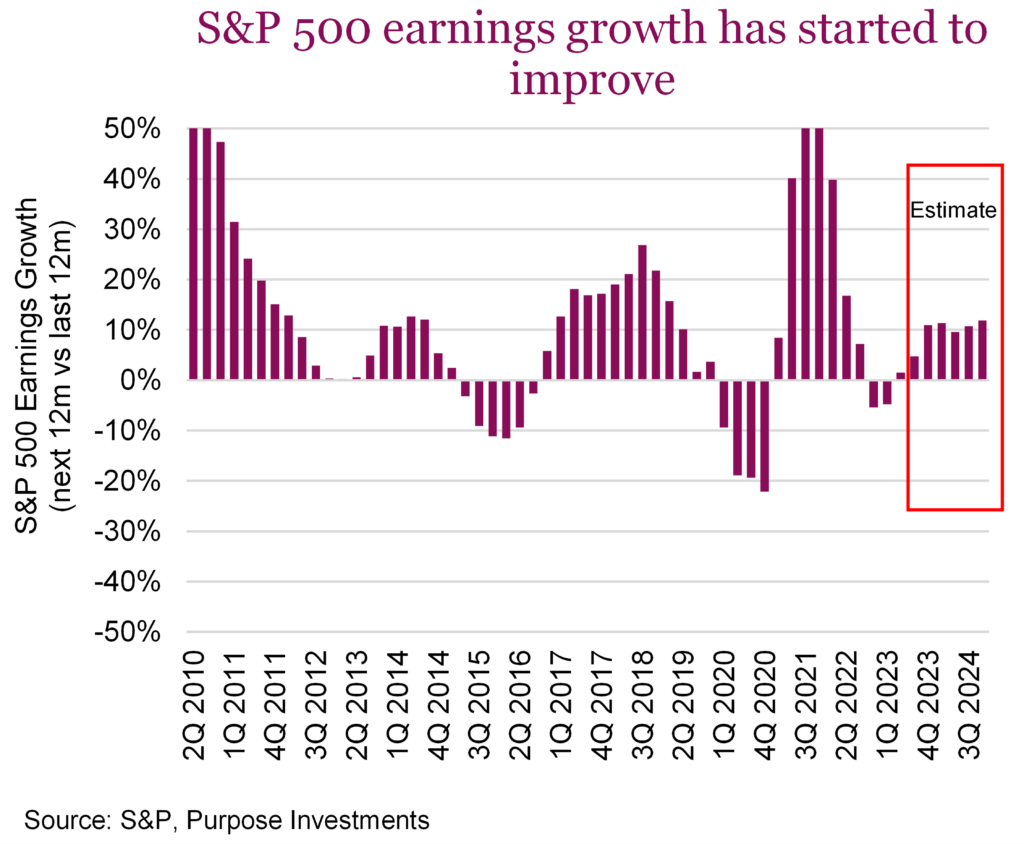

There is some good news: earnings growth has returned. After three quarters of negative or no earnings growth, Q3 2023 earnings appear to be coming in at about +5% compared to the same quarter last year. Based on current bottom-up analyst estimates, earnings growth is expected to continue to improve up to about 10% or so.

Continuing on a positive note, about 80% of companies have so far surprised to the upside, in keeping with historical norms. Impressively, this was widespread across all sectors except energy. Growth, too, was widespread, with all sectors except energy, materials and real estate showing positive earnings improvement over last year. With commodity prices lower than a year ago, that is what drives the earnings in energy and materials, so it is not surprising. And, of course, real estate continues to struggle. Margins have also remained resilient. Yes, costs are up, but so too is top-line revenue growth for most firms. Overall, it has been a decent earnings season so far.

