At Richardson Wealth, the name on our door holds our commitment to the short- and long-term success of our clients, creating sustainable and intergenerational wealth for individuals, families, and communities.

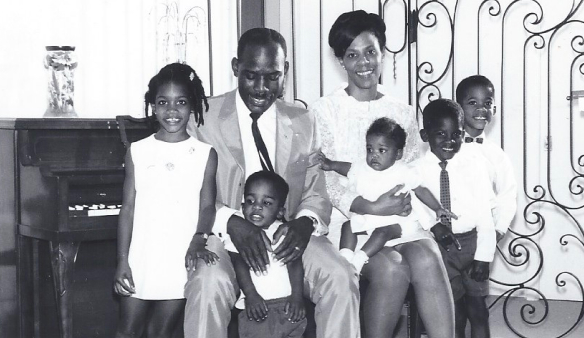

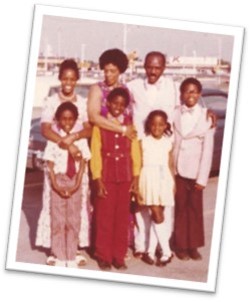

The Richardson story is an inspiration for many, including immigrant families like mine. My parents came from humble beginnings, with the hope of establishing their family in Canada. I have previously written about my father’s inspirational journey from the sandy shores of Trinidad and Tobago to the Port of Montreal in the early 1950s. My mother had a similar story, coming to Canada from the small island of Grenada where her father and mother, the local administrators for a nutmeg plantation, helped their five children migrate to Canada and Great Britain in the mid-1950s.

The great diaspora

My family’s story, however, began many generations earlier. We, like many others who identify as Black, African, or Caribbean, were part of a massive migration story of approximately 12 million people from West Africa to North and South America between the 16th and 19th centuries during the transatlantic slave trade. This significant diasporic event created, amongst other things, a widespread economic crisis for the descendants of slavery or indentured servitude, including the indigenous populations of the Caribbean that had been displaced by these events.

The descendants of this great diaspora were, and continue to be, generationally excluded, or limited, from participating in the mainstream economy which as former president Barack Obama once noted took centuries to form and, without purposeful intervention, could take centuries to unwind. The numbers tell us that even though more Black Canadians are participating in the mainstream economy, very few may be described as wealthy. An RBC special report in 2022, notes that “Canadians amassed record savings and wealth during the pandemic, but for Canadians of colour, the gains have been less substantial.” Specifically, they are “less likely to own financial assets or businesses, and critically, they are less likely to own homes. This should not come as a surprise given that visible minorities generally earn as little as 85 cents per dollar compared to the non-visible minority population, often despite having formal education.”

Addressing the wealth gap

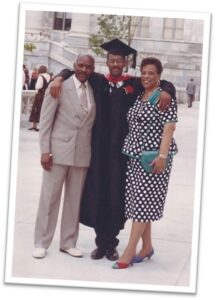

Just like my father and his family, for many Black Canadians, visible minorities and other immigrants to Canada, education is still the only predictable currency and access point to wealth. Professions like medicine, law, education, and accounting have created access to wealth but not the kind that guarantees its sustainability.

To narrow this wealth gap, the critical action word is inclusion; Black and other visible minorities must be intentionally included in the wealth conversation, enabled by education, employment, and access points to ownership where the community itself is empowered to build and generate wealth in community for community by community.

Furthermore, with very few Black leaders in the wealth space particularly as wealth advisors, and with likely even fewer Black Canadians having a financial advisor, the literacy and enablement required to build sustainable wealth will not be supported.

There are certainly many great success stories, like those of Eldon and Rosalind Williams however, higher education may contribute to higher-paying employment opportunities but may not, in and of itself, assure sustainable wealth for the next generation and beyond.

This is the risk and opportunity we must continue to rethink with acute intention, action, and long-term commitment.

Creating opportunity

Our Richardson Wealth community has continued to support initiatives that create opportunity, not just for the Black communities but across other areas within the diversity, equity, and inclusion spectrum. The path to building sustainable wealth in Black and other diaspora communities requires our continued commitment to investing our time and money to economic empowerment and advocacy.

For the last three years, the firm has supported the Black Opportunity Fund, a charitable organization that helps Black communities reach greater economic and social success. This year, we are strengthening our commitment to community through art by establishing a new corporate relationship with the Art Gallery of Ontario’s department of the Arts of Global Africa and the Diaspora (AGAD).

Established in 2020, the AGAD focuses on expanding the museum’s collections and its exhibitions and programs of historic, modern, and contemporary art from Africa and the African diaspora. Art is a universal connector. This collection provides an opportunity for viewers to form a deeper understanding of historical narratives and diverse experiences, which I believe will lead to greater inclusivity and empowerment.

Michael Williams

SVP, Chief Risk Officer