Sign up here to receive the Market Ethos by email.

Market Ethos

November 27, 2023.

Have you ever noticed when a manager or advisor or investor talks about their portfolio, they tend to focus much more on what has worked out well and often gloss over detractors? This behaviour isn’t just prevalent in the investment world, it is pretty much a human characteristic. Politics, sports … the list goes on. So, before we revisit our Japan portfolio tilt – a tilt in our multi-asset strategies that has worked out well – we will share one that hasn’t worked.

We are a bit underweight U.S. equities (25.2% vs 30%). In a word: whoops. The U.S. equity market has been one of the stronger ones this year. And yet, our rationales for this lower exposure remain.

- The U.S. market is very concentrated, with the top 10 names representing 33% of the index, and these names are responsible for about 75% of the gains this year. This is historically extreme and adds risk to the index/market.

- Valuations at 18.5x are a little high by historical standards, but given bond yields have risen so much and valuations in just about every other market are below historical norms, this makes America the outlier.

- Earnings expectations remain robust, while estimates for most other markets have come down given slowing activity and higher costs, from wages to interest expenses.

Suffice to say we remain a bit underweight in U.S. equities, and the rationale remains sound … but clearly wrong so far this year. Now that we have talked a bit about something that didn’t work, let’s talk Japan.

Our positive view towards Japan started last summer (July ’22 Post – Stars aligning for Japan) with the rationale based on 1) a very weak yen, 2) Japan is a safer way to gain exposure to Asian economies that were coming out of lockdowns later than the west, 3) valuations had the PE ratio near the lows of the past 25 years and the dividend yield near the top. And it has worked out; Japan is up about 23% since then, roughly the same as the S&P 500’s 25% advance, and well above the mere 10% for the TSX.

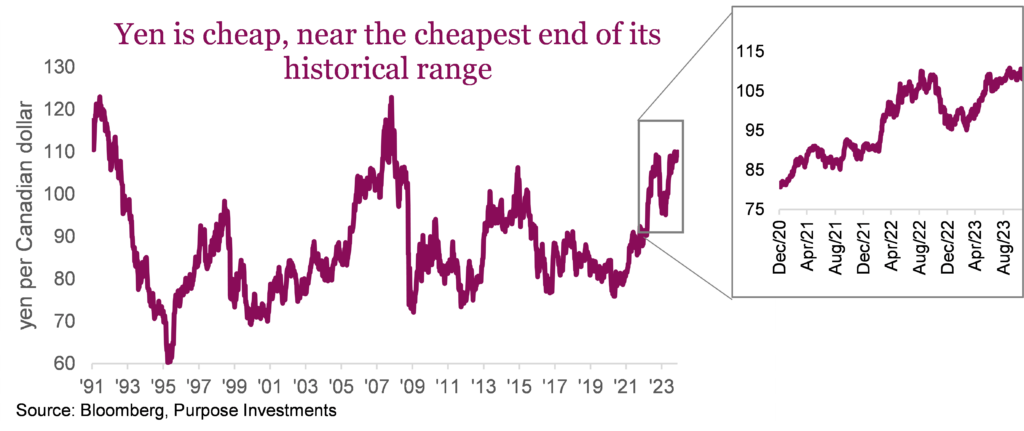

The yen did strengthen in late 2022, but in 2023, it reversed all the way back to about 110 yen to the Canadian dollar. In other words, it is still really cheap from a currency perspective. If you have come across anyone travelling to Japan, they can attest to their dollars going a long way, especially if they had travelled there a few years prior.

Of course, a cheap currency doesn’t mean it will go up. One factor that does matter is the relative hawkishness/dovishness of the central banks. For the past year, the U.S. Fed and Bank of Canada (BoC) had been increasingly hawkish, while the Bank of Japan (BoJ) was on this trend, too, but much more tepidly. Today, it appears the Bank of Canada and Fed are done hiking. If we had to guess who cuts first, we believe it would be the Bank of Canada (or should be). Meanwhile, in Japan, the more tepid moves from dove to hawk continue, albeit slowly. Put it all together, the direction of the relative hawk/dove tilt between the Fed/BoC vs BoJ should support the yen going forward. Or the historically high rate differential between Japan and the U.S. or Canada should narrow or at least not widen anymore. The wildcard is if or when the BoJ relaxes yield curve control; this could result in a rapid rise of the yen.

