Sign up here to receive the Market Ethos by email.

Market Ethos

July 24, 2023.

At the beginning of the year most strategists expected a couple things: recession to soon materialize and the Fed to stop hiking, pivot mid-year, and then aggressively cut in the second half leading to U.S. dollar weakness. None of that really materialized, except the U.S. dollar peaking last fall. The U.S. dollar index (DXY) is now down -11.8% from the peak and down -3.6% from the beginning of June. The DXY index also briefly dipped below 100 this week, breaking through support and well below key moving averages.

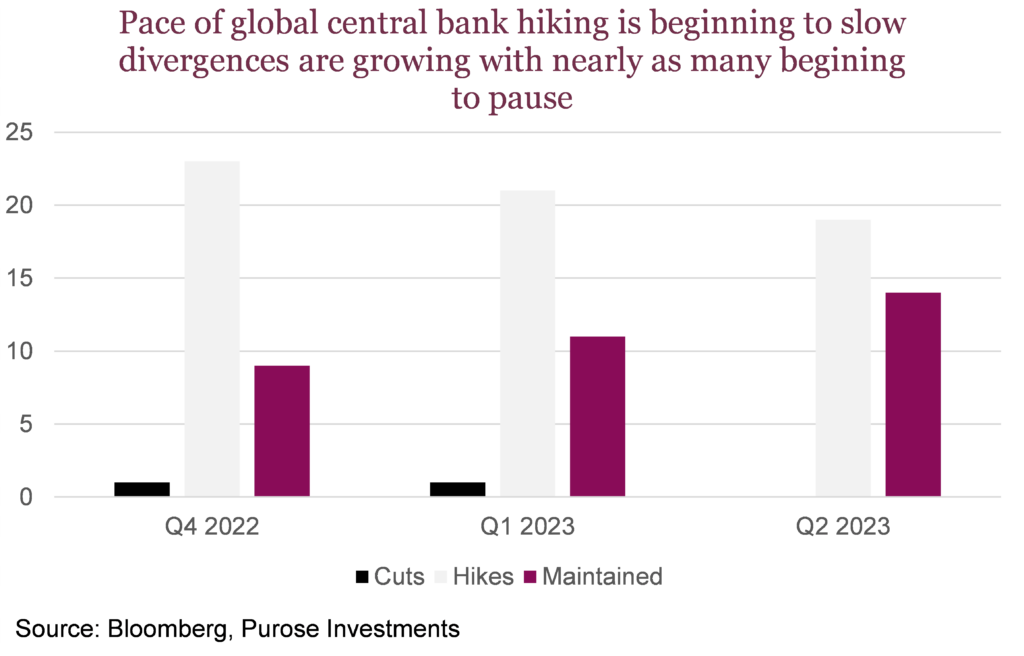

So, is the dollar depreciating, or are other major currencies just appreciating? Most G10 currencies have been rather strong recently. And it’s precisely these currencies that the U.S. dollar gained a lot of ground on when the Fed began aggressively tightening, compared to other banks. With the pause, and perhaps one more hike left, other central banks that started a little later are catching up. Divergences in central bank paths are budding. This is big, as not every global central bank is moving in lockstep with the Fed (BoC may be an exception). The pace of global central bank hiking is beginning to slow as more are beginning to pause, detailed in the chart below. Looking out, we’d expect this trend to continue as the market is expecting the Fed to pivot in the next 12 months. With U.S. rates at or near the peak, this only reinforces the fact that we’ve likely seen the peak dollar for this cycle.

Drivers of U.S. dollar strength historically are relative growth, rate differentials and demand for the dollar as a “safe haven” asset. Rate differentials are narrowing and it’s easy to see just looking at the performance of the S&P 500 or NASDAQ that we’re in a risk-on environment. Market volatility is low, so there is little appeal for “safe haven” protection.

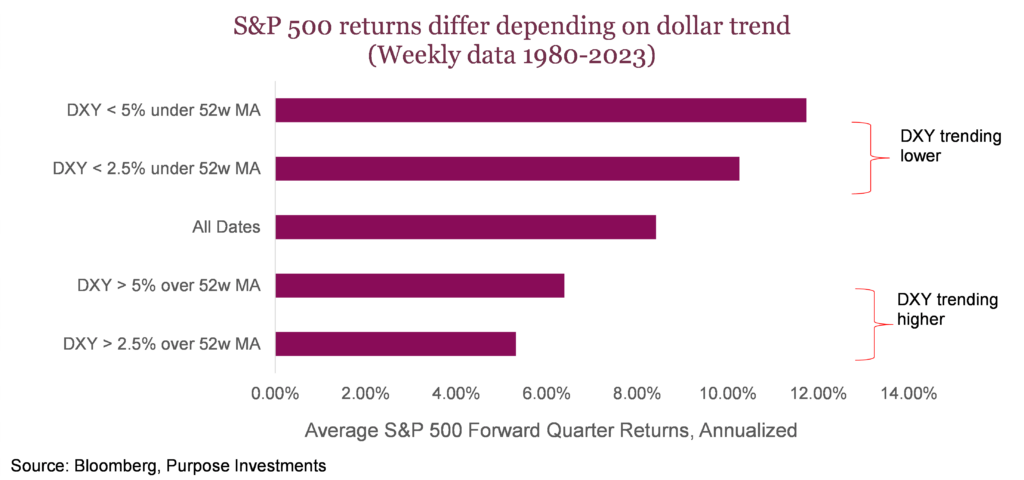

The implications of a longer-term cyclical dollar bear cycle are complex, but the most direct beneficiaries are commodities, most notably gold, emerging markets and risk-on currencies such as the Canadian dollar. One other spin-off effect is the impact on corporate earnings. Many of the largest U.S. companies generate a lot of revenue outside of the United States. A falling dollar tends to boost earning. Historically, the S&P 500 tends to do better when the U.S. dollar index is declining. Looking back to 1980, when the U.S. dollar index was more than 5% below its 52-week moving average, the average look forward quarterly return annualized is 11.74%, compared to an all-time average of 8.42%. In contrast, when the DXY is more than 5% above its 52-week moving average, forward returns are just 6.39%. It’s a small tailwind, but worth keeping in mind. Interestingly, the U.S. tech sector, which derives a substantial portion of its revenue from outside the U.S., could benefit from this relationship.

