Investor Strategy

March 7, 2024

Bubbles popping and gravity are inevitable

Sign up here to receive the Market Ethos by email.

Executive summary

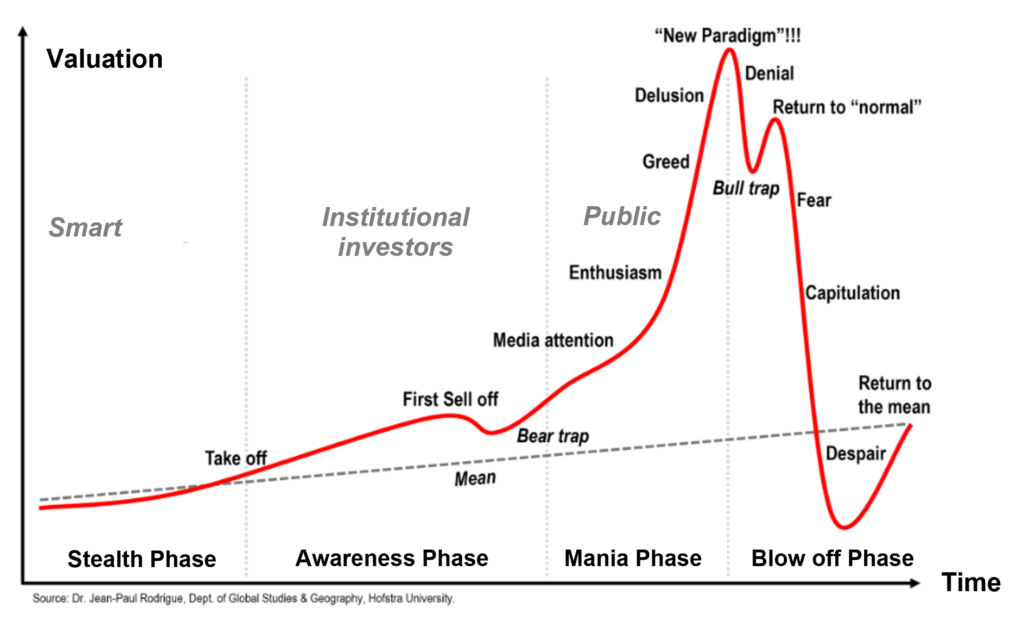

The history of markets is filled with examples of bubbles, creating great wealth on the way up and subsequently destroying much wealth on the way back down. Some date back centuries like the Mississippi Company, tulip mania, South Sea trading or the railway bubbles. Some are more recent such as the nifty 50, dotcom, housing in the early years of this century or marijuana in the 2010s. In each instance, there was always a solid foundational case supporting the bubble because the world was changing in one way or another. Yet also in each instance, markets became over enthusiastic and went too far, inevitably resulting in the popping of the bubble.

