Market Ethos

March 11, 2024

Welcome to the world of gold

Sign up here to receive the Market Ethos by email.

If you have ever held gold within your portfolio, it is a safe assumption that you found the experience frustrating. Sometimes, the stars align for gold, such as positive retail/bank flows, falling real yields, a weaker US dollar and war breaking out somewhere. And yet the price of the yellow metal does nothing or, even worse, goes down. How about during the period of higher global inflation from mid-2021 till the end of 2022? Yep, gold went down 5% – meaning it went down a lot more if you adjusted for inflation.

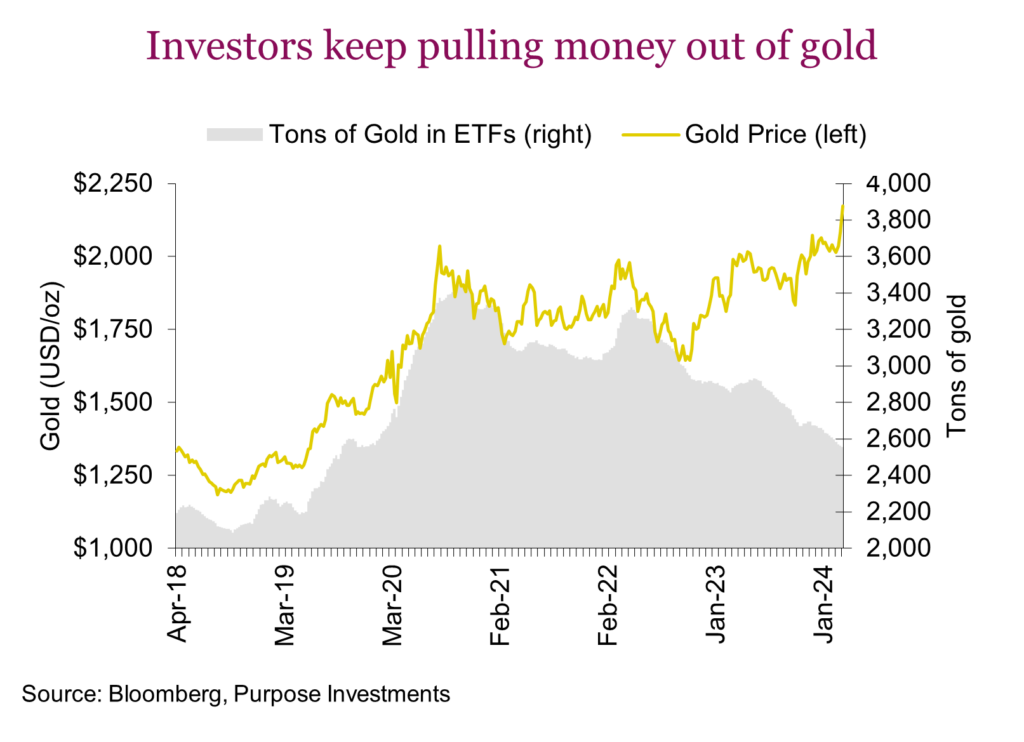

Fast forward to the present: a strong USD, higher real yields than we have seen in a long time, investors continuing to pull money out of gold ETFs, inflation continuing to come down, yet the price of bullion has reached a new all-time high. Breaking through a resistance level that had proven impenetrable on four previous occasions dating back to 2020.