Canadian dollar

Global currency trends are interesting, but what’s most important to Canadians is the loonie. And rightfully so! Risk is back on. And risk on currencies like the Canadian dollar have been getting bid back up. WTI is in a stubborn range below $80/bbl however oil prices are no longer falling, and we’re beginning to see some green shoots for the black barrels. With the combination of renewed risk appetite and at least some consolidation in the commodity complex, this could help entrench a moderately bullish trend on the Canadian dollar as we head into the second half of the year.

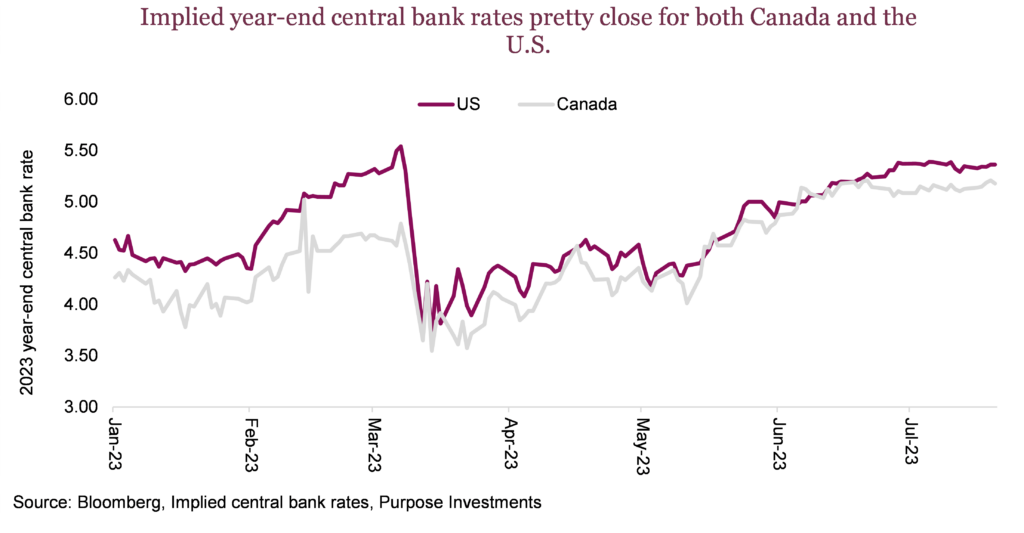

Yield divergence between Canada’s 2-year yield and the U.S. is just 20 bps after blowing out to as much as 77 bps in March. Yield differentials have historically been a key driver but the yield-driven case in support of the Canadian dollar lost appeal earlier this year. It has certainly come back with the recent U-turn by the Bank of Canada, which revised a bullish trend for the Loonie. While the market isn’t currently expecting more rate hikes, the BoC has kept the door open. In addition, Canada’s economy is proving more resilient than expected this year. The surprise pickup in housing is a big difference-maker, especially since it’s one of the largest risks for the country and at least it doesn’t appear to be getting worse. In terms of the future path, the implied year-end central bank rate for both Canada and the U.S. remains pretty close. We’ll have to wait and see which central bank blinks first.

Longer-term considerations like valuation measures such as purchasing power parity show that the Canadian dollar is moderately underpriced relative the U.S. dollar. At a current 7% discount to the greenback, it’s hard to have a firm view one way or the other. For now, shorter-term drivers will remain behind the wheel.

Technically, the Canadian dollar at $0.7567 CAD/USD is right at the top-end of the narrow range between $0.76 and $0.72 that’s been in place since last September. Momentum is not terribly stretched, and the recent trend has been higher. The recent move above prior peaks around $0.75 is encouraging for the current trend to remain. Since March it has consistently been making higher highs and higher lows which is indicative of a sold medium-term bullish trend.

Final thoughts

It’s worth remembering that the Canadian dollar is also a U.S. dollar proxy globally. Our economies are incredibly intertwined. If you expect a cyclical weakening of the U.S. currency to remain in 2023, that also probably means that the Canadian dollar may be exposed versus other international currencies (even with possible outperformance) versus the greenback. With that in mind, we strongly recommend remaining unhedged versus international currencies.

In terms of managing portfolios, currency considerations mainly have to do with whether to hedge or not to hedge. Our preference is to typically leave U.S. dollar exposure unhedged unless the Canadian dollar becomes so undervalued or technically oversold that hedging at least some U.S. exposure become an easy decision to make. At 76 cents, the loonie isn’t extreme enough for us to get excited about in either direction. If it gets to 80, remove any hedges and start doing some cross border shopping. If it gets down to 70 or 71, hedging becomes a much easier decision. Given markets continue to run with risk-on sentiment escalating, we think having some U.S. exposure makes sense, should things reverse. Though peak U.S. dollar may be in the rearview mirror, and global growth expectations have improved any signs of recession, Growth slowdown can see risk appetite sour quickly. It’s precisely at these times that “safe haven” currencies like the U.S. dollar tend to prove their true value.

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

*This report is authored by Craig Basinger, Chief Market Strategist at Purpose Investments Inc. Effective September 1, 2021, Craig Basinger has transitioned to Purpose Investments Inc.

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.