Sign up here to receive the Market Ethos by email.

Market Ethos

February 27, 2023.

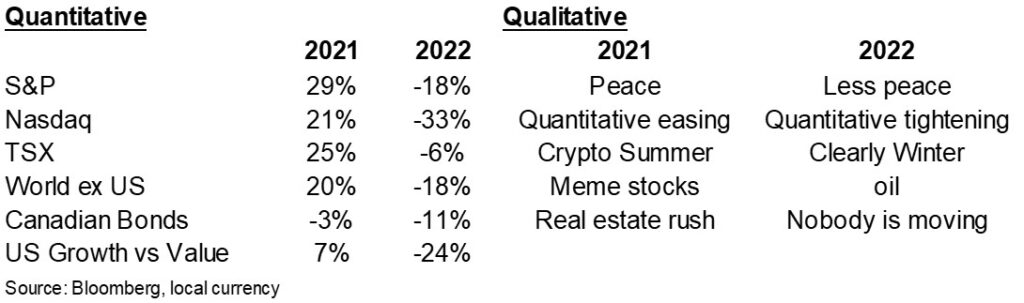

The S&P 500 is roughly where it was two years ago, around 4,000. Since then, it has visited 4,800 (+20%) and 3,600 (-10%) – clearly not a flat journey. The TSX has fared better, starting at 18,500, rising to 22,000, back down to 18,500 and then up to 20,000. Meanwhile, most bonds lost a little money in 2021 and a sizeable amount in 2022 … certainly a challenging investment market. Of course, we have seen worse periods for markets, and fortunately, we have often seen better. But even if your portfolio has become a tad smaller over the past two years, there is a silver lining. The scenario of events has created a great environment to understand yourself as an investor (or understand your clients’ behaviours better).

The past two years have seen big ups and downs across many parts of the market. From rampant speculation to despair in certain areas. From free money to money that has a real cost again. Growth to value, QE to QT, peace to war. Add in bonds not protecting the portfolio very well and rising inflation. This market, with all its crazy moves of late, has been near perfect for helping you understand what kind of investor you are.

Were you enticed by the high-flying meme stocks of 2021? Or the profitless tech disruptors that sounded like they were about to change the world? Flying autonomous taxis and such. Or even the more ‘conservative’ dabbling in those mega-cap tech names? Did you feel like or take on more market exposure during the upswing in 2021?

Turning to 2022, had you considered selling? After all, cash now pays 4%+, so who needs this market risk anymore? And there could be a recession coming. Maybe the flying cars are not imminent, or maybe the market is starting to value Tesla as a company that makes cars. Or those bonds that really dropped the ball as a portfolio stabilizer in 2022 – are we done with them and moving to those that did better? Those happen to be the strategies with more credit exposure.

Following positive performance is human nature

The simple fact is we are naturally drawn to investments that have performed better and away from those that have performed poorly. And during the past two years, many investments have flip-flopped from good to bad or vice versa. This created a ripe environment to either test your fortitude to remain on your financial plan or entice you to go off that plan in the hopes of gains or ending performance pain.

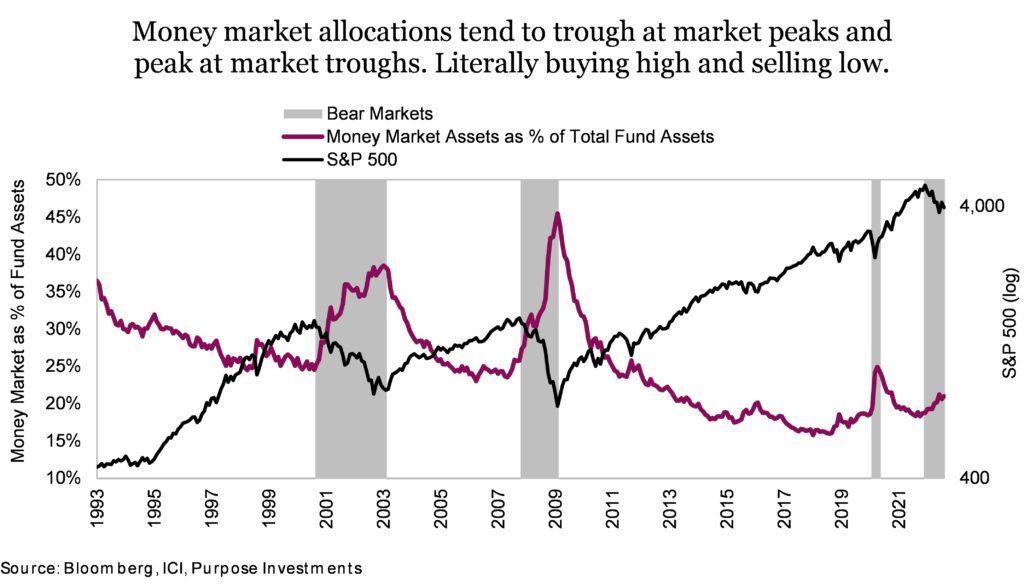

Unfortunately, positive performance chasing or poor performance fleeing are two behaviours that can really mess with long-term returns. Dalbar Inc. analysis highlights this behaviour with their money flow analysis showing the average U.S. equity investors experienced 7.1% annualized gains over the past 30 years while the S&P 500 index gained 10.6%. This is due to performance chasing in both directions. This can also be seen in mutual fund allocations over time. While this is U.S. data and only incorporates funds, the lesson remains valuable.