But a weak yen has a silver lining even if it doesn’t strengthen. It is a boon for Japanese equities, notably those that have exposure to exporting. A good portion of the Japanese equity market sales are external, at about 50%. All these business lines, arguably, are more competitive when the yen is weaker. This should remain a boost for earnings.

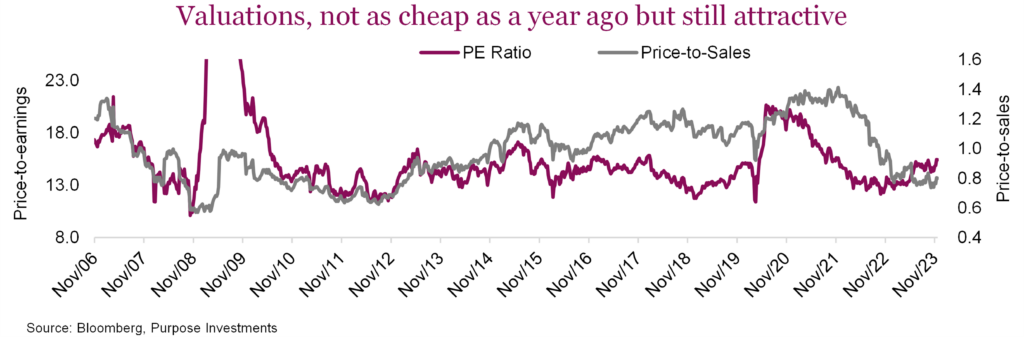

What about valuations?

This brings us to valuations. A year ago, the Japanese equity market was trading about 13x earnings; today, it is about 15x. It’s a bit more expensive but still on the cheaper side of historical averages. Price to sales at 0.8 remains near trough valuation levels. In total, it is not as compelling a reason to buy, but it is certainly still supportive.

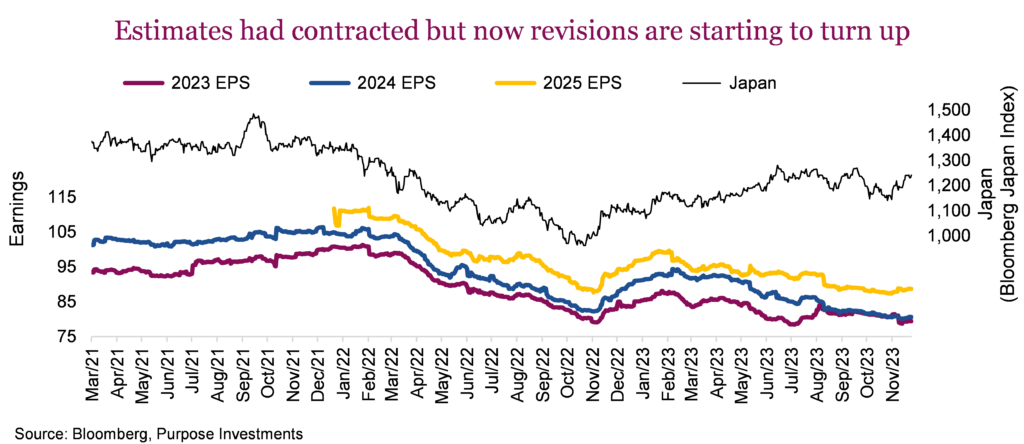

When it comes to valuations, PE ratio in this case, it is important to remember that it is not just the P (Price) that can move; it is also the E (Earnings). Earnings expectations for Japanese equities have fallen decently over the past year. This may not sound like good news, but it means the market has started to price in an economic slowdown. For instance, earnings for 2024 have come down from 106 in January of 2022 to only 80 today. That is a 25% haircut. Conversely, S&P 2024 earnings forecasts have come down a paltry 7% during the same period. In a nutshell, earnings estimates appear more conservative for Japan vs the U.S. Add to this that revisions have stabilized and turned a bit up of late.