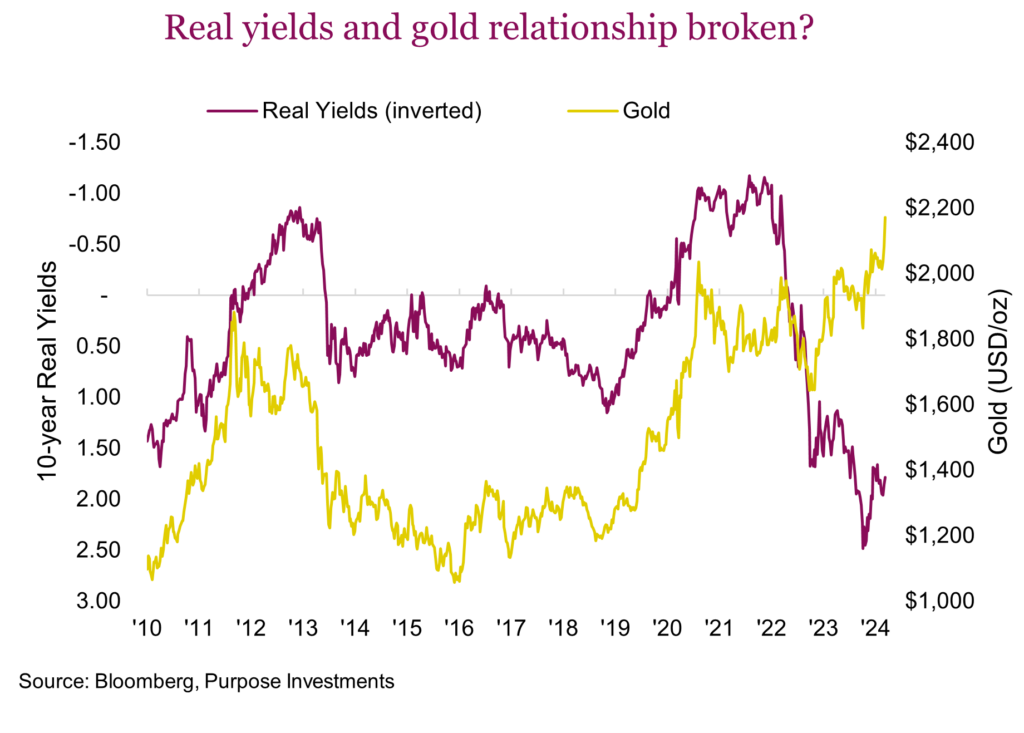

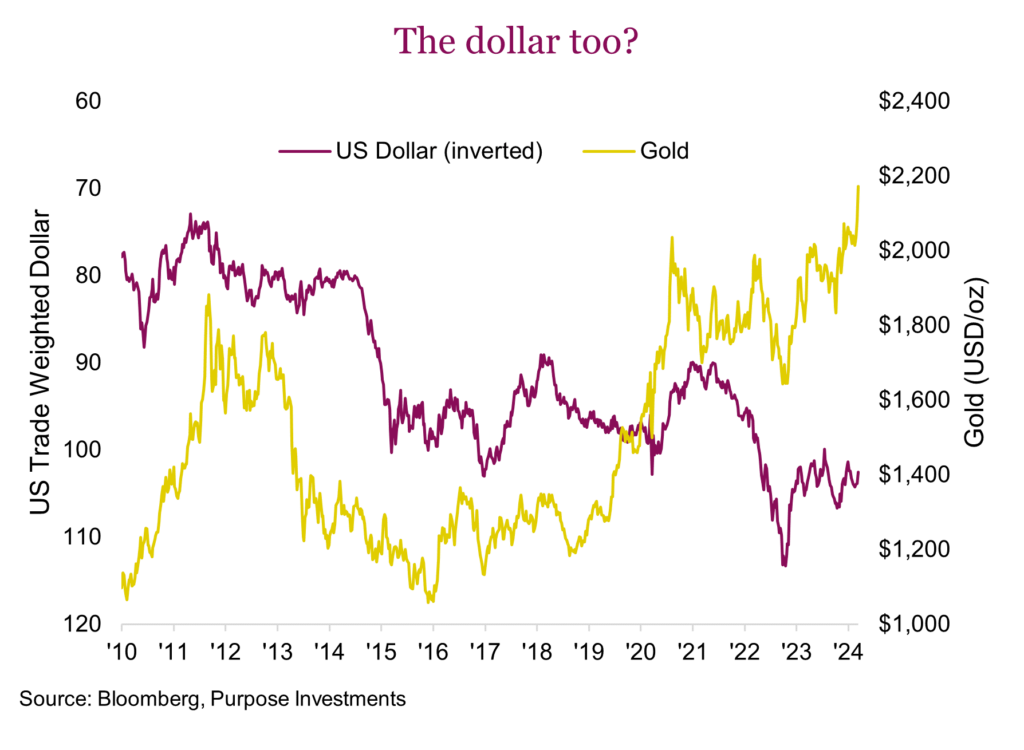

The charts below clearly show an environment that should not see gold rocking higher. Real yields (left) are at levels not seen in decades, and we would point out the strong directional connection between real yields and gold for many, many years. The dollar, too, has been on the stronger side of the past decade, yet gold is still higher. Meanwhile, a proxy for retail investors’ gold appetite is the flows in or out of gold ETFs. This peaked in 2020 at 3,440 tons and has continued to decline, likely with some dollars moving to crypto assets. Central banks have been more active in buying gold over the past few years, but it is really hard to say if that is a big enough driver.

This is the frustrating characteristic of gold – it often doesn’t behave as you think it should. The good news is the current direction is higher. Perhaps due to some signs inflation may be returning. While gold didn’t do well during the period of higher inflation from the second half of 2021 till early 2023, it actually appreciated considerably beforehand, perhaps due to concern over an upcoming US election or rising geopolitical tensions. Slap on whichever financial narrative you like, the fact is gold is moving higher even with many headwinds. The path of least resistance appears to be up (for now).

Why we hold gold

We continue to have gold exposure in our multi-asset portfolios as it checks three important boxes from a portfolio construction perspective. These include:

Real asset exposure: While we do believe inflation is coming down in the near term, it will likely resurface in coming years. Many of the macro factors that contributed to low inflation in the past couple of decades have either softened or, in some cases, reversed direction. We believe this will lead to a world that sees higher average inflation and more cyclical moves.