Behavioral coaching

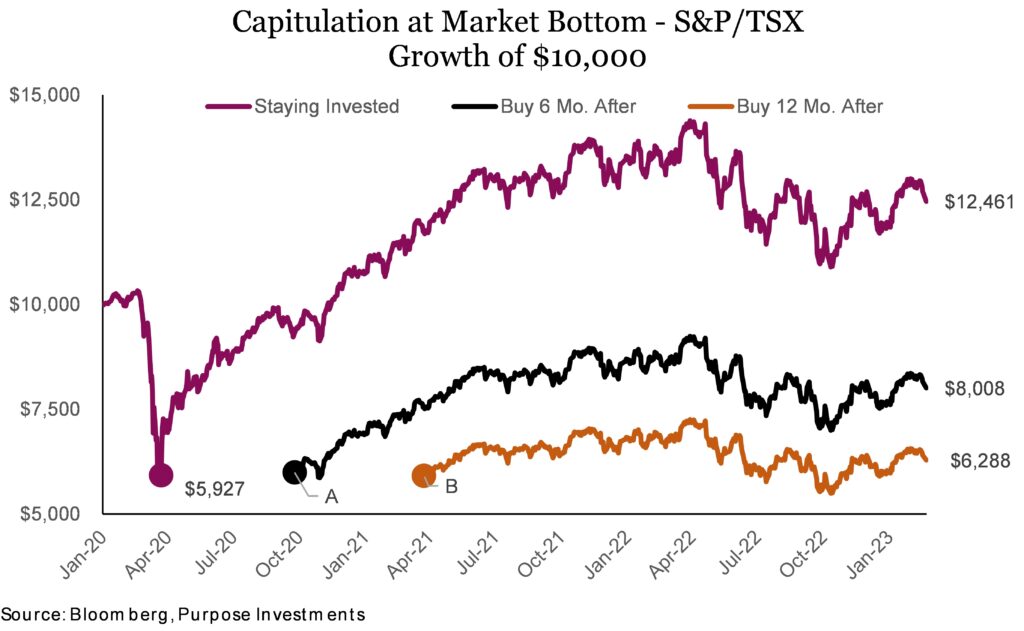

Of course, examples of the “average investor” often elicit the response, “well, that isn’t me.” So, to make it a bit more salient, consider the wealth damage capitulation can cause.

Take the example in the chart on the next page. Investors A & B capitulate at the bottom of the pandemic, and who would blame them? Those were scary times, and for an investor with little experience in significant market corrections (the last one being way back in 2008), emotions can take over and cause a mistake. However, to an inexperienced investor, it does not feel like a mistake at the time. You initially invested $10,000, and it is now below $6,000; you just want the bleeding to stop. Therefore, the band-aid for an investor is to sell the investments and go to cash.

Fast forward to the future, as Investor A reinvests the same capital six months later. In this scenario, the market has largely recovered to pre-pandemic levels. However, they have missed out on much of that initial growth off the bottom and end up in a significantly worse position today than if they had the wherewithal to remain invested. Investor B is in a similar position, but instead of waiting six months, they wait a full year until they are comfortable. This allows them to miss out on approximately $6,100 of capital gain in the market.

The cost of fear

This is what we like to call the “Cost of Fear.” For investment professionals, charts like this one have been around for a long time. It is not a new or revolutionary concept. But it visually represents a common mistake investors make: selling low and buying high. Market corrections happen, and they are healthy for an efficient market environment. But if you leave the market, I hope you have an expensive crystal ball because it is nearly impossible to pick the correct time to return.

This is where investing and psychology have an immense overlap. Money is emotional, and for the most part, the stock market is not a tangible purchase you can touch, like real estate or a painting. For some reason, we as investors feel we need to value our portfolios daily, checking stock prices etc. Conversely, those tangible investments we are comfortable with, we check the value maybe once a year, probably every two years. So, what about the stock market makes us feel like we have some form of control? The market will do what it wants to do. The mistakes come from investors admitting defeat. This is why investment and portfolio construction advice is paramount, avoiding those A & B return paths and reaching retirement goals faster than expected.

Final thoughts

Financial advice takes many forms, from planning, tax, and portfolio construction, to mention a few. However, during times like the past few years, behavioural coaching may add the most value by helping investors avoid making those emotional mistakes that can cause long-term portfolio performance damage. We are not saying the market will go up from here in either equities or bonds. But focusing on the long-term journey can help mitigate the dangerous tendencies that market volatility can elicit in the short term.

Take stock of your behaviours and feelings about investing over the past few years. Understanding your personal tendencies with an objective lens can really help your own decision-making process during periods of market volatility. And understanding can help avoid or mitigate damaging performance behaviours.

“To know thyself is the beginning of wisdom.” – Socrates

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

*Authors:

Purpose Investments: Craig Basinger, Chief Market Strategist; Derek Benedet, Portfolio Manager

Richardson Wealth: Andrew Innis, Analyst; Phil Kwon, Head of Portfolio Analytics; Mark Letchumanan, Research; An Nguyen, VP Investment Services

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.