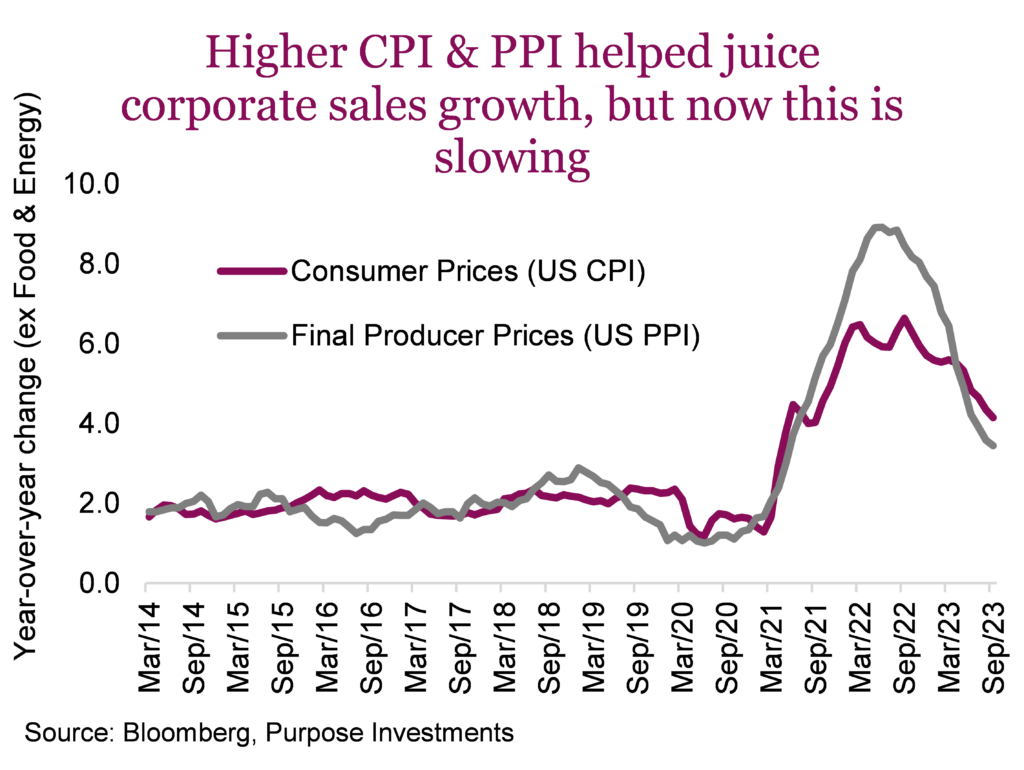

On aggregate, it does appear that things are holding up or even improving from an earnings perspective. But it is important to remember that periods of higher inflation create a great deal of confusion, not just for people making decisions but for businesses and even for economists. Inflation churns up the water, making it hard to see what is really happening in the economy.

There is no denying higher inflation helped offset higher input costs to maintain margins and help restore earnings growth. Now the question is, what happens as prices and producer prices come back down? Without the ability to raise prices, either input costs have to reverse as well, or margins suffer.