No love lost for equities in February

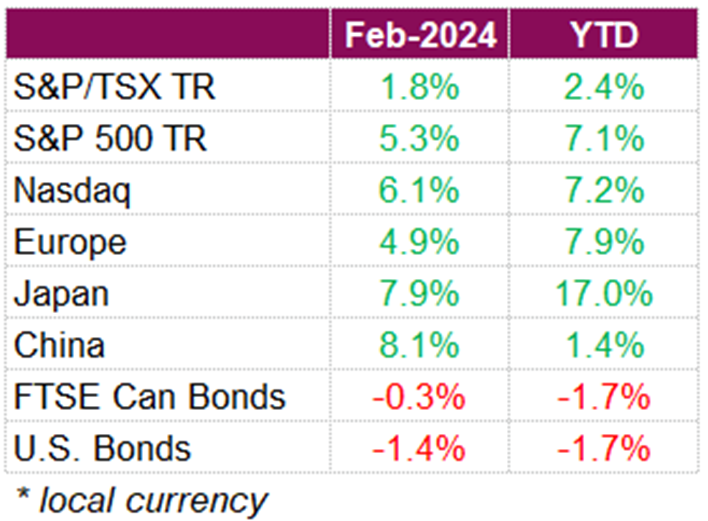

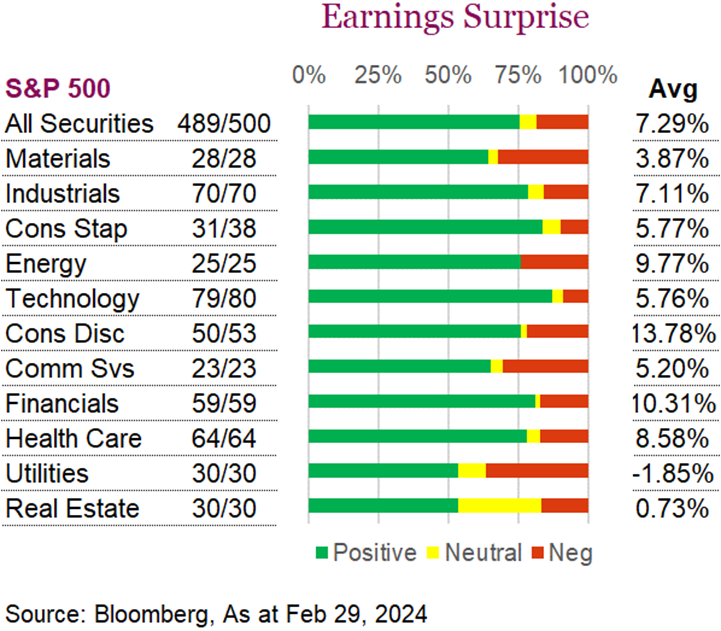

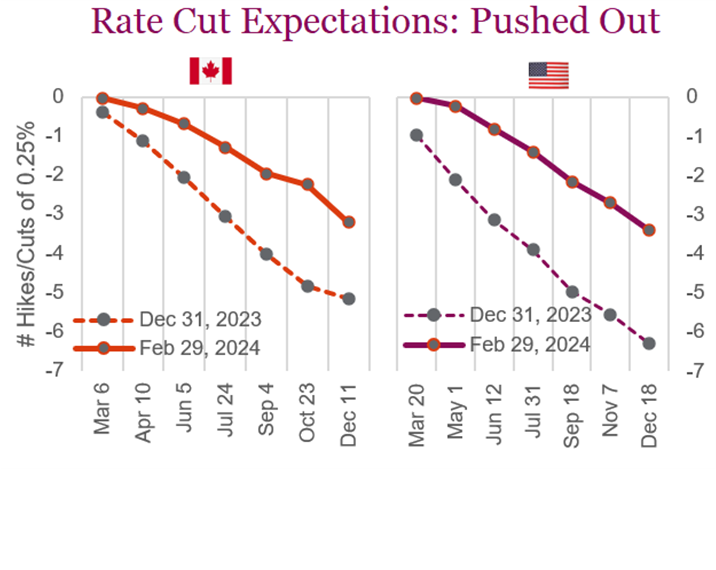

The equity rally continued into February, buoyed by strong earnings results, which helped U.S. stock indexes break out new highs over the month. Optimism around artificial intelligence (AI) after Nvidia’s Q4 earnings release sparked a rally which helped the S&P 500 and Nasdaq finish 5.3% and 6.1% higher, respectively, for the month. It wasn’t just Nvidia who reported strong earnings though, with the overall earnings season being a success. By month end, 97% of S&P 500 companies reported their Q4 earnings, with 73% beating estimates. Markets were also encouraged when the Fed’s preferred inflation gauge came in as expected, with core PCE growing 2.8% y/y, its lowest level since March 2021. Despite moving in the right direction, Fed policymakers continue to push back against aggressive market expectations for rate cuts, prompting markets to revise their interest rate expectations. Futures markets now anticipate the first Fed rate cut to take place in June and expect the benchmark rate to end the year around 4.5%. With expectations for cuts pushed out, yields rose over the month and pushed the U.S. aggregate bond index down, with the index finishing -1.4% lower for the month.