Inflation is not just a market risk, it is also a risk to financial plans. Tilting towards investment that can hedge this inflation risk to your financial plan is likely a theme that will remain for many years. Real assets offer this characteristic, as do some equities. Yet many of these investments are very sensitive to the economic cycle, while gold is less so.

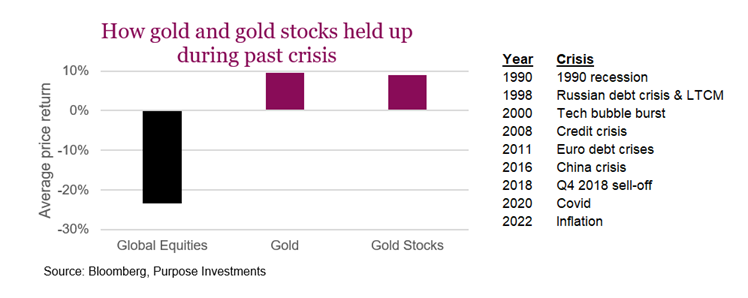

Crisis alpha: You can’t buy home insurance when your house is already on fire. Yet gold often sees strong inflows after a crisis has surfaced. The last period of inflows to gold ETFs was during the scare over US regional bank bankruptcies. The price of bullion and gold stocks have a long history of doing well during periods of crisis. It is during these kinds of crises that diversification becomes hard to find, which remains a great characteristic for some gold exposure in a portfolio.

USD protection – As our regular readers are aware, we are positive on US dollar exposure within portfolios. Diversification benefits, plus expectations that other central banks will cut rates more/faster than the Fed given the diverging paces of economic growth, have a positive effect on the US dollar. However, we could be wrong; equally important, at some point, the US dollar is likely going to give back a lot of its gains compared with other currencies that have racked up over the past decade. Developed market currencies are typically a zero-sum game in the really long term. Having some gold exposure is a hedge against this risk.

Gold vs gold stocks?

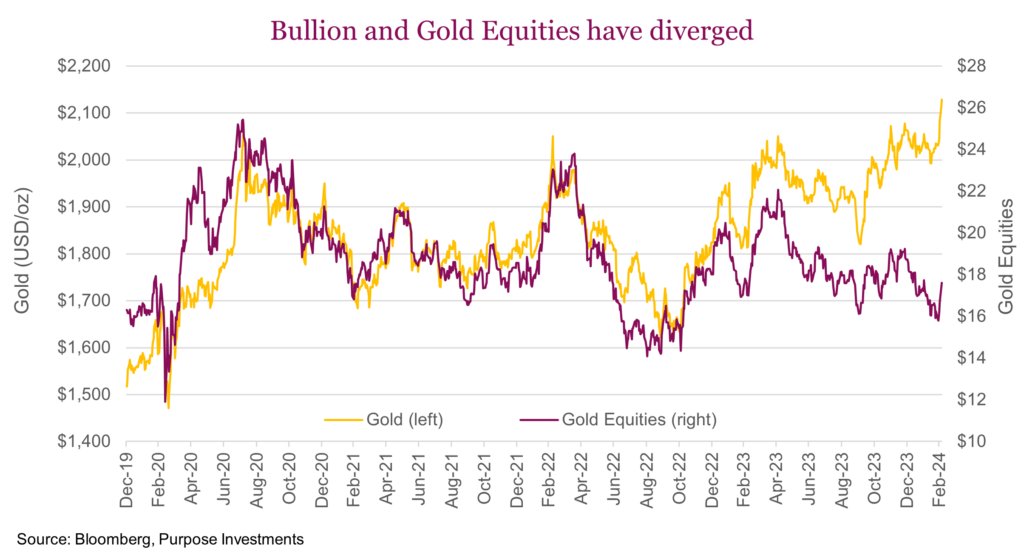

There is no simple answer to this often-asked question. The bullion is less volatile and less subject to the variances of the stock market or stock-specific company stumbles (or good news, but that seems to be rare with gold stocks). Often, during crisis situations, the stocks will fall within the overall market initially before rebounding. The good news on the stock side is that they carry a pretty high correlation of about 0.8 to the price of gold. This is measuring the iShares Global Gold ETF vs the price of gold bullion. Even better news comes in a higher beta. In other words, stocks move more than bullion, and when it comes to portfolio insurance, a smaller allocation can have just as big an impact.

Yet, sometimes, things diverge. The price of gold has taken off, yet the price of gold stocks has certainly lagged. No denying there are some operational issues with the larger cap gold companies. Rising costs are an issue, as are country-specific problems. But this divergence has become rather extreme, likely making the gold stocks cheaper relative to bullion.

Final thoughts

We do remain positive about having a small gold allocation within portfolios even after the recent run-up; not sure we would be going out to add gold after this sharp rise, but we are not reducing at this point either. However, we did pivot some of our exposure from bullion into gold mining stocks in some of our multi-asset strategies. We believe that big divergence offers a margin of safety and/or better upside.

Just remember, when it comes to gold, be prepared to be frustrated most of the time … just not lately.