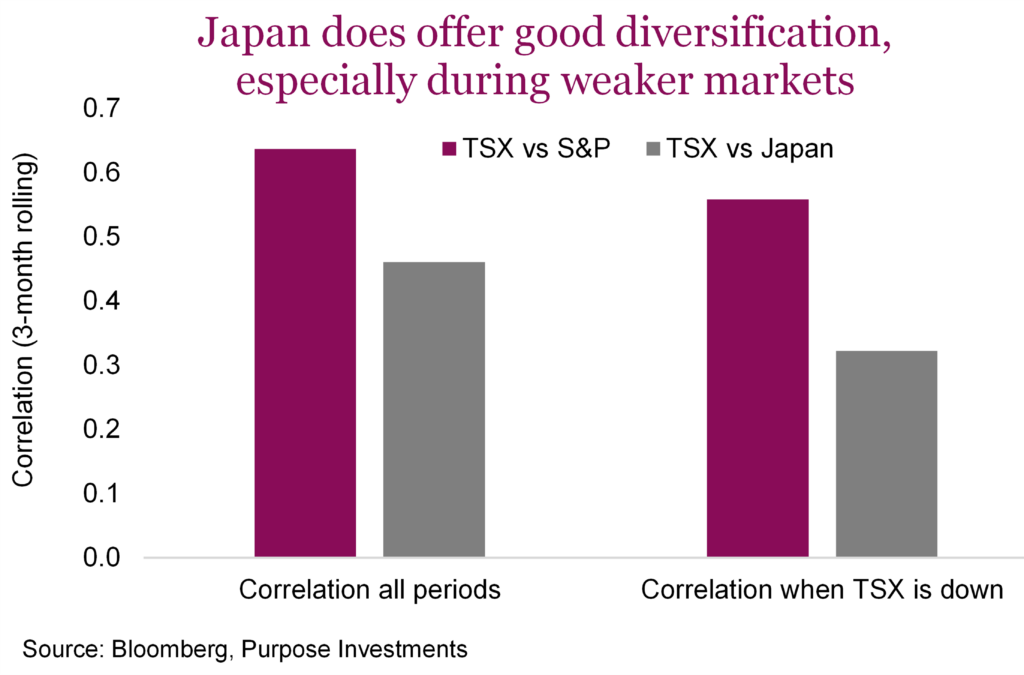

And then there is diversification. Sometimes good, sometimes bad, the TSX and the S&P are rather directionally correlated. Then why isn’t the TSX up 19% this year like the S&P? Well, it’s directional but not necessarily the same magnitude. Besides, the TSX did hold up better in 2022. The S&P does offer diversification as the correlation to the TSX is about 0.6, based on 3-month rolling returns back to 1990. Japan’s index on the surface may look roughly the same at 0.5, but this misses a key factor. Nobody cares about higher correlations when things are going up; it is more important to have a lower correlation when things are going down. Based on the same time period, only looking at periods when the TSX is in the red, the S&P 500 correlation remains at about 0.6, but Japan’s is much lower at 0.3.

Final thoughts

Thanks for coming on this meandering journey through our past rationale on Japan and a more updated view. Suffice it to say that we remain positive about Japan.

Sign up here to receive the Market Ethos by email.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Richardson Wealth Limited for information purposes only.

*This report is authored by Craig Basinger, Chief Market Strategist at Purpose Investments Inc. Effective September 1, 2021, Craig Basinger has transitioned to Purpose Investments Inc.

Disclaimers

Richardson Wealth Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Richardson Wealth warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise.

Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice.

The particulars contained herein were obtained from sources which we believe are reliable but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Richardson Wealth or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security. Richardson Wealth Limited, Member Canadian Investor Protection Fund.

Richardson Wealth is a trademark of James Richardson & Sons, Limited used under license.