Canada also saw positive economic news in February, including data that showed Canada’s inflation decelerating more than anticipated, helping the TSX rise 1.8% over the month. The index trailed its U.S. peers, and while the difference is significant, the main drivers of growth in the U.S. came from a very concentrated group of tech names. The headline CPI rose 2.9% y/y last month, following December’s gain of 3.4% y/y, marking the lowest level since June 2023 and falling within the BoC’s target range. Though overall inflation continues to move in the right direction, BoC officials have followed the Fed’s approach, reiterating that they want to see more evidence of inflation declining before pivoting to interest rate cuts. They may have time to do that as well. The Canadian economy rebounded in the final quarter of last year, growing at an annualized pace of 1%. This growth surpassed both economists’ expectations and the BoC’s forecast, marking a turnaround from the previous quarter’s contraction. With data showing that the country is still growing while prices are declining, the BoC is widely expected to maintain its policy rates at 5% in its upcoming meeting. Markets are now pricing in 75 bps of rate cuts for the year, with the first cut expected to occur as early as July. With the number of cuts for the year reduced, yields rose over the month and pushed the Canadian Aggregate bond index down -0.3% over the month.

A bubbly world

The history of markets is filled with examples of bubbles, creating great wealth on the way up and subsequently destroying much wealth on the way back down. Some date back centuries like the Mississippi Company, tulip mania, South Sea trading or the railway bubbles. Some are more recent such as the nifty 50, dotcom, housing in the early years of this century or marijuana in the 2010s. In each instance there was always a solid foundational case supporting the bubble because the world was changing in one way or another. Yet also in each instance, markets became over enthusiastic and went too far. Inevitably resulting in the popping of the bubble.

There are two constants investors should remember when investing in potential bubbles: markets always go too far, both up and down, and gravity inevitably exerts its force.

In the past few years, one could argue that bubbles have become more widespread, albeit smaller in size. For instance, clean energy (ETF proxy), up 312% from the start of 2020 to the peak in early 2021 was followed by a -83% decline over the past three years. Now we have _______________ (insert whichever rapidly rising industry or sector you like). Could it be crypto (again), AI, or a fat bubble (companies with drugs that combat obesity)? Of course, you can also argue that things are changing and companies or investments positioned to benefit from those changes are simply enjoying rising future prospects. It is usually a combination of both.

Markets change over time, and we would contend many of the changes in the past decade have contributed to a market more susceptible to forming bubbles. Not the same as some of those past ‘mega bubbles’ that can rock the entire market, these are smaller ones that don’t seem to last as long but still share similar characteristics. Below are some of the contributing ingredients or seeds that are contributing to a more fertile market for growing bubbles:

