Sign up here to receive the Market Ethos by email.

Market Ethos

January 15, 2024.

The illusion of causality is a behavioural bias in which we believe there is a cause-and-effect relationship at work which just isn’t there. This bias is created because we humans love a simple causal relationship – rules make us feel like we understand the world better and are in control, to some degree. This bias is prevalent in how people think about the markets and economy. Unfortunately, neither markets nor economy lend themselves to simple cause and effect because both are such complex systems with countless moving parts. Those parts are made up of the behaviours of all consumers, corporations, investors, governments, etc.; best of luck truly deciphering a simple cause and effect in such a dynamic, fluid system.

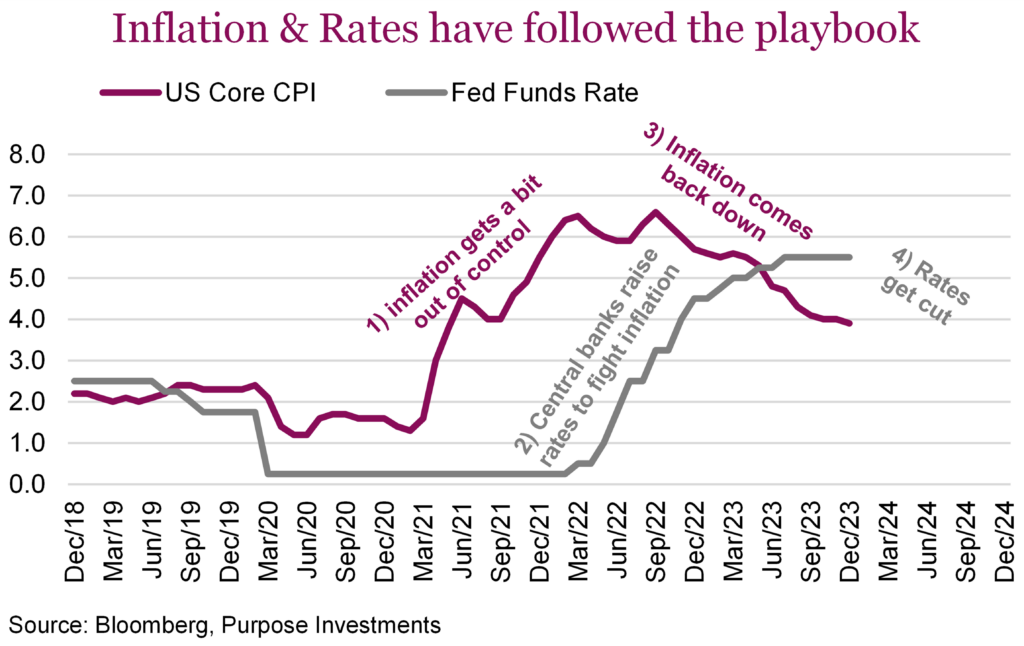

Rate hikes and inflation may be one of those illusions of causality that is prevalent today among investors. The playbook is well known: Inflation is caused by too much demand compared to supply. To fight inflation, central banks raise overnight rates, which slows the economy or aggregate demand, alleviating said inflation.

So that is clearly what has happened, right? On the surface, it sure looks that way. We focus on America, but it is similar in most countries. Inflation started rising materially in 2021, central banks started raising rates in 2022, and inflation peaked around the middle of the same year. As inflation has been trending lower for over a year, central banks have now stopped raising rates and are now expected to cut rates this year.

The bonus has been the absence of a recession. Historically, rate hike cycles like this one have been followed by some sort of recession. So far, that has not shown up, emboldening the soft landing narrative, which appears firmly baked into the markets as we start 2024.

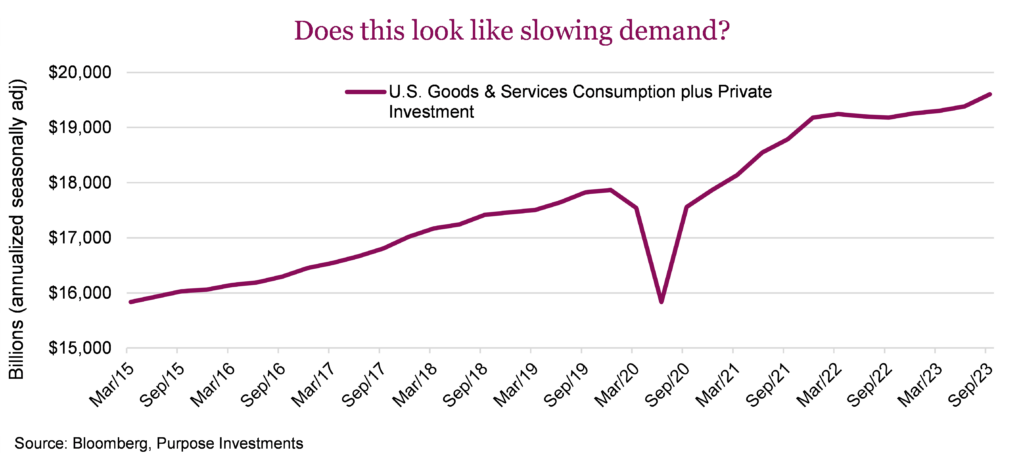

What if the consensus has it all wrong? Or, more specifically, the consensus has the causal illusion that rate hikes solved the inflation problem, and since no recession is evident yet, it all worked out perfectly. Rate hikes are supposed to lower or slow demand (sometimes called demand destruction), to alleviate inflation pressure. We don’t think we have seen much of that for a few reasons.