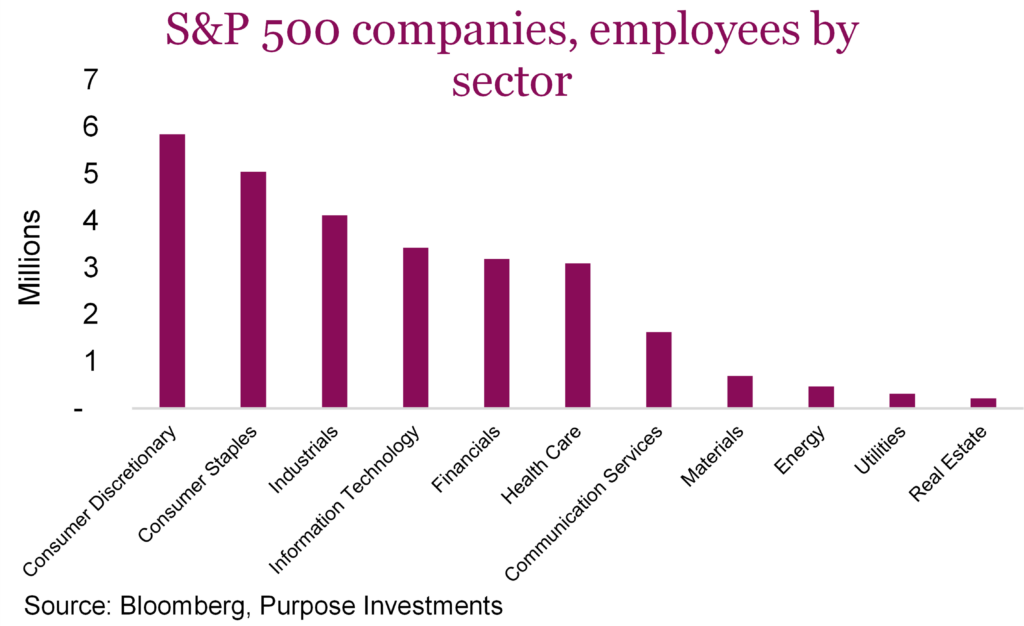

So, will input costs come down? Ford appears to have resolved the strike and, as a result, removed profit forecasts. Sure sounds like input costs may keep going up even as inflation comes down. This may put labour-intensive industry margins at greater risk in the coming quarters.

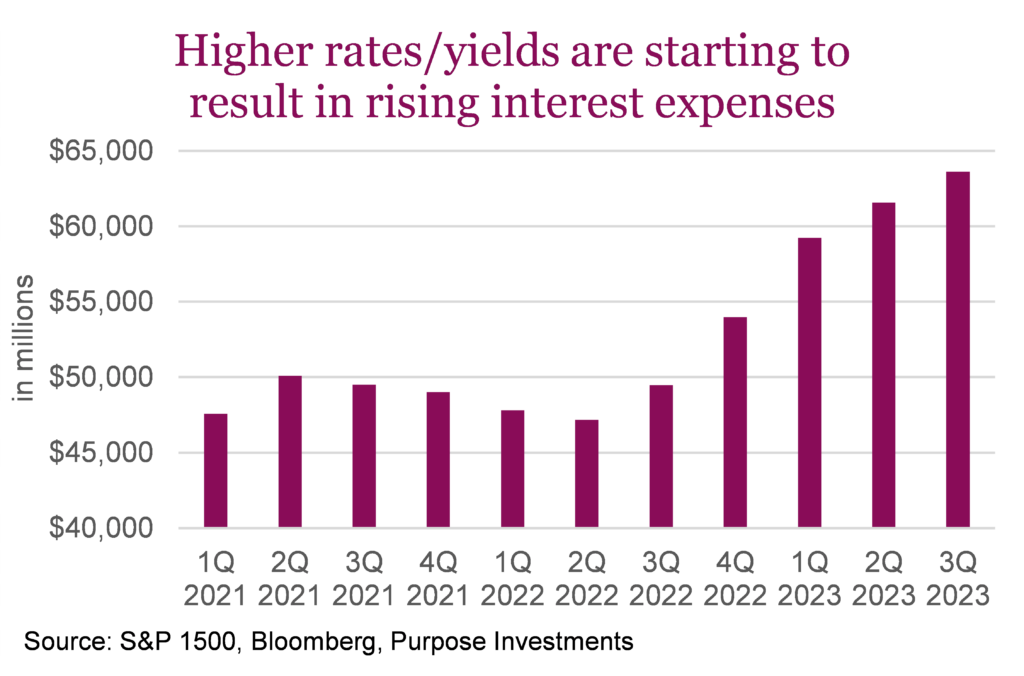

There is another cost that is starting to bite: interest expense. In 2022, when yields started to rise, there was much talk about how great a job corporate America did on extending the terms of their debt when yields were so low. Absolutely true, and this has helped. But as time goes by, it starts to show up more and more as rising interest expense.

Final thoughts

We are encouraged so far by this earnings season, but we also are starting to see forward estimates come under a bit of pressure. It is important to focus on the composition of companies, their ability to pass through costs, how labour-intensive their operations are, and what the debt situation looks like.

S&P estimates for 2024 remain too high in our opinion, and we believe this adds to risk. Canada and most international markets have already seen a rapid decline in estimates, which does provide a margin of safety. U.S. earnings appear the most at risk, but it really depends on the industry and the company.

Sorry, there is no quick and easy shortcut here, just the conclusion that digging deeper into fundamentals is becoming increasingly important in this challenging market.

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security. Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.