Too much money

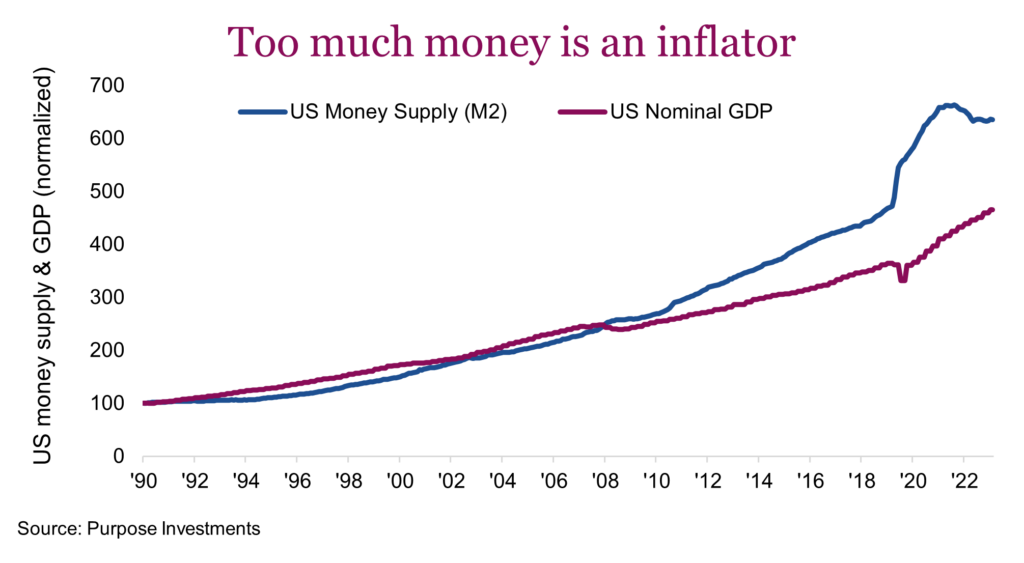

The money supply has historically grown somewhat in line with nominal GDP. But in the 2010s it started to grow much faster, a follow on response to the financial crisis. This resulted in a rising savings rate as well. Both these trends exploded to the upside in 2020/2021 due to the pandemic, a period during which many mini bubbles inflated – crypto, disruptive tech, even used video game retailers – the list was long.

In 2022, many of those mini bubbles deflated as money growth began to contract, central banks raised rates, etc. Many of those mini bubbles also went too far. The gap between the economy and money supply is improving, which may be a risk to anything in bubble territory today. Yet there is still way too much money floating about, which is one of the fuels for a bubble.

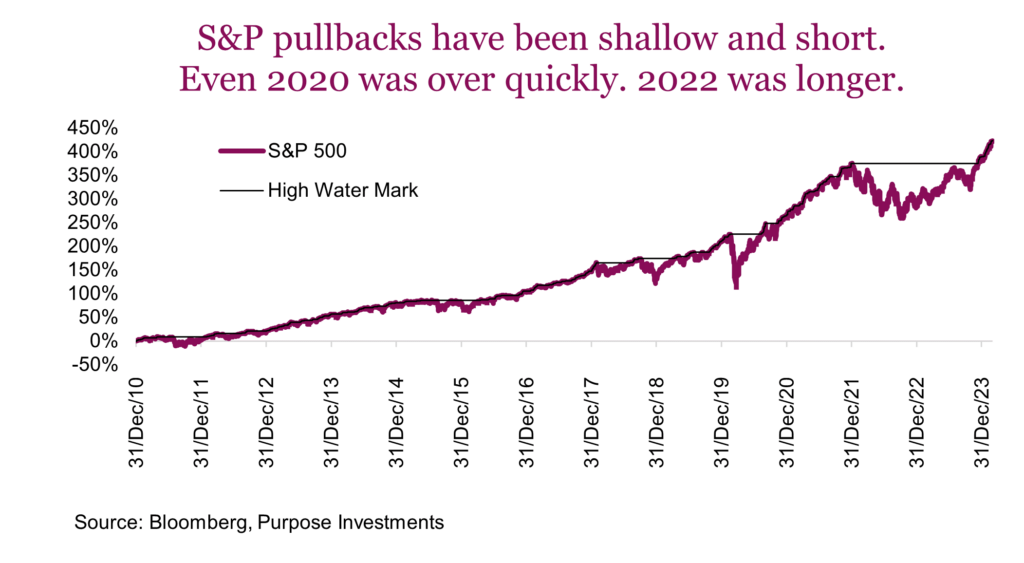

Fearless investors

For investors who have only experienced markets after the 2008 financial crisis or for those with short memories, it has been a rather pleasant experience. From 2010 until 2020, declines in the equity market tended to be shallower and shorter in duration than previous decades. Markets would drop and recover pretty quickly, encouraging the ‘buy the dip’ mantra. Then the pandemic drop in 2020 solidified this view, as the drop may have been bigger but the bounce back was incredible.

2022 threw some cold water on this strategy of buying any weakness, yet with markets now making new highs, the buy the dip mindset appears alive and well. Investors just don’t seem to be fearful anymore, another key ingredient for bubbles.