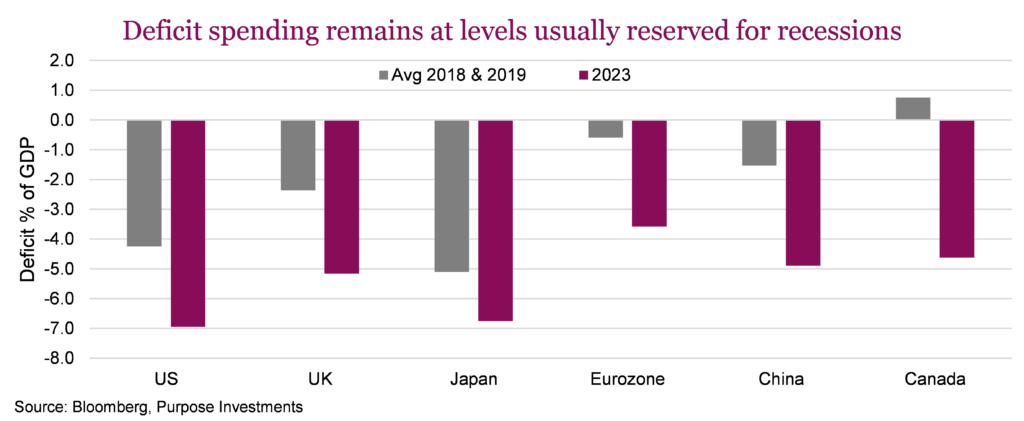

Counterproductive

On their own, higher interest rates slow down demand or economic activity. But there have been other factors at work here that are diametrically opposed. Fed raising rates slowed economic activity, but the Fed injecting liquidity to backstop the regional bank failures in March of 2023 was a quantitative stimulus. Add to this, the draining of the Repo market over the past six months was stimulus. And add to that, the U.S. government is running a deficit that rivals the stimulative spending usually only seen during recessions. The U.S. is not the only government. It seems if governments spend a lot of money, as in providing support for the economy during a pandemic, but they sure don’t rush to reduce spending back to normal afterwards. This also fits nicely with why no recession has started to show up.

It really explains why demand, measured by consumption and private investment, has remained pretty robust even with short-term rates rising from nearly zero to 5.5%. This measure of demand did slow a bit in 2022 but has largely turned back positive. You could say it is excess savings, government spending, and a splash of QE helping counteract the impact of higher rates. Clearly, trying to draw a simple cause and effect is challenging, given so many components in flux.

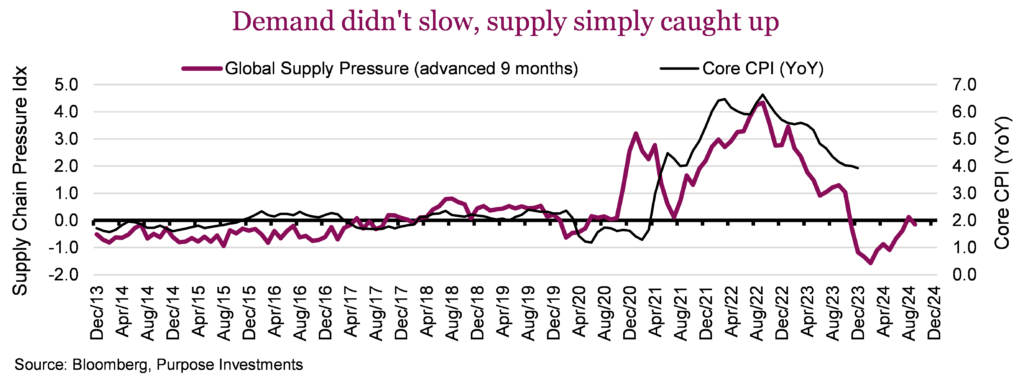

So why did inflation come back down from 6.5% to below 4%, and continue trending lower? It is clearly hard to argue that rate hikes have resulted in softer demand. Chances are it is on the other side of the ledger – supply. Capitalist economies work well. When there is not enough of something, people find a way to get it / make it and sell it. The pandemic messed with supply chains and changed our consumption behaviours. Ever since then, capacity has been expanding, relocating to better meet demand. The Fed’s rate hikes didn’t tame inflation – corporations did.

The chart below shows that inflation lagged one year vs global supply chain pressure, peaking about a year after supply chain pressures peaked. Supply chain pressures have steadily improved and gone negative recently. Chances are that prices will continue to follow.

We are not implying rate hikes had no impact on inflation. They are certainly a positive contributor to helping bring inflation down. However, other parts of the government have been operating in a counterproductive manner. And don’t underestimate profit-driven corporations for identifying and meeting demand in the marketplace.

Final thoughts

It is challenging to try and draw causation in the economy or markets. Believing it has been the central banks that tamed inflation simply doesn’t add up when demand has remained robust. Likely it has been corporate capacity catching up with changing demand that has helped more so in bringing inflation lower. Dare we say inflation was transitory after all? Just maybe the time implied in being transitory was measured in years, not quarters or months.

This also should give some pause to the euphoric market view that cooling inflation will encourage central banks to start cutting rates. They will likely cut sometime in 2024, but there are many other moving parts. What happens when the Repo market is largely drained? Will QT be back on in full effect? The fiscal impulse from government spending is set to slow in 2024. Plus, don’t forget the impact of rate changes, which has large variable lagged impacts on the economy that are still percolating their way through.

A lot of moving parts really make drawing causation challenging.

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

*This report is authored by Craig Basinger, Chief Market Strategist at Purpose Investments Inc. Effective September 1, 2021, Craig Basinger has transitioned to Purpose Investments Inc.

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

ichardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.