Less fundamentals

Everyone probably believes the value of something is its price in the market. Apple closed at $179, implying a worth of $2.8 Trillion. Maybe. The price of any asset in the market is where the marginal seller and marginal buyer meet. If there are more motivated buyers than sellers, the price rises until the higher price entices more sellers.

Yet more and more volume is driven by passive investment vehicles that are simply transacting due to flows, and giving no thought to the price. Add to this, trade flow momentum strategies, HFT, option book managers, etc. None of which will say Apple is worth more or less than $179. They are price acceptors, accepting whatever the price is.

Countering this group are active managers or investors, that have a view on the value of an investment and will often transact if that price gets too far away from their perceived value. They do not believe value equals price, and attempt to profit from the discrepancy. The problem is that over the past decade, the amount of money in price accepting strategies keeps growing faster and the active group keeps shrinking.

We are not saying the market pricing mechanism is broken. However, this increasing tilt has created a more fertile market for bubble formation. Price and value can become very distant from one another.

Access

One steady trend is the democratization of investment strategies. If you wanted to buy one of the nifty 50 stocks in the 1970s, you probably had to call your broker to instruct them to buy some shares of Xerox or Avon. Today, with a tap on your smartphone, you can buy shares of Nvidia, trade some bitcoin or buy an ETF that holds companies focused on cyber security.

Easier access is a sign of progress. Make something better, faster, cheaper or easier is how our economy progresses. Easier access has also made investing more fun and exciting. It has also given rise to more speculators or investors throwing a bit of money at a more speculative investment idea. Call it play money, mad money, there is a lot of it out there.

Social media

Information travels faster than ever, which means ideas travel faster too. The Reddit crowd lifted a near bankrupt used video game retailer from a few hundred million market cap to over $20 billion. The company is back down to $4 billion and has been losing money since 2019. This is an extreme, but the speed at which ideas become mainstream has dramatically increased over the years.

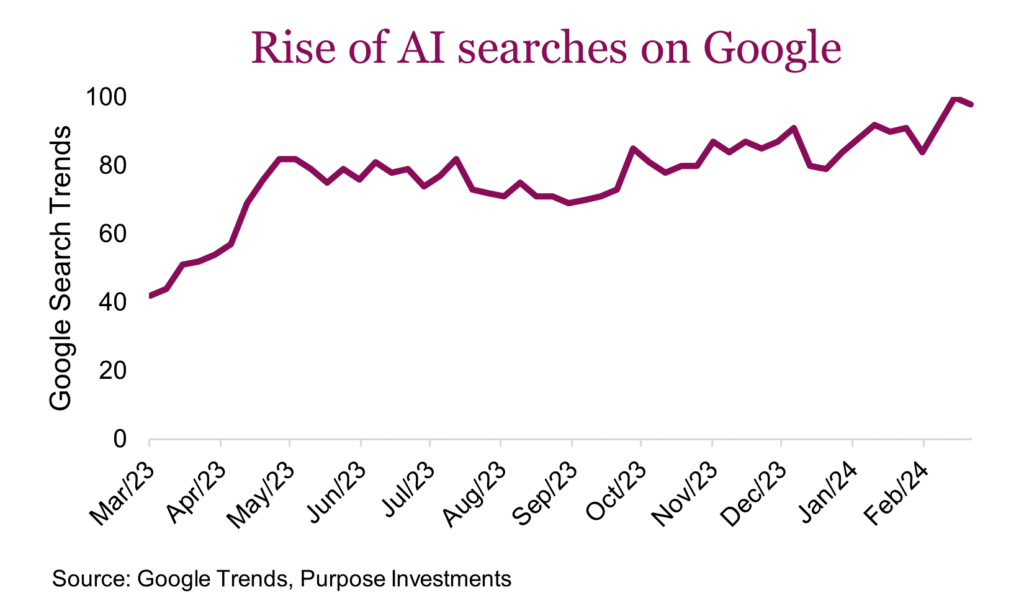

The speed of ideas or thought dispersion across investors likely feeds quicker bubble formation than years past. Just look at the Google search trends for AI.

AI is either a bubble now or becoming a bubble. Herein lies the rub: bubbles are only bubbles after they burst, which clearly does little to help investors. Lots of money to be made during inflation, lots to lose during the deflation. But there is no standardization in how big bubbles get, how long they last, or what causes them to start the descent. A bubble can occur in a narrow pocket of the market and may end without a broader recession or anything macro oriented.

Before we dive into investment strategies for a bubblier world, let’s all just realize it is our behaviours that create these bubbles. Much about bubbles can be grounded in behavioural finance and momentum.

Biases & bubbles

Market momentum refers to the tendency of asset prices to persist in their current trend. In essence, it’s betting on the winners. While there isn’t a single individual credited with “proving” the momentum factor, it’s been widely documented by many academics across various markets for some time. This factor can be quite powerful, but it is also a double-edged sword. It contributes to the formation of bubbles, driving asset prices to levels that deviate significantly from their intrinsic values. There are many explanations behind market momentum as a factor. Some are technical but most explanations rely heavily on the work of behavioural finance.

The behavioural biases behind momentum:

Anchoring and underreaction

Tendency to overweight the importance of the first information that we learn. Social anchoring can also increase pressure toward conformity and acceptance of the status quo. It tends to anchor investor expectations to past performance, such as extrapolating past trends into the future. One way it can fuel momentum and contribute to bubbles is that it causes investors to initially underreact to news, which keeps prices below fair value for too long. Once price trends do finally develop, they remain strong for some time as prices catch up to their ‘fair’ value, and often go beyond.

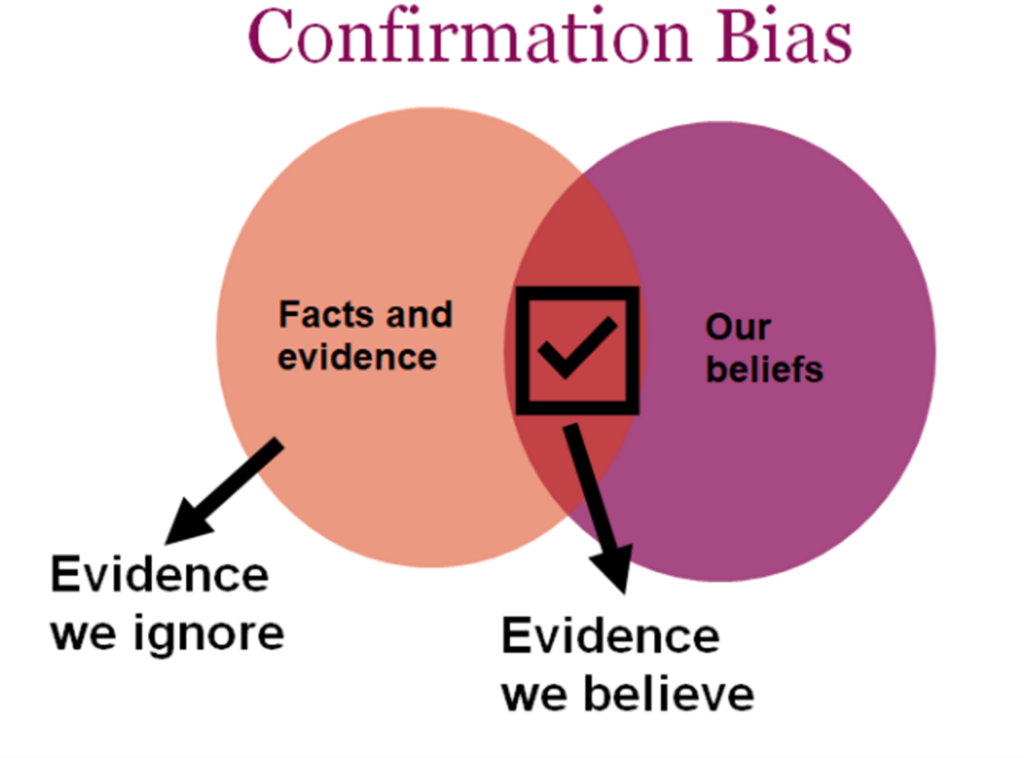

Confirmation bias

Closely related to anchoring is confirmation bias. It’s the tendency to overemphasize the importance of information that reinforces our view, while ignoring contradictory evidence. The bias can reinforce momentum by focusing investor attention only on information that supports the current dominant narrative, ignoring warning signs at their peril. In general, we look at price moves as representative of the future we want to see. We may invest more in securities that have recently done well, and less in those that have not done as well, thereby causing stocks to trend for too long.

“People can foresee the future only when it coincides with their own wishes, and the most grossly obvious facts can be ignored when they are unwelcome.”

‑ George Orwell

Herding

Herding is a strong physiological and psychological bias. It’s primordial; we’re physically wired to prefer the pack and it’s associated with the release of oxytocin reinforcing the positive feelings of trust and security. It’s far more natural as an investor to ride the wave with the rest of the herd even if we see it fast approaching the rocky shore. As humans, we think in herds, go mad in herds, but only recover our own senses slowly, and one by one.

Overconfidence

This bias is simply believing your skill and ability are greater than they really are. We’re all prone to overestimate how much we understand about the world and to underestimate the role of luck. The sad reality is that overconfidence can lead to suboptimal outcomes; it is the strongest swimmers who are more likely to drown. Overconfident investors underestimate the risks associated with momentum-driven markets, leading them to engage in excessive buying without fully considering the fundamentals which contributes to bubble formation.

Not only that but overconfidence also triggers other biases such as hindsight bias as well as self-attribution bias. In a raging bull market, it is easy to attribute success to skill, causing investors to buy more which only pushes prices higher.

Disposition effect

Investors tend to sell winners too early in order to lock in gains, while holding onto losers too long in the hoping to make it back what they lost. It also brings in ideas around prospect theory and mental accounting. How often have we heard that it is only a loss if it is realized? When negative news hits, investors can be reluctant to sell stocks that have had a strong run. This action delays the price discovery prices, which contributes to the momentum effect and continuation of bubbles until investors react all at once.

Besides the behavioural factors behind momentum there are also a number of structural factors as well. These include liquidity constraints, transaction costs and a delay of adjustment to new information that leads to trends. Investors with different time horizons, react to news and events at their own pace. This staggered approach can supply enough sustained buying and selling pressure to begin the feedback loops that behavioural biases thrive on.

Reflexive bubbles

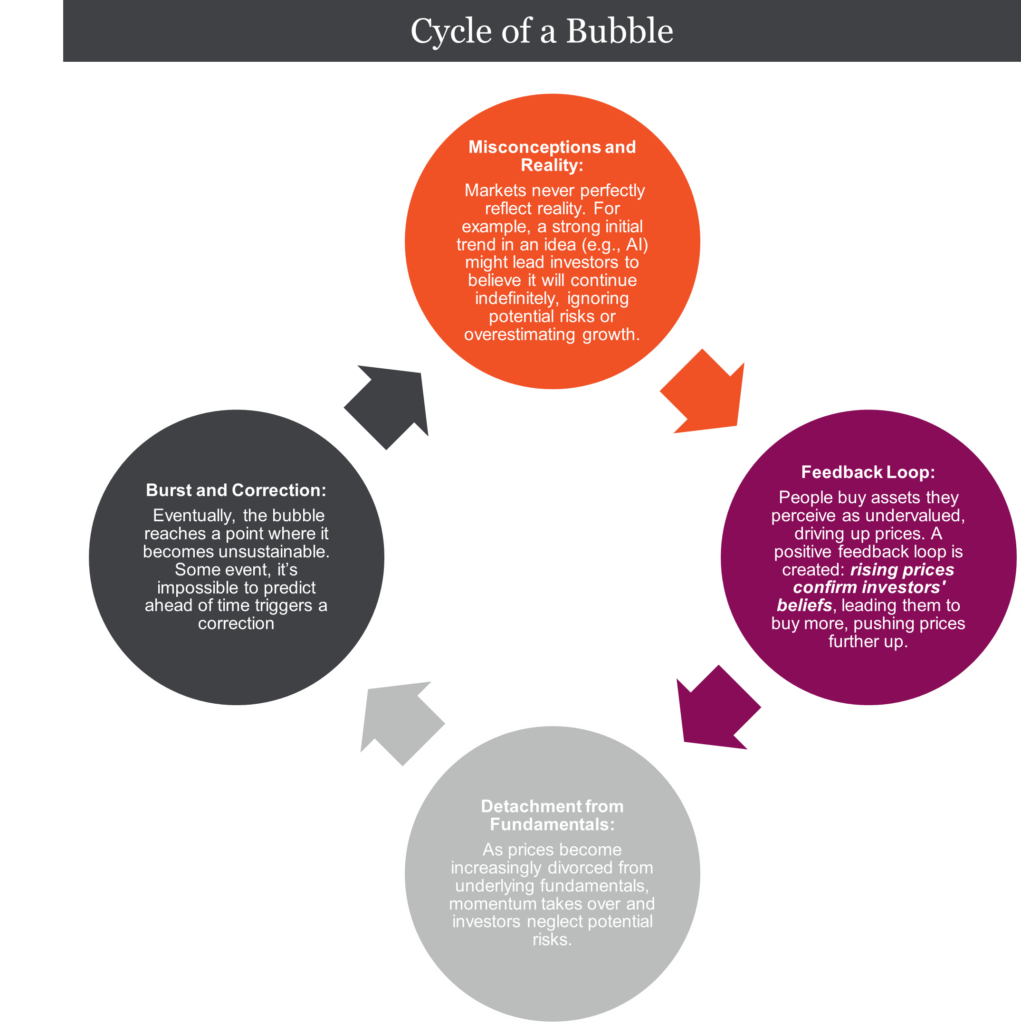

For anyone who has read Soros, this theory should sound familiar. Positive feedback between prices, expectations and economic fundamentals prevents economic equilibrium. At its core, the theory of reflexivity offers a unique perspective on how stock market bubbles can develop. In an efficient market, bubbles wouldn’t exist. The Theory of Reflexivity focus on the interactions between market participants’ perceptions and reality. Here’s a simplistic graphic on how it applies:

The key is the important role psychology and investor sentiment play in market movements. Bubbles are not just about irrational exuberance, but also about the self-fulfilling nature of strong market narratives. By understanding the interplay between perception and reality, investors can be more mindful of the risks associated with bubbles and make informed decisions. Investing is hard. It might seem easy during a bubble, and the allure of easy money is strong, but investors should remain diligent to avoid the eventual pop.

Investing in a bubblier world

If we are living in a world more prone to bubbles (or mini bubbles) should our investment process change? It’s important to make money from bubbles but equally important not to lose it. We believe there are a few components that are crucial for success:

Market efficiency would argue against the existence of momentum and even bubbles. Markets can be mostly efficient, but the argument that the price is always right is absurd. When you think about efficient markets, Markowitz probably comes top of mind, but I think about Bob Barker and Adam Sandler. Bob Barker always argues the ‘Price is Right’, while Adam Sandler aka Happy Gilmour famously noted “the price is wrong $!&@#”.

The final word

Bubbles are fun, exciting, and dangerous. They also appear to be increasingly widespread. Having a thoughtful, disciplined approach that incorporates some hard trading rules can go a long way in enjoying success in our bubbly world. It also offers the potential for strong returns. We prefer using momentum as both a buy and sell signal. True, we blame bubble creation in part on momentum trading, the key is to avoid being late. Too late to hop on board and too late to exit are the biggest risks. Momentum can provide a defense against this risk.